Property Investment Manchester – 9 Reasons To Invest in 2024

Investing in Manchester property positions you within one of the UK’s most promising markets.

This city, renowned for its economic vitality and diverse culture, offers investors a unique blend of opportunities.

With ongoing urban regeneration enhancing its appeal and a strong educational sector attracting young professionals and students, Manchester’s property market presents a robust rental demand.

This guide aims to equip potential investors with insights into the advantages of owning property in Manchester, underscoring the city’s potential for growth and profitability in the property investment landscape.

Read on to discover more about investing in Manchester and the top reasons for owning a property in the city.

1. Manchester Economy – A Powerhouse

Manchester has an economy bigger than that of Wales and Northern Ireland and is a key member of the Northern Powerhouse. This cluster of leading cities in North England together forms a super economy to rival London’s.

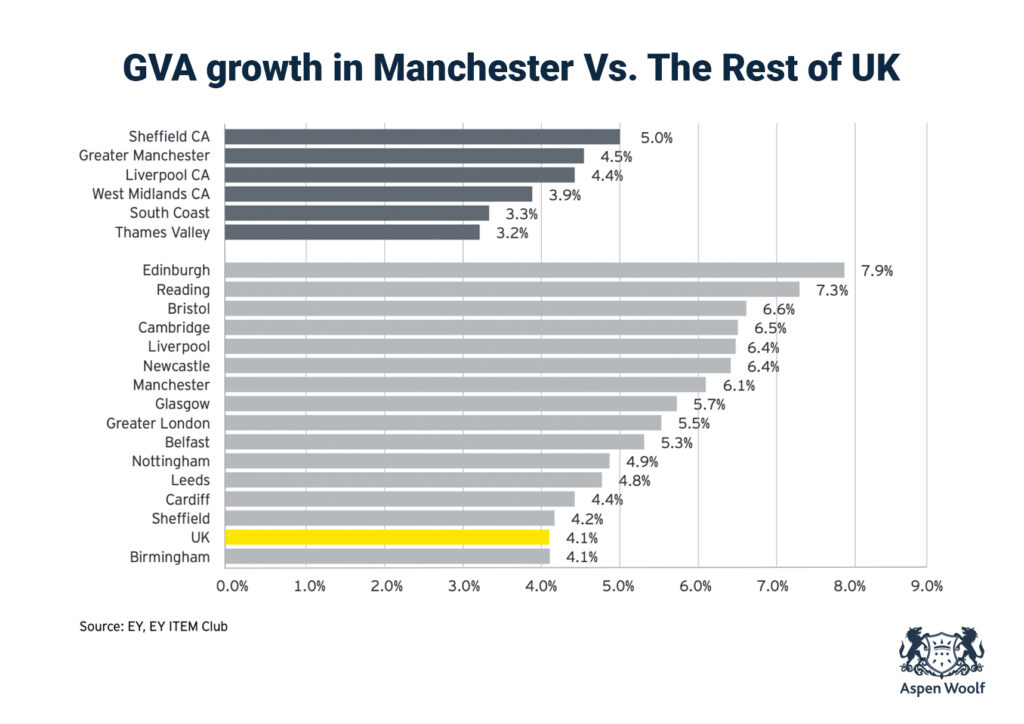

By 2026, Manchester’s GVA is expected to be £2 billion larger than in 2022. According to Ernst & Young, Manchester’s economy will see an annual average growth of 2.5% between 2024 and 2026. This outpaces the national growth rate (2.1%) and puts the city third-fastest in terms of economic growth out of all UK towns and cities 2024 – 2026 (behind Reading, 2.7% and London, 2.6%).

The strength of the city’s professional, scientific, technical and financial sectors support Manchester’s positive economic outlook. Between 2024 – 2026, Manchester is due to record the fastest rate of employment growth of any UK city, with job numbers increasing 1.8% per year (the national average is 1.3%).

Talent-hungry companies are flocking to Manchester thanks to the stream of workers provided by its world-class universities. This is good news for property investors. Manchester’s increasing popularity amongst young professionals is spurring a healthy rental and buy-to-let market.

