What is Stamp Duty? Property Tax UK- Updated 2023

Considering Stap Duty is an integral part of buying or inversing in property, it is essential you’re armed with the knowledge of all rules and regulations.

Stamp Duty Land Tax applies to the transfer of ownership on land and property in the UK that meets certain conditions.

In simple terms, is a type of property tax that needs to be paid once you buy a property in the UK.

Over the years the rules have changed, but we’ve compiled this guide to help you understand how it works & to give you the most up-to-date facts.

What is stamp duty, exactly?

When buying property in the UK it is important to be aware of the tax requirements that come with such a purchase and continued owning of that asset.

In England, Wales and Northern Ireland, tax on the sale of a property is known as Stamp Duty Land Tax (SDLT), often shortened to Stamp Duty (in Scotland you pay Land and Buildings Transaction Tax instead).

Not all property is subject to stamp duty, as it is dependent on the value & purpose of the property and also the type of buyer you are.

Meaning, different rates that apply depending on whether the land or property is designated as residential or non-residential, and whether you’re a first-time buyer or not.

Currently, the stamp duty threshold is:

- £125,000 for residential property

- £150,000 for non-residential property

Any property transaction under those thresholds won’t incur SD, but any sales over those points will be subject to stamp duty at a certain rate.

Similar to Income Tax, the rate applies only to the value of the property above those thresholds. So if your residential property is valued at £250,000, you will only pay SD on £125,000.

There is also a higher rate of SD for property purchases if you already own a property in the UK and are purchasing an additional one i.e. a buy-to-let property.

In this case all property purchases will incur the additional higher rate and will be taxed at a minimum rate of 3%, with the percentage increasing as the price increases.

It is important to be aware of these rates and to calculate what your total tax will be before you go ahead with the purchase. It is also highly advisable to seek legal advice from a professional in order to ensure you have all the necessary information.

The government website provides a Stamp Duty Land Tax calculator which will help you to work out the total amount of tax you need to pay on your property purchase. Or you can use other tools available online, as well as our own, here.

It is important to remember that you also need to factor in any additional costs such as legal fees, surveyor’s fees and mortgage arrangement fees when working out your total budget for the purchase.

It is advisable to seek independent financial advice from a qualified professional if you are unsure about any aspect of the purchase or the associated taxes.

How much is stamp duty in the UK?

The rate of stamp duty that is applied to a property sale is linked to the value of the property. The higher the price, the higher the tax.

For non-residential properties, the following rates of stamp duty are applied:

- Up to £150,000, there is no stamp duty tax applied

- The portion between £150,001 and £250,000 is taxed at 2%

- The remaining amount, above £250,000, is taxed at 5%

For residential properties, the rates of stamp duty work out as follows:

- Up to £125,000, there is no stamp duty tax applied

- The portion between £125,001 and £250,000 is taxed at 2%

- The portion between £250,001 and £925,000 is taxed at 5%

- The portion between £925,001 and £1.5 million is taxed at 10%

- The remaining amount, above £1.5 million, is taxed at 12%

However, if you are purchasing an additional residential property for £40,000 or more, when you already own at least one other (as is usually the case with buy-to-let properties), they will be taxed at the higher rate of SD. For these transactions, SD is applied at the following rates:

- Properties up to £125,000 are taxed at 0%

- The portion between £125,001 and £250,000 is taxed at 2%

- The portion between £250,001 and £925,000 is taxed at 5%

- The portion between £925,001 and £1.5 million is taxed at 10%

- The remaining amount, above £1.5 million, is taxed at 12%

For First Time Buyers

It’s good news if you’re a first time buyer in England or Northern Ireland. You will not have to pay Stamp Duty on properties worth under £300,000. For properties valued in excess of this figure the standard rates apply on the sum above the threshold.

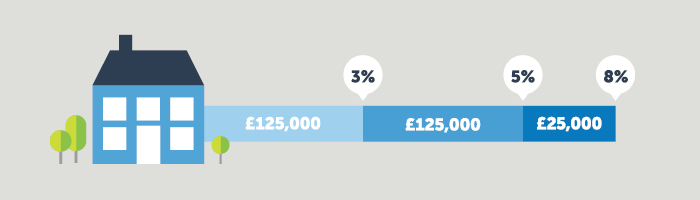

So how does that work out exactly? Let’s take the example of a buy-to-let property that costs £275,000 (if you already own one or more properties, and therefore the higher rate of Stamp Duty applies). The Stamp Duty you would owe on this property is calculated like this:

0% on the first £125,000 = £0

2% on the next £125,000 = £2.500

5% on the final £25,000 = £1.250

Total SDLT = £3.750

Stamp duty is applied equally to freehold and leasehold properties.

This means that if you’re buying a leasehold property, the same Stamp Duty rules apply. However, it is worth noting that when purchasing a leasehold property there are additional costs to consider such as ground rent and service charges. It’s important to factor these into your budget so you know exactly how much money you will need to complete the purchase.

So, now you know how SD is applied to different property purchases, but how is it paid?

How Do I Pay Stamp Duty?

Stamp duty is paid to HMRC, the UK’s taxation department. Whenever you purchase a property of any kind, you must send an SDLT return to HMRC. You must then pay any tax incurred within 14 days of completion – this time limit came into effect as of 2021.

If you are working with a solicitor, agent or conveyancer to complete your purchase, they will usually file your return and pay the tax on your behalf on the day of completion, then adding the amount to the fees they charge you.

However, if you are conducting the transaction entirely by yourself, it is your responsibility to file the return and pay the owed taxes directly to HMRC.

Understanding SD. can seem daunting, and naturally, you’ll want to ensure you pay the correct amount. But with patience and careful consideration (and the assistance of a reliable solicitor!), it needn’t be a big headache in the property buying process.

Fortunately, HMRC have made the process of filing and paying SDLT easier than ever before. With their online services, you can now file your return and pay the tax immediately with just a few clicks of a button. If you prefer to pay by post, you can download an SDLT return form from the HMRC website, fill it in and send it to HMRC with your payment.

You must also keep evidence of your payment so make sure to get a receipt or other proof of payment when you file your return. This could come in the form of a bank statement showing the payment or an email confirmation from HMRC. It’s important to keep this for at least 12 months after filing your return in case HMRC need to check that you have paid the correct amount.

Stamp Duty Calculator

Now that you have read everything you need to know about SD, you can calculate yours by clicking here and getting more info about your SD payment. It will help you to calculate the amount of stamp duty. It makes it easy to determine how much stamp duty needs to be paid, and can save time and money when doing your final calculations regarding your property and help you budget properly.

Using the Stamp Duty Calculator is simple and straightforward. All you need to do is enter some basic information about your property transaction, the calculator will then provide an estimate of what your total stamp duty cost will be. Visit our SD calculator for more info

If you found this article useful, you may also find Is Property Still a Good Investment? and The Difference Between Freehold Vs Leasehold Properties interesting.