How to Find a Below Market Value Property

Investing in real estate provides a lucrative opportunity for financial growth. However, the challenge lies in locating properties that align with investment goals while remaining reasonably priced. Seasoned investors have discovered an effective strategy: targeting a below market value property.

These properties are being offered for purchase at prices below their actual market value, creating a unique opportunity for investors to maximize their returns. This guide will explore the concept of BMV (Below Market Value) properties, including its definition and benefits. Additionally, it will provide strategies for locating such properties, evaluating their potential, making the most of returns through renovations, discussing financing options, and mitigating associated risks.

You can trust that our recommendations are supported by the expertise of renowned real estate professionals and credible industry research. Our goal is to provide accessible and expert advice, ensuring you have the most current information to make well-informed decisions.

Join us on this captivating journey as we unveil the hidden treasures of the exclusive property market. Discover the immense potential that lies within and chart a path towards your triumphant foray into real estate investments.

What are Below Market Value Properties?

Understanding properties below market value often referred to as BMV properties, is crucial for astute real estate investors. These residential properties are available for sale at a price lower than their actual market value, presenting a unique opportunity for potential buyers.

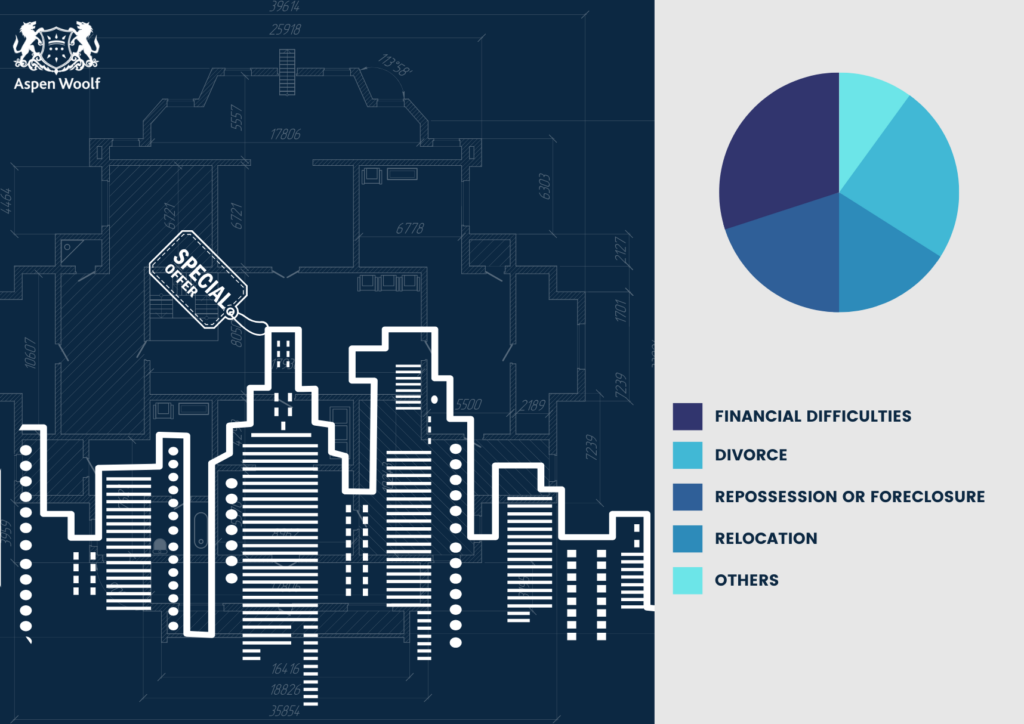

Sellers who are motivated to sell their properties quickly often offer them at prices below the market value. These sellers, driven by circumstances like financial difficulties, divorce, relocation, or repossession, choose to expedite the selling process and avoid complications associated with a prolonged sale. By doing so, they can attract buyers and achieve a quicker transaction.

Unveiling the Market Value

According to the Royal Institute of Chartered Surveyors (RICS), market value represents the estimated price at which a property could be exchanged between a willing buyer and a willing seller in a transaction conducted at arm’s length. This definition emphasizes the objective nature of determining market value based on mutually agreed terms.

Valuers meticulously compare the property with similar ones in its vicinity to determine its market value. They consider factors such as demand, transferability, scarcity, and livability. However, it is important to acknowledge that the existing valuation system in the United Kingdom may have limitations.