The city’s role as a digital and tech hub is attracting multinational corporations and startups alike, fostering an ecosystem ripe for investment. Infrastructure projects, like the expansion of Manchester’s Metrolink and the High-Speed Rail (HS2), promise to enhance connectivity, further boosting the city’s appeal to businesses and residents.

2. Manchester Businesses Create Endless Opportunities

Manchester is a city with innovation running through its veins. Among its accolades is its role in the Industrial Revolution, the realisation of economic theory, and the birthplace of Vitro Fertilisation (IVF).

Today, Manchester’s strengths are diverse and numerous, with well-established and globally renowned sectors making up its modern economy:

- Life sciences

- Cyber-security

- FinTech

- Advanced materials

- Healthcare

- Manufacturing

- Creative, digital and tech sectors

80 out of the 100 FTSE 100 companies are located in Manchester, including Amazon, BBC and Kellogg‘s, helping to build and attract a growing talent pool in the city. Globally trading companies with a base in Manchester include PZ Cussons, Co-operative Group, Umbro and Peel Group.

Diverse and pioneering companies fuel job growth, new business opportunities and support start-ups and large and small businesses, offering plenty of opportunities for young professionals. As a result, Manchester is an attractive city for property investors, particularly for those targeting the young professional rental demographic.

3. A Start-Up, Digital and Creative Hub

Manchester is a top Digital Tech City and has become a national and European leader in a number of innovative and emerging sectors.

Manchester has a £5 billion technology ecosystem and is home to 10,000 digital and tech businesses. The city is recognised as one of Europe’s largest creative, digital and technology clusters. The city’s tech industry is growing at six times the rate of the UK economy and employs 100,000 people.

A big factor in the city’s success is the establishment of MediaCity. This purpose-built digital hub has a broadcast and media heritage and is home to companies like the BBC, ITV and Mediacom. It is one of the largest media and creative hubs in Europe and home to a wide range of businesses, including TV studios, radio stations, production companies, and creative agencies.

MediaCityUK has helped to establish Greater Manchester as a major hub for the creative and digital industries. The city’s creative, digital and tech ecosystem houses more than 10,000 businesses at all stages, from start-ups to SMEs to globally renowned brands.

As well as a leader in advertising, marketing, animation, gaming and augmented and virtual reality, Manchester has given birth to some of the fastest-growing tech companies in the UK, including unicorns (start-ups with a value of £1 billion) like boohoo clothing, AO.com and data-integration company, Matillion.

The city’s tech and start-up scene do so well thanks to a sustainable flow of graduates from the city’s five universities. Businesses have a wide range of talent with the right skills to choose from.

A strong creative, media, tech and start-up ecosystem, and the continued growth of MediaCityUK is driving huge demand for properties in the Salford Quays area and its surrounds. As more graduates and young professionals flock to this area, property investors can capitalise on a steady and growing rental market for real estate in Manchester.

4. Manchester House Prices

Manchester property investment has caught the eye of investors in recent times. House prices in Manchester have soared by 330% over the past 20 years. The city experienced double-digit growth post-pandemic – the first of the UK’s big six cities to do so – with annual growth of 12.6% recorded in June 2021.

By the end of December 2022, the market saw new one-bedroom flats in Manchester averaging at £213,000, and two-bedroom flats at an average sale price of £300,000. This upward trend in property prices reflected the city’s robust demand for housing, a scenario that has persisted into 2024.

The rental market across UK cities, including Manchester, remains strong as the demand for housing consistently surpasses supply. Forecasts by JLL in 2023 anticipated annual house price growth in Manchester to hit 5%, a prediction aligning with the city’s dynamic market conditions. Moreover, the five-year forecast from 2024 projected a promising 19.3% increase in property prices, presenting a compelling case for investment.

As of the latest data available, the average house price in Manchester has adjusted to £234,841, with the rental market also showing robust figures, with an average monthly rent of £850. These figures reflect the city’s healthy property investment environment, driven by a combination of factors including economic growth, infrastructure development, and a vibrant cultural and educational scene.

For investors, Manchester’s property market presents a range of opportunities, from residential to commercial real estate. The city’s continued focus on development, coupled with its strategic importance as a northern economic powerhouse, suggests that Manchester will remain an attractive location for real estate investment.

Potential investors are advised to keep an eye on emerging trends, including the impact of new transport links and regeneration projects, which could further influence property values and rental demand in the coming years.

