Manchester Properties – Treasures Of The Real Estate Scene

Manchester is one of the UK’s most dynamic cities. Home to a thriving property market and consistently ranking as one of the country’s top locations for buy-to-let investment, more investors are turning their attention to the Northern Powerhouse. The city is undergoing substantial economic and demographic growth, and Manchester properties are increasing in value, spurred by urban regeneration and continual population growth—all factors that shape a promising and stable investment environment.

Investing in Manchester offers more than just financial returns; it provides a gateway to a city with steady economic growth and a lively culture, promising appealing yields and capital gains potential.

In this article, we take a look at Manchester’s meteoric rise as an investment destination, what the future looks like for its property market and areas investors should have their eyes on when it comes to investing in Manchester properties.

Overview of the Manchester Property Market

Investors who got in early on Manchester and Salford’s growth have seen great returns—not just in capital gains but also through a recent spike in rental rates thanks to an ever-expanding population and ongoing redevelopment.

But Manchester property investment opportunities aren’t over. The whole North West region is set to see property prices rise by 11.7% by 2027, according to Savills, which only cements Manchester’s stand-out position in the market.

Manchester is still growing and developing, which means plenty more investment opportunities are on the horizon. Before looking at the opportunities, let’s take a look at trends in Manchester’s property market over the last couple of decades.

Robust Growth in Property Values

Manchester has reliably been one of the UK cities experiencing robust property price growth, fueled by factors like economic development, a rising population and heightened investment.

In the early 2000s, Manchester properties witnessed a consistent increase in value, and Manchester became a stand-out location for investment. Between 2002 and 2022, the city experienced a 143% rise in home prices from £73,910 to £179,537.

Buy-to-Let Market Growth in Manchester

Over the past decade, there has been a boom in buy-to-let properties in Manchester.

According to Rightmove (Aug 2022) data, UK private rents have skyrocketed, with a remarkable 23.4% increase over the past year. Rents outside London have surged 19% above pre-pandemic levels—marking the steepest annual hike in 16 years.

While Manchester’s rental prices are below London’s, they surpass other major regional cities, including Liverpool, Birmingham, and Newcastle.

Development Boom

New Manchester developments have been prominent over the past 20 years, with a particular increase in high-end residential and Manchester commercial properties. These properties cater to a growing demand for quality accommodation and modern office spaces.

From 2006-2010, new developments in Manchester and urban regeneration projects, such as in Salford Quays, began to reshape the city’s skyline and property market. The transformation brought about by Spinningfields and MediaCityUK was pivotal.

According to the UK house price index 2011- 2021, the population in Manchester and Salford doubled in the 10 years following their regeneration, pushing property prices to soar by over 70%.

Shift Towards City Centre Living

Manchester has established its allure for young professionals with an impressive 84% surge in global business and employment from 2002 to 2015. As more companies found a home in Manchester, creating a flourishing job market, job growth has helped drive demand for rental property amongst young professionals.

Urban living, particularly in Manchester’s vibrant city centre, has notably increased, especially among young professionals and students. This shift has fueled a growing demand for central apartments, spurring additional residential developments.

During and post-Covid, trends such as young professional leaving London for more affordable cities like Manchester has helped fuel demand for rental property.

Foreign Investment

Manchester has become a popular location for foreign capital in the real estate sector. The city has gained attention from international investors thanks to its solid rental returns and consistent rise in property values. Particularly, the luxury apartment sector has seen a notable influx of overseas funds.

Chinese and Hong Kong Investment

London’s residential property has typically been the key epicentre for Hong Kong and Chinese investments in the UK housing market. While London remains a key market, the North West is rising in popularity, with investors lured by advantageous property pricing.

Manchester is popular with Chinese students, and Hong Kong buyers have been active in securing properties in the city, driven partly by the strength and stability of the UK’s property market, even amid global uncertainties.

Increase in Co-Working Spaces

In the commercial property sector, there’s been a notable increase in the demand for co-working spaces. The shift towards flexible working arrangements and the growth of the tech industry in Manchester have contributed to this trend.

Affordability Issues

To be classed as affordable, a property must cost no more, in rent or mortgage, than 30% of the current average gross household income of a Manchester resident.