The possibility arises because properties used for comparison may have been sold under compulsion, thereby contradicting the definition proposed by the RICS. For more comprehensive information, please consult the guidelines on property valuation provided by the Royal Institute of Chartered Surveyors.

The Significance of a Below Market Value Property

Investing in below market value (BMV) properties offers an enticing opportunity for investors. These properties already possess instant built-in equity, making them a compelling choice. Let’s consider an example to illustrate this concept: Imagine a property with a market value of £100,000. However, through astute negotiation or other circumstances, the property can be acquired as a BMV property for just £75,000. By seizing such an opportunity, the investor gains an immediate advantage of £25,000 in equity right from the beginning. This infusion of equity not only provides a financial cushion but also enhances the potential for higher returns when the property is eventually sold or rented out.

It is crucial to understand that properties below market value can arise from several factors. These include motivated sellers, distressed sales, or undervalued properties within emerging markets. To identify and capitalize on these investment opportunities effectively, thorough research, collaboration with industry experts, and staying informed about market trends are key steps. By following these strategies diligently, one can make the most of such prospects.

The Benefits of Investing in a Below Market Value Property

Instant Equity and Increased Profit Potential

Investing in BMVs provides investors with a distinct advantage: the opportunity to acquire properties at prices below their market value. This advantageous purchase sets the stage for increased profit potential as investors secure instant equity. Such immediate equity can serve as a valuable resource, enabling investors to leverage it for future investments or allocate it towards property renovations and improvements that further enhance its value.

The concept of instant equity holds a particular allure for investors. It allows them to embark on their investment journey with a head start. By purchasing a property below its market value, investors position themselves to capitalize on its potential appreciation over time. Moreover, this acquired equity serves as a financial cushion, mitigating risks and increasing the potential for higher returns upon an eventual sale or rental of the property.

Faster Return on Investment

Purchasing properties below their market value presents an opportunity for investors to accelerate their financial gains. By acquiring discounted properties, investors position themselves favourably for potential appreciation in value or increased rental income. This favorable position shortens the time required to achieve a substantial return on investment.

The key advantage of investing in property lies in the difference between the purchase price and the market value. This gap serves as a buffer, increasing the potential for future appreciation. As the property’s value gradually aligns with its market worth, investors can enjoy accelerated capital appreciation benefits.

Moreover, investors gain the advantage of acquiring properties at a lower cost, which empowers them to effectively diversify their portfolio. By spreading investments among multiple below market value properties, they can minimize risks and increase their potential for a consistent rental income stream.

Lower Risk and Increased Stability

BMVs (Below Market Values) can provide a compelling advantage by reducing the risk associated with property acquisitions compared to purchasing properties at their market value. This decrease in risk results from the discounted purchase price, which acts as a protective buffer against market fluctuations and potential downturns.

In challenging market conditions, investors can find increased stability and higher chances of positive returns through acquiring these properties.

In a scenario where property values decline, investors who purchase properties below market value gain an advantage. The discounted price acts as a safeguard against potential depreciation, minimizing the impact on their investment portfolio. This strategic position empowers investors to withstand market downturns with reduced exposure and potentially avoid significant losses.

Access to Untapped Opportunities

Properties priced below market value offer a plethora of untapped potential in the property market. These hidden gems often evade the attention of other buyers, creating an opportunity for astute investors to unveil clandestine property markets and undervalued assets with substantial growth prospects.

Investors can uncover hidden opportunities and secure properties that others may have missed by targeting motivated sellers and conducting thorough due diligence.

To seize such opportunities, investors need to approach the BMV market with a comprehensive strategy. This involves conducting thorough research and analyzing local market trends. It also entails understanding the potential of the property and evaluating its overall viability as an investment. By leveraging their knowledge and expertise, investors can make well-informed decisions that align with their investment objectives.

