Fixed-rate – Definition, Overview & FAQ

What is the fixed-rate?

Definition: In real estate, the fixed-rate typically refers to a loan or mortgage wherein the interest rate remains constant throughout the entire repayment period. This means that the monthly amount payable to the bank will not change over the duration of the loan, rendering financial obligations predictable, regardless of fluctuations in market interest rates.

Understanding the fixed-rate in real estate

When discussing loans and mortgages, the word “fixed-rate” refers to an interest rate that stays the same for the duration of the loan or mortgage. A fixed rate remains constant despite changes in the overall economic climate, in contrast to variable or adjustable rates, which are subject to variations in market interest rates. As a result, the borrower will have stability and be able to more easily budget and plan for future financial obligations because the borrower’s monthly payment amounts will remain constant throughout the loan term. With long-term financial obligations like house mortgages, this kind of rate is especially well-liked since it shields borrowers from the possibility of gradually rising interest rates.

Advantages of fixed-rate financing

In the context of loans and mortgages, there are a number of important distinctions between fixed and variable interest rates that can have a big impact on borrowers’ payments and overall financial planning. The most important ones are the rate’s stability, which makes planning and budgeting easier, and its predictability, which keeps unanticipated expenses at bay.

Disadvantages of fixed-rate financing

Greater starting costs: At the outset of a loan or mortgage, they may be greater than variable rates. They are less adaptable, and refinancing can be necessary in some situations.

Types of mortgages and loans with fixed rates

- Distinguish between short- and long-term mortgages. Describe term lengths such as 10 years, 15 years, 20 years, and 30 years.

- Particular Loan Categories: Discuss the various loans that are frequently available, including personal, and school loans.

How to choose the right option?

Choosing the right fixed-rate option for a loan or mortgage involves considering several factors that can affect your financial health over the term of the loan. Here are some key considerations to guide you in making this decision:

1. Assess Your Financial Situation

Understand how much you can comfortably afford to pay each month without straining your finances. Also, consider your income stability and predictability. Fixed-rate loans are ideal if you expect your income to remain stable or grow modestly over the years.

2. Understand the Loan Term

Determine whether you plan to live in the home or hold the loan for many years. Longer fixed-rate terms generally offer more stability but might come with slightly higher interest rates compared to shorter terms. Think about how long you realistically see yourself using the financed item or property. If it’s likely to be a short period, a variable rate might be more cost-effective unless the market is expected to have high volatility in interest rates.

3. Consider Current and Expected Future Interest Rates

Look at current interest rate trends and expert forecasts. If rates are historically low, locking in a fixed-rate can protect you from future increases.

Consider broader economic conditions that might affect interest rates in the future, such as inflation rates and monetary policy.

4. Compare Different Lenders and Loan Offers

Don’t settle for the first offer you receive. Compare rates, terms, and fees from multiple lenders.

Important: sometimes, terms can be negotiable, especially if you have a good credit score or a strong relationship with the lender.

5. Evaluate the Flexibility of the Loan Terms

Check if there are penalties for paying off the loan early. Some fixed-rate loans come with prepayment penalties that could offset the benefits of early repayment.

Consider the possibility and the cost of refinancing if interest rates drop significantly.

6. Seek Professional Advice

If you’re unsure, speaking to a financial advisor can provide personalized insights based on your financial situation and goals. Also, a broker can help you understand the market better and find a loan that fits your needs.

FAQs:

What is the length of fixed-rate mortgages?

The length can vary widely depending on the borrower’s needs and the options provided by lenders. The most common terms: 30, 20, 15 or 10 – year, other terms, such as 25-year or 40-year.

How to Calculate Fixed-Rate Mortgage Costs?

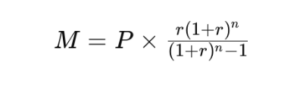

To calculate the monthly payment, you can use the following formula derived from the standard amortization formula:

Where:

- M is the monthly payment.

- P is the loan principal (the amount borrowed)

- r is the monthly interest rate (annual rate divided by 12 months).

- n is the total number of payments (loan term in years multiplied by 12).

What happens when the fixed-rate ends?

The loan may move to an adjustable rate at the conclusion of the fixed-rate term, which could mean either higher or lower payments. In order to prevent rate rises, borrowers frequently decide to refinance to a new fixed-rate. The loan may be repaid or have new terms if the loan term falls within the fixed-rate period. To properly handle the financial ramifications in the future, preparation for this shift is essential.

Are fixed-rates good or bad?

Particularly in contexts when interest rates are growing, fixed interest rates offer stability and predictability, which makes them advantageous for long-term planning and budgeting. They may, however, start higher than variable rates and be less adjustable, which could be a disadvantage for certain borrowers.