Although Manchester remains more affordable than London, the rapid increase in the value of Manchester properties has led to growing concerns about affordability, particularly for first-time buyers.

Over the years, various government schemes, such as Help to Buy, have influenced the property market, assisting first-time buyers to get on the property ladder. However, these policies can have adverse effects, driving demand and increasing property prices. You can read more about the causes of the UK’s housing crisis here.

The Future of Manchester’s Property Market

Looking ahead, Manchester is poised to stand out as one of the UK’s most robust housing markets with respect to the growth of house prices.

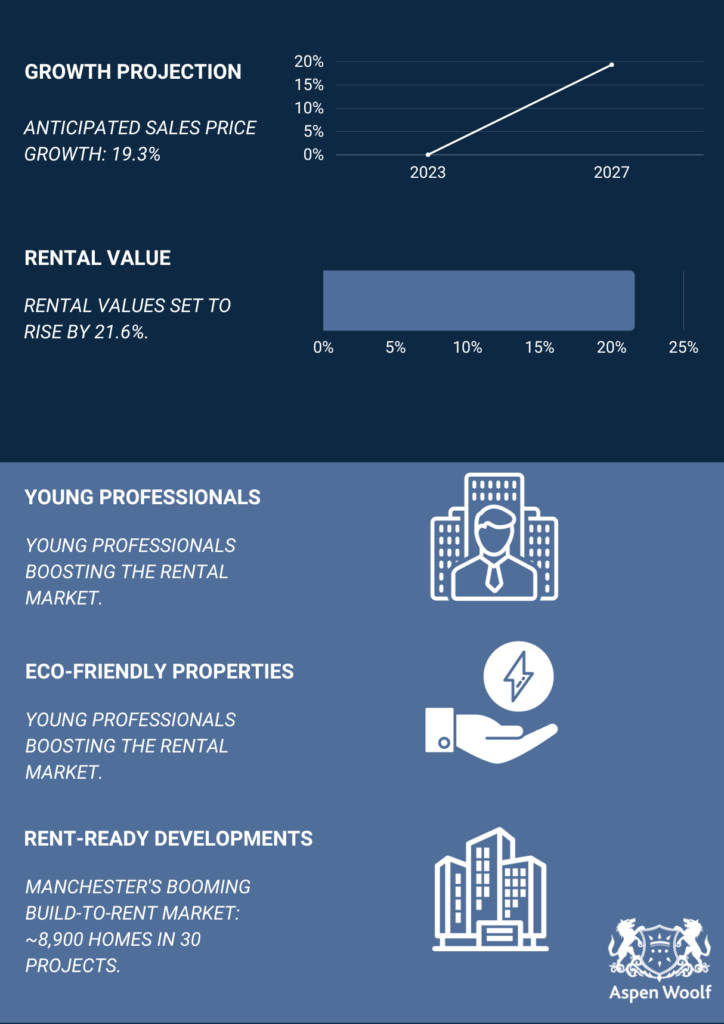

Demand is notably surpassing supply, a trend that is anticipated to continue. From 2023 to 2027, the growth in sales prices in Manchester is forecasted to climb by 19.3%.

Strongest Predicted Rental Value Growth

Property in Manchester is set to see its rental values rise by 21.6% over the next five years. A steady stream of young professionals moving to the city for work is boosting rental market activity and contributing to this anticipated growth.

Eco-friendly Properties

Anticipating the future, renters are predicted to favour new build properties Manchester in the city centre that prioritise energy efficiency and reduce their utility costs. This preference is likely to enhance the demand for sustainably built developments.

Rent-Ready Developments

Manchester is home to the nation’s second-largest active build-to-rent market. With about 8,900 homes spread across approximately 30 different projects and several more developments in the pipeline.

A Strong Manchester Economy is Fueling Property Investment

One of the Fastest growing UK Economies

With its rapidly expanding economy, Manchester is experiencing the swiftest growth out of the UK’s leading cities (Birmingham, Leeds, Edinburgh, Glasgow and Bristol).

Boasting a 34% economic expansion over the past decade alone, Manchester saw the highest GVA growth of the Big Six cities over the past ten years. Over the next ten years, Bristol is expected to see the highest GVA growth of 24%, followed closely by Manchester at 23%.