Strategies for Finding Below Market Value Properties

Utilize Online Property Search Platforms

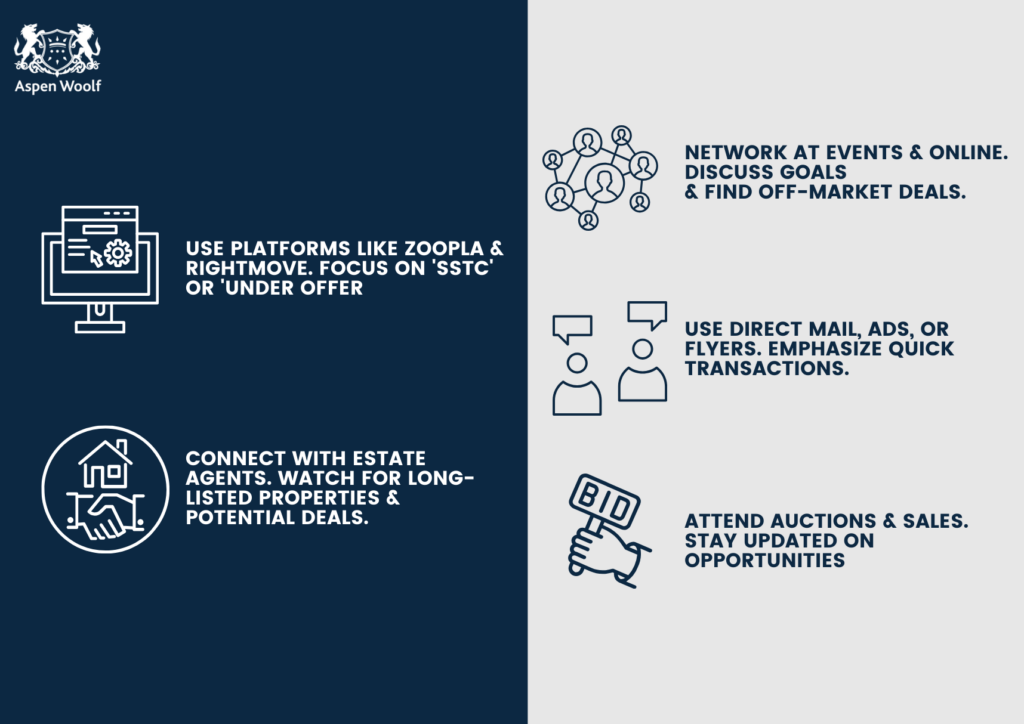

To discover properties for sale below market value, individuals should utilize reputable online property search platforms like Zoopla and Rightmove. These platforms offer a vast array of property listings and enable investors to refine their search based on specific criteria. When conducting searches, it is vital to utilize the “advanced search” feature and consider properties labeled as “SSTC” (Sold Subject to Contract) or “Under Offer.” While some investors overlook these properties, it is important to note that approximately one in three sales falls through, creating an opportunity for astute investors to seize.

Contact Estate Agents and Build Relationships

Estate agents can be a valuable resource when searching for BMV properties. By establishing relationships with local estate agents and keeping them informed of your investment criteria, you increase the likelihood of being notified when suitable properties become available. It is recommended to regularly communicate with estate agents, inquire about properties that have been on the market for an extended period, and express your interest in potential deals that may arise from sales falling through.

Networking and Word-of-Mouth Referrals

Networking within the real estate community and establishing connections with fellow investors, property professionals, and industry experts can yield valuable leads for properties priced below market value. Attending local property networking events, participating in online forums and social media groups, and actively engaging in conversations related to property investment are effective strategies. By openly discussing your investment goals and connecting with like-minded individuals, you increase opportunities for referrals and gain access to off-market deals.

Direct Marketing and Targeted Advertising

To discover properties below market value, one effective approach is to utilize direct marketing and targeted advertising. This method involves personally connecting with property owners via various channels, including direct mail, newspaper ads, online listings, or even distributing physical flyers in strategic locations. By expressing interest in buying properties within specific areas and emphasizing your ability to swiftly finalize transactions, it becomes possible to attract motivated sellers seeking hassle-free and expedited sales.

Auctions and Distressed Property Sales

Property auctions and distressed property sales hold the potential for discovering below market value opportunities. Auctions serve as a platform where properties are sold to the highest bidder, often at prices below their actual market value. Likewise, distressed property sales—such as bank repossessions or properties offered by motivated sellers—highlight significant discounts. To seize potential deals below market value, it is advisable to conduct research on local auction houses, actively attend auctions, and stay informed about distressed property sales.

Analyzing and Assessing Below Market Value Properties

Conduct Comprehensive Due Diligence

When considering a property that is priced below the market value, it is crucial to thoroughly conduct due diligence. This ensures that you make an informed decision when investing. The process involves researching the property’s history, analyzing its potential in the market, and assessing any potential risks or issues. It is important to consider several key aspects during due diligence:

- Property condition and potential renovation costs

- Rental demand and projected rental income

- Comparable property prices in the area

- Local market trends and future development plans

- Legal and title issues, such as restrictions or encumbrances

- Financial viability based on cash flow analysis and return on investment calculations

Seek Professional Advice

Engaging the services of professionals can provide valuable insights and expertise when analyzing below market value properties. Property surveyors, solicitors, or property investment consultants are skilled in identifying potential red flags, assessing property valuations, and guiding investors through legal and financial aspects. By relying on their expertise, you can mitigate risks and make informed decisions based on accurate information.