5. Manchester Rental Growth

Manchester was the UK’s best-performing city for rental growth in 2022 and the city centre recorded a 22% increase in achieved rents in December. The average rent for a one-bed flat in the city centre was £1,172 per calendar month and £1,495 for a two-bed flat.

Q3 2022 statistics show that there are 26% fewer homes to rent compared to the pre-pandemic average. The supply-demand imbalance continues to make for a lively rental market. Due to restricted supply and an increase in demand for rental homes, in many instances, renters are bidding higher than the asking price when trying to secure their rental property.

Manchester is seeing even greater yields of 9.4% as rental values push ahead of house prices. The M14 postcode, for example, covering the areas of Platt Fields Park, Fallowfield, Moss Side and Rusholme, performs strongly, offering a yield of 9.5% in 2023.

As of 2024, Manchester remains a standout city in the UK for rental growth, building on its previous years’ performances. The city centre, in particular, has continued to see a robust increase in rental prices, reflecting the ongoing demand for living spaces within this vibrant urban area. While I don’t have real-time data, we can project trends based on past performances and current market dynamics.

The average rent for a one-bedroom flat in Manchester’s city centre has likely seen further increases from the £1,172 per calendar month recorded in December 2022, in line with the city’s growth trajectory. Similarly, two-bedroom flats, which were at £1,495, are expected to have experienced comparable growth. The rental market’s vitality is partly due to Manchester’s appeal among young professionals, students, and families looking for a dynamic living environment with access to a wide range of amenities and employment opportunities.

As of the latter part of 2023, the supply-demand imbalance in Manchester’s rental market remains a critical factor. The shortage of available rental homes compared to pre-pandemic levels has not significantly improved, maintaining upward pressure on rental prices. This scenario has often led to renters offering above the asking price to secure properties, underscoring the market’s competitive nature.

Investment yields in Manchester have been particularly attractive, with areas like the M14 postcode — encompassing Platt Fields Park, Fallowfield, Moss Side, and Rusholme — offering yields upwards of 9.5% in 2023. These high yields reflect the strong rental demand relative to house prices in the city.

Despite economic uncertainty including rising interest rates, the Manchester rental marketplace continues to offer exceptional returns for landlords. With plenty of investment opportunities, securing a buy-to-let investment property in Manchester is an appealing prospect. When it comes to buy-to-let investments within a top UK housing market, Manchester is one to watch.

6. Manchester Lifestyle: A Sought-After City

Manchester property investment is helped by the city being an attractive place to live and work. Also, Manchester holds the title of the UK’s most liveable city and is ranked 28th in the world. The city and region offer a quality of life unlike any other in the UK, attracting young professionals, families as well as tourists from around the world.

Whatever the interest, Manchester has something to offer and is well-known for its music and performing arts scene, gastronomy, nightlife and sport and leisure offerings.

As well as all the conveniences of a major city, there’s plenty of nature right on the doorstep with The Lake District, Pennines and Peak District just a stone’s throw away.

7. A Strong Student Rental Market Accommodation

Manchester is the home to five of the UK’s leading universities known for their excellence in teaching and research and strong industry collaboration.

The University of Manchester ranks 28th in the world (QS World University Rankings). The university is the UK’s largest single-site university campus, attracting high numbers of students from the UK and all corners of the globe. Manchester property investment in the student market can be lucrative indeed.

There are around 90,000 students across Greater Manchester’s five universities. With a strong growth in student numbers, the city adds 1,000 new bed spaces each year. However, in the past five years, for every new bed space added to the supply three more full-time students are added to the population, resulting in a continued student accommodation shortfall.

With demand for accommodation exceeding supply, landlords can expect high demand from students and young professionals. There is a good opportunity in the luxury and high-end student apartment market, in particular. Many students, especially those from overseas, are searching for accommodation of a higher standard.

If you’re looking for long-term high-net returns, investing in student property in Manchester is something worth exploring.

8. Manchester as the Heart of the North

Known as the “gateway to the north of England”, Manchester’s convenient location and excellent infrastructure make it a useful and accessible base to travel farther afield.

