Property Investment in Greater Manchester – A Guide by Aspen Woolf

As an investment destination, property in Greater Manchester repeatedly catches the eye of investors. Regeneration continues to transform the Greater Manchester area, and the last few decades have seen areas of the city reemerge beyond recognition.

In 2023, there are still plenty of opportunities for investors. Greater Manchester’s growing population, high quality of living and active job market continue to push the city onto the list of best places to live in the UK and attract new residents.

Greater Manchester’s growing popularity is great news for investors as both rents, yields and property values continue to increase. Here’s our guide to property in Greater Manchester and which areas should be on your property investment radar.

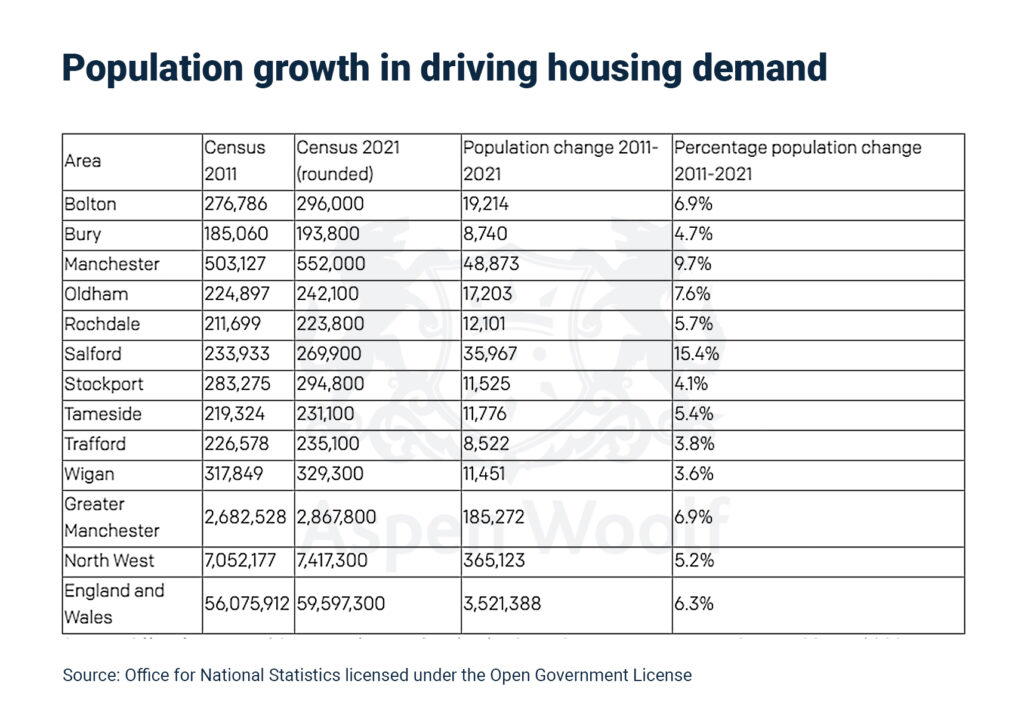

Population Growth is Driving Housing Demand

An increasing population means higher demand for housing, which is good news for buy-to-let investors. One of the reasons property investment in Greater Manchester is such a hot spot is that demand for housing outstrips supply, offering the potential of great returns.

According to the UK’s last census (in 2021), Manchester’s population increased 9.7%, from around 503,100 in 2011 to 552,000 in 2021 – higher than the 6.6% overall increase for England. Areas like Salford saw populations increase by 15.4% in the same period and other areas of Greater Manchester like Stockport and Trafford, saw an increase of 4.1% and 3.8%, respectively.

Looking ahead, Manchester City Council predicts that 70,000 more people will move to the city by 2026. Growing populations go hand in hand with higher rental demand and increasing property prices. Those who invest in Greater Manchester can take advantage of the market’s popularity to find a profitable investment.

Young Professionals are Relocating to Greater Manchester

A notable trend in recent years is the record number of Londoners moving into the region. In 2017, 10,200 people left London to move to Greater Manchester. The pandemic only spurred this relocation trend as people searched for more space and cheaper rents by heading north.

Greater Manchester has one of the highest labour market growths in Europe with 30.7% increase in employment growth overall since 2016. This labour market growth is good news for property investors. With a market of desirable tenants like young professionals, investing in property in Greater Manchester means fewer void periods and stronger rental yields.