Utilize Property Data and Market Research Tools

To gather valuable information about the local market, property prices, rental demand, and other relevant factors, one can leverage property data and market research tools. Utilizing online platforms and resources that provide access to historical property sales data, rental market statistics, and market trend analysis enables thorough analysis of this data. By making informed decisions based on these insights of below-market value opportunities become more apparent.

Consider the Exit Strategy

When considering an investment in a property that is below market value, it becomes crucial to have a well-defined exit strategy. This entails determining whether you intend to hold the property for the long term, renovate it and sell it for profit, or generate rental income. By understanding your chosen exit strategy, you can evaluate the potential returns, associated timelines, and inherent risks of the investment. Moreover, it is advisable to consider alternative exit strategies should your initial plan not unfold as anticipated.

Below Market Value Property Renovations and Improvements

Assessing Renovation Potential

Renovating properties below market value can significantly boost their worth and increase potential returns. It is crucial to conduct a thorough assessment of the property’s renovation potential before commencing any refurbishment projects. Factors such as the property’s condition, local market demand, and associated costs should be carefully considered. Prioritize renovations that have the greatest impact on both the property’s value and its attractiveness to prospective buyers or tenants.

Budgeting and Cost Management

To ensure a successful renovation project, it is crucial to develop a comprehensive budget that covers all associated costs. This includes materials, labour, permits, and contingency funds. Proper budgeting and cost management are vital for staying within the allocated budget and maximizing return on investment. It is recommended to gather multiple quotes from contractors, negotiate pricing, and diligently track expenses throughout the renovation process.

Enhancing Curb Appeal and Interior Design

To make a favorable first impression, it is essential to prioritize enhancing the property’s curb appeal. This can be achieved by implementing simple improvements like landscaping, applying fresh paint, and maintaining the exteriors in good condition. These small changes can have a significant impact on how potential buyers or tenants perceive the value of the property. Moreover, it is important to consider the interior design and layout to create a space that resonates with the target market. Opting for neutral colour schemes, incorporating modern fixtures, and ensuring functional layouts can enhance marketability and desirability.

Energy Efficiency and Sustainable Upgrades

Incorporating energy-efficient and sustainable features into a property has dual benefits. Not only can it lower utility costs, but it can also boost the property’s value. Consider implementing upgrades like insulation, double-glazed windows, energy-efficient appliances, and renewable energy sources such as solar panels. These enhancements are likely to attract environmentally conscious buyers or tenants while providing an additional selling point for the property.

Financing Options for a Below Market Value Property

Traditional Mortgage Financing

Traditional mortgage financing is a commonly chosen method to finance BMV properties. However, it’s crucial to recognise that lenders typically determine the loan amount based on the property’s market value, rather than the discounted purchase price. As a result, investors may need to provide a larger down payment in order to secure traditional mortgage financing for these types of properties. It is wise to seek advice from mortgage brokers or lenders specializing in investment properties who can guide you through available options.

Bridging Loans and Short-Term Financing

Bridging loans and short-term financing are viable options for investors seeking quick acquisition of below market value properties. These financing alternatives provide temporary funds to bridge the gap between purchase and long-term financing solutions. Although bridging loans typically carry higher interest rates, they offer flexibility and expedited funding, catering to investors who can swiftly renovate, sell the property or refinance within a short period.

Joint Venture Partnerships

Entering into joint venture partnerships offers an appealing alternative financing option for investors seeking below market value property investments. Through collaboration with individuals or companies possessing the necessary capital, investors can combine their resources and distribute both the risks and rewards involved in the investment. These strategic partnerships not only facilitate access to funds for purchasing BMV properties but also provide invaluable expertise and additional support in effectively managing the investment.

Self-financing and Cash Purchases

Investors with ample capital have the option to finance their acquisitions through self-funding or cash purchases, which can prove attractive when aiming to acquire properties below market value. By bypassing mortgage financing, investors simplify the purchasing process, negotiate more favorable terms, and potentially secure the property at a discounted price. Nevertheless, it remains crucial to weigh the opportunity cost of tying up capital against alternative investment prospects and evaluate potential returns.