Manchester to London is around 2 hours by train, making it easy to get into the capital. The Great North Rail Project will allow more than 40,000 more passengers to travel throughout Northern cities on a daily basis and increase visits to Manchester from both tourists and commuters.

On the fringe of the city is Manchester Airport, the largest UK airport outside of London. Flying to almost every continent and serving more than 200 destinations, each year the airport handles more than 19 million passengers.

9. Manchester Regeneration Transforming the City

Manchester is one of the fastest-growing cities in Europe being transformed by skyscrapers, residential buildings and office space.

Manchester continues to solidify its position as a key player in the UK’s urban transformation and economic growth, showcasing remarkable resilience and dynamism in its development landscape.

The city’s regeneration efforts, which gained significant momentum in the early 2020s, have further accelerated, bringing substantial investments and infrastructural enhancements to its urban fabric.

As of 2024, these initiatives have not only transformed Manchester’s skyline but also revitalized neighborhoods, fostering a vibrant urban living environment and making the city an attractive destination for property investors.

Manchester’s Regeneration Highlights for 2024:

- Skyscrapers and Residential Developments: The city’s skyline continues to evolve, with numerous high-rise buildings completing or making significant progress. These developments are not just residential; they also include mixed-use projects that integrate office spaces, retail outlets, and leisure facilities, contributing to the city’s dynamic urban lifestyle.

- Northern Gateway: Building on the initial £185 million investment to create 634 new homes, the Northern Gateway project has expanded into a comprehensive regeneration strategy. This ambitious initiative aims to develop thousands of homes over the next decade, alongside new public spaces, commercial areas, and community facilities. It’s designed to connect and rejuvenate neighborhoods north of the city center, making them more attractive for residents and investors alike.

- St. John’s Neighborhood: The regeneration of St. John’s neighborhood has advanced, transforming this area into a vibrant cultural and commercial hub. The project emphasizes sustainable urban living, incorporating green spaces and public realms that encourage community engagement. This development further cements Manchester’s commitment to creating inclusive and innovative urban environments.

- Co-Living and Modern Housing Solutions: The trend towards co-living has grown, with developments like the 2,000-room scheme on First Street leading the way. These modern housing solutions cater to the city’s diverse population, offering flexible and community-oriented living arrangements that appeal to young professionals, creatives, and students.

- Manchester Arena and Entertainment Venues: The completion of the £350 million Manchester Arena has added a state-of-the-art entertainment venue to the city, capable of hosting large-scale concerts, sports events, and cultural gatherings. This development has not only enhanced Manchester’s cultural landscape but also stimulated economic activity in the surrounding areas.

- Investment in Infrastructure and Public Transport: Ongoing investments in Manchester’s infrastructure, including improvements to public transport networks, are crucial to supporting the city’s growth. Projects aimed at enhancing connectivity, such as the expansion of the Metrolink tram system and upgrades to rail services, facilitate easier movement across Manchester and the Greater Manchester region.

Which Areas to Invest in in Manchester?

There are a number of areas across the city with attractive property prices and strong rents. Here are some areas to take a closer look when purchasing an investment property Manchester.

Manchester City Centre

Manchester City Council states that over 5,000 people move into the city centre each year. The current metro area population of Manchester in 2023 is 2,791,000.

Some of the best property investments in Manchester can be found in the city centre. As the city’s population continues to grow there is a lack of housing stock to meet demand, particularly high-end flats. Currently there are a number of new build apartments Manchester city centre springing up. An ideal place to invest, house prices and yields of Manchester city centre property are rising more rapidly than other up-and-coming areas of the city.

Properties in Manchester City Centre had an overall average price of £254,877 over the last year.

Salford

With the heart of the city centre a short walk away, property investment Manchester makes Salford an increasingly popular area for investors. Home of the University of Salford, the area is popular with students. This makes buy-to-let property in Manchester in the student accommodation category an attractive option. With the regeneration of Salford Quays and MediaCityUK in close proximity, young professionals, too, are flocking to the area.

This area, including MediaCityUK, has seen significant development and is a hub for media and technology companies. It offers opportunities in both residential and commercial real estate.

Average property rents in Salford are currently £1,414 per calendar month and flats in Salford had an average selling price of £213,050.