Manchester is also home to world-class universities and boasts impressive graduate retention rates. As well as a student tenant market, Manchester retains 51% of the city’s graduates. With so many students staying on after graduation, property investors in Greater Manchester have a thriving tenant market of young professionals.

Job Opportunities Create a Strong Tenant Market

Greater Manchester is a city celebrated for its business scene. The hugely successful regeneration project MediaCityUK in Salford Quays attracts professionals looking to work for household names like ITV and BBC.

80 of the FTSE 100 companies are based in Manchester and companies such as Talk Talk, Kelloggs, Deloitte and Amazon boost the city’s employment opportunities and attract younger populations to the city.

Manchester is known as the creative hub of the north with more creative businesses, marketers and designers per square mile than any other northern city. With 9,000 creative and technology companies making Manchester their home, this impressive sector hires over 78,000 people and generates a GVA of £3.8 billion annually.

Out of residents moving to Manchester’s city centre from 2001 to 2011, close to 60% had a professional degree. Property investors can take advantage of a tenant group that is reliable with rent payments and likely to stay for a longer period of time.

Regeneration is Transforming the Area

Regeneration in the city of Manchester and the Greater Manchester region has changed not only the face of the area, but its housing market too. Manchester is part way through a multi-billion pound regeneration scheme, improving all areas of the city centre, airport and general infrastructure. Many of these regeneration projects are spurred by major companies moving north away from the capital and south.

In 2022, research by Stripe Property Group stated that the regeneration taking place in Greater Manchester will add £10.2 billion to the value of the property market. Local redevelopment schemes significantly boost nearly property prices (an average of 3.6% according to CBRE). Improving connectivity, public amenities, job opportunities and leisure facilities results in a place where a greater number of people want to live, which is good news for those in the property market.

Recent, ongoing and up-and-coming projects in Manchester include:

- Spinningfields

Spinningfields is one of the largest and most successful regeneration projects in the country. Home to world-class business distinct and luxury residential areas, it attracts international investment from leading global organisations across property, retail and professional services.

One of the city’s most vibrant destinations, Spinningfields is home to bars, shops and restaurants and houses some of the largest corporations in the North West as one of Manchester’s biggest commercial districts.

- St. Johns

St. Johns is one exciting £1 billion regeneration scene transforming the city. Parts of the project are opening in 2023, with a development completion date of 2025. St.Johns is home to Enterprise City, a cluster of tech, media and modern businesses in new and heritage buildings. The likes of Booking.com, WPP and Mediacom already made the area their home.

Factory International, opening in 2023, is a new destination for arts, music and culture in St. Johns. Factory International will commission and produce a year-round program of creative work, music and special events. The area will also be home to coliving developments, boosting its standing as a place to live, work and socialise.