Potential Risks and Mitigation Strategies

Market Volatility and Economic Conditions

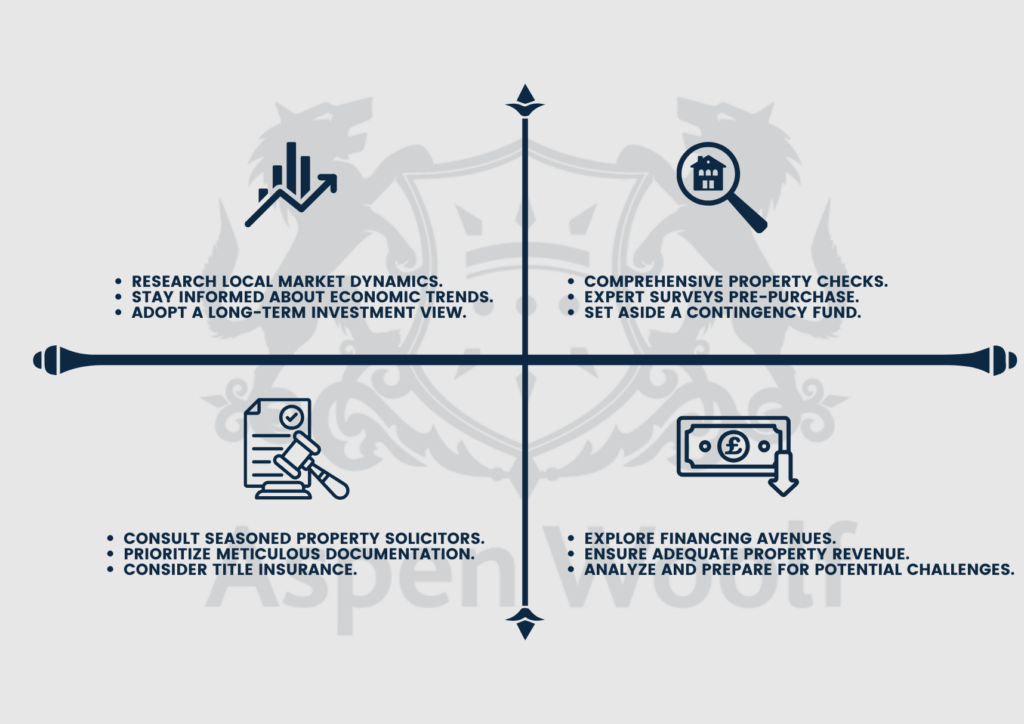

Investing in properties below market value, like any investment, comes with inherent risks. These risks include market volatility and economic downturns. Changes in market conditions can affect property values, rental demand, and the ability to sell properties at desired prices. To minimize these risks, it is crucial to thoroughly evaluate the local market and economic conditions, carry out proper due diligence, and maintain a long-term perspective on the investment.

Property Condition and Hidden Issues

Properties listed below market value may require extensive renovations or have hidden issues, which can result in unexpected costs and delays. To minimize these risks, it is advisable to conduct thorough property inspections and obtain professional surveys before finalizing the purchase. Additionally, setting aside contingency funds and collaborating with experienced contractors and tradespeople will help ensure that renovations are done effectively within budget.

Legal and Title Concerns

When purchasing properties below market value, it is essential to address any legal and title concerns promptly. This will help avoid potential complications in the future. Engaging the services of experienced solicitors who specialize in property transactions can be immensely beneficial. They can identify any legal issues, ensure proper documentation, and offer guidance throughout the purchasing process. Additionally, considering title insurance can provide protection against unforeseen legal disputes or claims.

Financing and Cash Flow Challenges

When financing properties below market value, challenges may arise. This is particularly true when traditional mortgage lenders base their loan amounts on the market value instead of the discounted purchase price. To navigate this, investors should carefully evaluate their financing options and ensure that the property’s cash flow can cover mortgage payments, renovation costs, ongoing maintenance, and potential periods of vacancy. By conducting thorough financial analysis and stress-testing different scenarios, potential cash flow challenges can be identified and mitigated.

Conclusion

Investing in a below market value property can be a highly rewarding strategy for property investors. While investing in BMV properties comes with inherent risks, taking the right steps can help mitigate them and lead to successful outcomes. By practising thorough due diligence, seeking professional advice, and maintaining a long-term perspective, investors can navigate this opportunity effectively. Let’s explore the untapped potential offered by below market value properties with confidence and enthusiasm.