Stockport

South of the city and around 7 miles from the centre, Stockport is popular with families and commuters travelling into the city for work thanks to efficient transport connections.

A highly sought-after residential area, there is strong demand for property and rental accommodation in Stockport.

Properties in Stockport had an overall average price of £281,379 over the last year.

Moss Side

The inner-city area of Moss Side is a popular area with students thanks to its proximity to Manchester and Manchester Metropolitan universities. While mainly Victorian terraces, new builds have been introduced in recent years along with the regeneration and investment in the area, making it a popular area for investments in Manchester.

The average asking rent for a 2-bedroom flat in Moss Side is £1,388.01 per calendar month. Properties in Moss Side had an overall average price of £192,093 over the last year. Which makes it one of the best areas in Manchester to buy a house.

Ancoats and New Islington

Ancoats and New Islington have emerged as two of Manchester’s most vibrant and sought-after neighborhoods for property investment. Once at the heart of Manchester’s industrial revolution, these areas have undergone significant regeneration and are now celebrated for their unique blend of historical character and contemporary living.

Both areas have seen extensive redevelopment, transforming into lively communities with a mix of residential, commercial, and leisure spaces. This has attracted a diverse population, from young professionals to families.

The availability of modern apartments, refurbished industrial buildings, and innovative new developments makes Ancoats and New Islington highly attractive for renters and buyers seeking urban living with a community feel.

These neighborhoods boast a range of amenities, including artisan eateries, independent shops, green spaces, and cultural venues. The lifestyle appeal contributes to strong rental demand and potential for capital growth.

Their proximity to Manchester city centre, with excellent transport links, makes them convenient for commuters and enhances their desirability.

Given their popularity and the level of investment in the areas, property prices may be higher than in other parts of Manchester. However, the strong demand for housing can lead to favorable rental yields and long-term capital appreciation.

The Corridor Manchester

The Corridor Manchester is a strategic area that spans from St. Peter’s Square to the universities and hospitals along Oxford Road. It is recognized as a center for knowledge, science, and innovation, making it a prime location for property investment.

Home to the University of Manchester, Manchester Metropolitan University, and several hospitals and research institutions, The Corridor attracts a significant population of students, academics, and healthcare professionals.

The area’s population provides a steady demand for rental properties, ranging from student accommodations to apartments for professionals.

Ongoing and planned developments for residential, commercial, and mixed-use properties offer investors a chance to be part of The Corridor’s growth.

The focus on education and healthcare sectors can lead to cyclical rental demand, with peaks at the start of academic and professional years.

Is Buying Property in Manchester a Good Investment?

Manchester is tipped as a top property for investment in 2023. House prices are expected to increase by 5% in 2023. The north-West region as a whole is the UK’s second-fastest growing property market, making Manchester property investment a good option.

Regeneration around the city is changing the face of its housing market. The city is becoming an increasingly popular place to live and work. Investors are getting higher returns than cities like London, and with a buoyant tenant market fueled by students and young professionals, Manchester remains a top property investment destination.

Manchester has one of the largest rental demands by volume outside of London. Rental prices in Manchester are set to grow by nearly 16.5% over the next few years which is more than any other city in the UK. When all of these facts are considered, buying property in Manchester can be a good investment.

As we move into 2024, Manchester continues to stand out as a premier location for property investment in the UK. The city has not only maintained its momentum from previous years but is also poised for further growth, thanks to its strong economic fundamentals, ongoing regeneration projects, and a vibrant urban living environment. The property market in Manchester and the wider North-West region has shown resilience and growth, making it an attractive option for investors.

What is the Average Rental Yield in Manchester?

Manchester offers plenty of high-yielding property. Average yields in Manchester are currently 6% – 7%. Average rental prices in Manchester vary depending on room number. For HMOs, double rooms currently rent for £532 per calendar month on average. Whereas single rooms rent for £436 per calendar month. A one-bedroom flat in the city centre can command rent of £1,172 per calendar month. Manchester rents are currently around £100 higher than cities like Birmingham due to a supply-demand imbalance.

Manchester property investment is being driven by a fast-growing economy, innovative businesses and a thriving student market. With one of the UK’s largest growing rental markets, investing in Manchester is an attractive prospect for investors. If you are looking to invest in a property in Manchester, contact our team today.