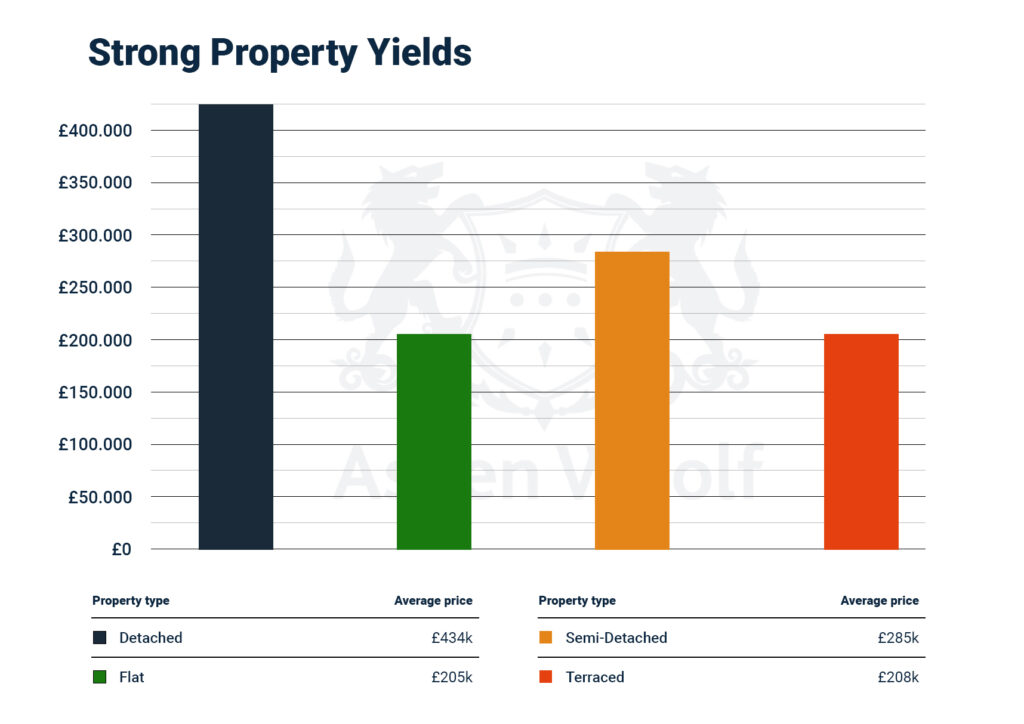

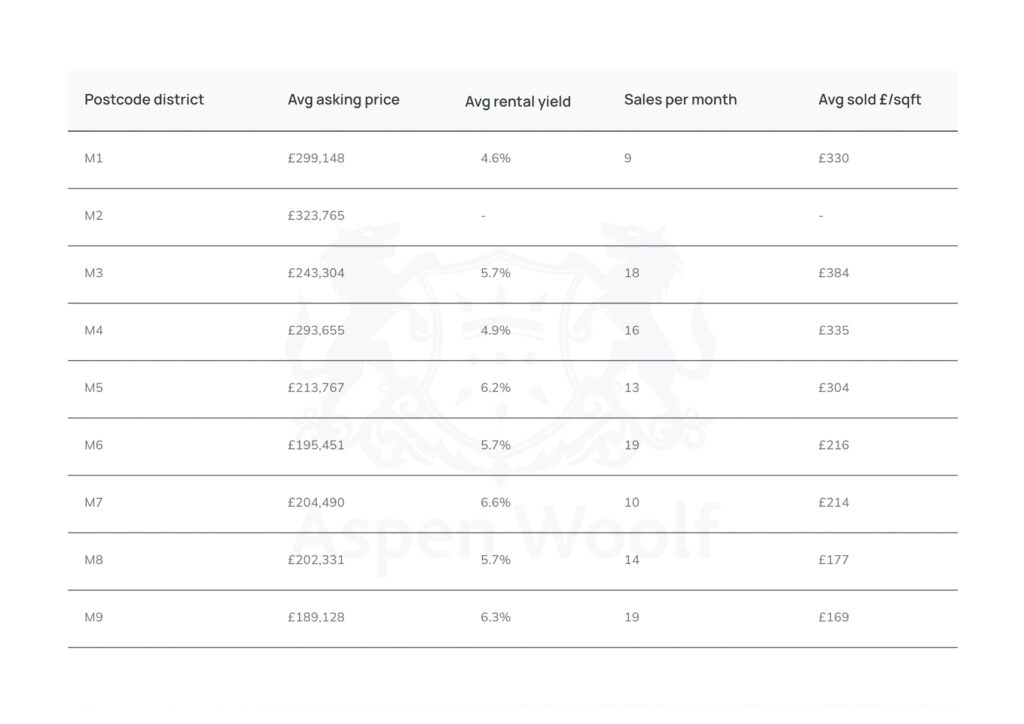

Strong Property Yields

Along with capital growth projections, rental yield is an important factor for property investors. A rental yield of 5.2% is considered strong, particularly when the property is in an area where strong capital growth is likely, too.

According to Rightmove, Manchester houses for sale went for an average price of £247,833 last year (although this figure varies according to property type). According to Home, rents are on average £1,353 and rental yields an average of 5.17%. The average gross yield in the UK is 4.71%, which places Manchester’s performance pretty favourably.

Is Greater Manchester a Good Place to Invest in Property?

A growing population of young professionals, ongoing regeneration, consistent growth in property and rental values and a thriving tech and creative scene help make Manchester one of the most exciting cities in the UK.

Buy-to-let property investors have plenty of reasons to consider Manchester a good place to invest in property, particularly due to its thriving rental market, property prices and rental demand. From new build homes in Greater Manchester to flats to coliving developments, there are plenty of diverse properties to choose from.