Serving as the busiest air hub outside of London, Manchester International Airport, paired with robust rail links to numerous major UK cities, plays a pivotal role in the city’s connectivity.

The city continues to be a magnet for both companies and young professionals, and this momentum will continue as further investments and developments focus on Manchester.

Manchester Population Growth

Manchester has led the pack in population growth over the past decade among the UK’s largest cities. Thanks to its continuously enhancing livability, Manchester’s population is predicted to keep rising, with the city council previously estimating it to exceed 635,000 by 2025.

An influx of young people has also been gravitating toward this northwestern city. In 2020, as per ONS data, Greater Manchester topped the list for housing the most 25 to 29-year-olds in the UK.

The city’s growing population and liveability are poised to further fuel the housing market in the coming years, with numerous residential developments underway to meet growing demand.

Attractive Opportunity for Investors: More for Your Money

The North of England remains a much more attractive investment opportunity than London and the South of England.

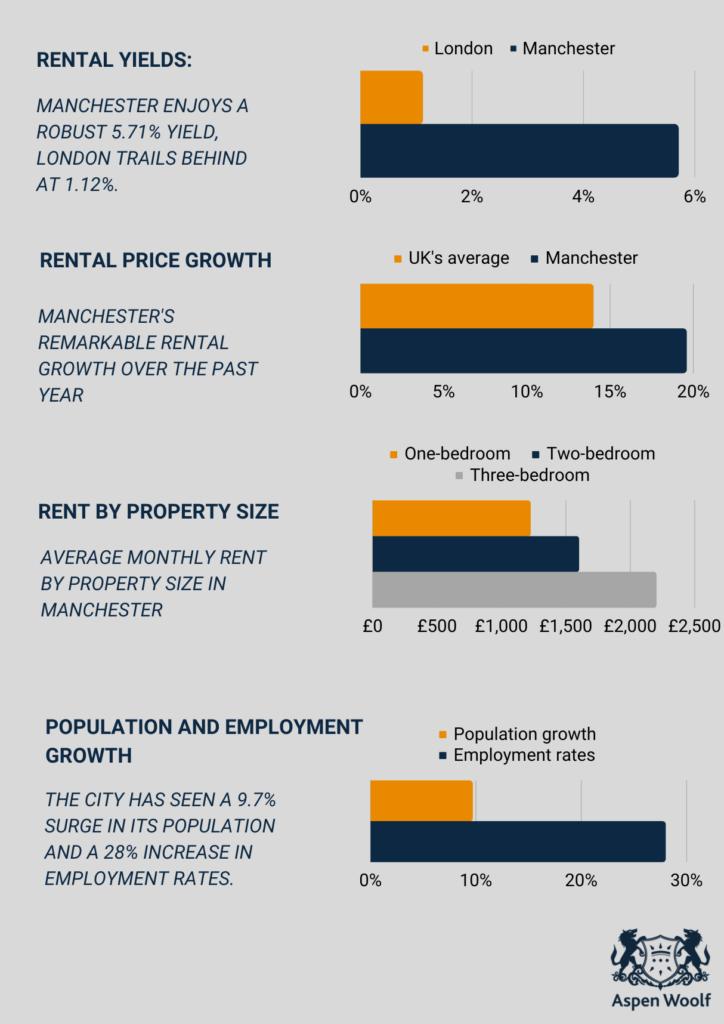

Manchester has seen a significant fall in rental stock; in 2022, listings were down 23% compared with 2019. Due to this constrained supply, investors in Manchester are enjoying one of the highest yields in the country.

According to Home.co.uk, Manchester’s average house price is £238,253, and the average monthly rent is £1,611, resulting in a 5.71% yield . In contrast, rental growth in London is relatively low at 1.12%.

Rental Price Growth

Manchester’s rental market has experienced remarkable growth over the past year, surpassing the national average rental increase of 14%. With 19.6% annual rental growth and 25% annual prime rental growth, this is the highest rent increase among the major UK cities.

For those considering the Manchester rental market, the average monthly rent for a one-bedroom home stands at £1,225, as reported by JLL. Two-bedroom residences average £1,600 per month, while three-bedroom homes come in at £2,200 per month.