Is it a Good Time to Buy a Flat in Greater Manchester area?

The Manchester property market forecast for 2023 is optimistic. Savills predicts that the North West will see the highest level growth of any region in the UK over the next 5 years at 11.7%.

Between Manchester, Salford and Salford Quays, 15,000 new developments are under construction due to demand for city-centre living. The city is rapidly growing and the construction industry continues to move forward with projects now that covid restrictions are at an end.

Investing is always about timing. Investors who bought in Manchester up to now have built up good equity. 2023 is a great year for investors to take advantage of prices across Greater Manchester as the city moves outwards. The earlier you add Greater Manchester to your portfolio, the more lucrative prices are likely to be down the line.

What Areas are Up-and-Coming in Greater Manchester?

When considering property investment in Manchester, here are some up-and-coming areas investors should take a closer look at:

- Bolton

Just 20 minutes away from Manchester itself, Bolton is a prime example of one of the North’s burgeoning commuter towns. While regeneration is ongoing, house prices remain relatively low, making property investment in Bolton an attractive prospect.

According to Rightmove, Bolton semi-detached properties sold for an average of £200,605, offering excellent opportunities for investors before the next wave of regeneration – like the areas of Trinity Quarter, Coral Valley and Cheadle Square – further transforms the town.

- Oldham

Property prices in Oldham tend to be lower than surrounding areas. The average price of a property in Oldham in the last year according to Rightmove is £190,740.

Significant regeneration is taking place in Oldham. Projects include new retail and leisure facilities in the town centre, large-scale commercial regeneration in Hollinwood Junction and the possibility of 14,290 new homes being built between now and 2037. There’s certainly opportunity for capital growth when considering property investment in Oldham.

- Salford

Once a centre of the UK textile industry, today Salford has a vibrant arts and cultural scene and is home to the media and technology hub, MediaCityUK.

Strategically connected to the city centre with strong links to the airport, new homes, community areas, and public spaces are part of ongoing regeneration work transforming the area into a place to be.

Salford property investment is becoming increasingly attractive thanks to new development projects. The transport hub Salford Central is due to open Summer 2023 after undergoing improvements that will increase train reliability across Manchester. Greengate is an up-and-coming property hotspot. Coined as the Brooklyn of Manchester, Greengate is a 10-minute walk from amenities and Manchester’s key shopping district.

Salford Quay redevelopment has created a world-class business, cultural and residential area and demand for property is on the rise. According to Rightmove, properties in Salford had an overall average price of £249,507 over the last year.

- Stockport

Stockport is a popular area for students and young professionals alike, giving landlords a strong rental market. Property investment in Stockport helps investors attract tenants to a location with an historic market town, galleries and cultural centres, and where recent investment is transforming the area.

Stockport is currently being revitalised by the Stockport Exchange. This £1 billion investment will put Stockport on the map as one of the North West’s most thriving business hotspots, and generate 1,400 new homes and 400,000 sq ft of commercial and retail space. Stockport Exchange has direct trains to Manchester centre in 8 minutes 11 times an hour, and direct trains to London in under 2 hours, every 20 minutes.

With strong rental demand, good capital growth prospects and ongoing regeneration transforming the area investors should look closely at Stockport for new opportunities.

- Wigan

Wigan property investment is becoming increasingly popular. Wigan’s strategic location puts it in proximity to industrial and commercial centres. The area also has good transport links to the city centre, across the Greater Manchester region and beyond.

Property prices in Wigan have steadily increased in recent years, and ongoing regeneration projects, including the multi-million-pound Wigan Pier Quarter on the Leeds-Liverpool canal are helping to give its popularity, and house prices, a boost.

According to Rightmove, properties in Wigan had an overall average price of £167,730 in the last year.

Why is Greater Manchester a Good Place to Invest?

The bottom line is that the price increase in the Manchester property market is a combination of a growing population and the market’s lack of stock. Lifestyle and employment opportunities continue to make the city hugely appealing, giving landlords ongoing demand for rental property. Lack of supply and population growth will continue to push house prices and rents up for years to come.

With a growing rental market, plenty of areas to invest and a future that looks bright, investing in Manchester can be a wise decision for many types of property investor. If you’re looking for properties for sale in Greater Manchester, get in touch with our experts today.