The upward trajectory in the price of Manchester properties is attributed to a rising population and a diminishing supply of available homes. Over the past decade, Manchester has seen a population increase of 9.7%.

Demographic Dynamics

Manchester’s population has grown by 9.7% in the past year, with employment rates surging by an impressive 28%, according to JLL. This surge has placed additional strain on the city’s housing market.

Manchester remains a magnet for a substantial influx of inward investment, students and young professionals, all seeking to call the city home. With abundant employment and educational opportunities, demand for housing continues to outpace supply.

The city’s appeal to young professionals, particularly in sectors like technology and finance, has driven a heightened demand for top-tier rental properties and Manchester property buyers should keep this in mind if looking for a buy-to-let property.

Notable Developments in Manchester

Manchester’s property market is thriving. Last year, it saw a 30% increase in the number of residential units delivered compared to 2017.

The driving force behind this construction boom is demand from tenants. Particularly the 24 to 37-year-old demographic, which Manchester leads among all UK cities. Priced out of the market and renting for longer, the demand for rented accommodation over home ownership is driving demand for buy-to-let.

As a hub for finance, commerce and tech, in 2018, Manchester saw record-breaking office space take-up. Also, the city should create approximately 3,100 new jobs annually until 2034.

Undersupplied and in high demand, many areas of the city are undergoing regeneration. Here are some top areas investors should keep an eye on to find investment properties in Manchester.

Ancoats

Ancoats, located in the north of the city, has emerged as a vibrant neighbourhood and earned the title of one of the ‘coolest neighbourhoods in the world’ by Timeout magazine.

The next phase of Ancoats’ regeneration involves redeveloping a former industrial site into 256 homes, known as Phoenix Ironworks.

The project includes a mix of one-, two- and three-bedroom apartments and townhouses. Along with commercial space totalling up to 14,500 sq ft, including workshops for creatives. The scheme is estimated to have a gross development value of £87.5 million and a development cost of £76 million, according to Savills.

Old Trafford Civic Quarter

Trafford Council has adopted the Civic Quarter Area Action Plan in 2019. This plan, covering a 135-acre area, includes proposals for over 500,000 sq ft of commercial space.

The plan’s primary goals are to build up to 4,000 homes. Subsequently, improve public spaces and develop new infrastructure to create Trafford’s “newest, greenest, and most vibrant neighbourhood.”

Several projects within this area are progressing. Such as the redevelopment of the former Kellogg’s headquarters and plans for 200,000 sq ft of offices. As well as a primary school and a 100-bedroom hotel.

Victoria North

Victoria North, previously known as “Northern Gateway,” is one of Manchester’s most significant residential development endeavours. Spearheaded by Far East Consortium (FEC), it represents one of the UK’s largest residential development projects, with an ambitious goal to rejuvenate a substantial area of north Manchester over the next 15 to 20 years.

Strategically positioned, Victoria North will unfold across several neighbourhoods. Including Collyhurst, New Cross and the Irk Valley, effectively bridging the city centre with north Manchester.

Victoria North should create 15,000 new homes across 155 hectares and seven distinct neighbourhoods within the next two decades. This substantial undertaking aims to address the housing shortage in Manchester while fostering the creation of well-connected public spaces. Likewise, enhanced transport links, additional housing options, parks and retail spaces to cater to the city’s growing population.

The development includes:

- Over 15,000 homes, with at least 20% designated as affordable housing, alongside new and improved retail, health and educational facilities.

- The unique City River Park will seamlessly connect North Manchester to the city centre. This will establish a continuous network of green and public open spaces.

- Full integration into the existing public transport network, including the Metrolink. As well as improvements to local infrastructure to promote walking and cycling.

Victoria North represents a £4 billion investment in North Manchester over 20 years. Enabling works for the inaugural development of Victoria Riverside commenced in early 2021. The entire project should be done by 2041.

Conclusion

Manchester’s property market presents a golden opportunity for investors seeking stability, growth and the chance to be part of a city that continues to redefine itself. Predictions point to continued growth in property prices and rental values. This is mostly fueled by population growth, economic expansion and a rising demand for sustainable, rent-ready developments. To find out more about property investment in Manchester, get in touch with our experts.