Smart Money Moves: What to Invest in Right Now in the UK

With the current economic uncertainty, it’s increasingly crucial to make wise investment decisions that can make your money work its hardest for you and learn what to invest in right now in the UK.

While there is no such thing as a risk-free investment, understanding different investment avenues and their pros and cons can help you decide the best investment types for you.

Property investment in the UK remains an attractive choice in 2023, given its resilience and attractive rental yields. In this comprehensive guide, we give you insight into the property invetment as well as different types of investment options you might want to explore and their suitability for your financial goals and appetite for risk.

Read on to find out what to invest in right now in the UK.

The UK Economy in 2023

After the economic uncertainty of 2022, many will be wondering what the UK economy has in store for 2023 and beyond. Falling wages and rising food prices have many households feeling the pinch this year, meaning making sound investments more important than ever.

While the UK will escape a recession in 2023, economic growth is expected to remain weak with GDP at just 0.3%, rising to 1.1% in 2024. While inflation is falling, it should average around 7% in 2023 and close to 3% in 2024.

With this economic outlook in mind, what are the best places to invest your money based on affordability, potential for returns and risk?

What to Consider Before Making Any Investment

Wondering “where to invest money to get good returns?”. Before making any investment, there are a few essential things to keep in mind:

- Your financial goals: You’ll need to determine your investment objectives long-term and short-term.

- Your risk appetite: Your appetite and ability to handle potential losses will determine the right investment avenues for you.

- Do your homework: Learn about different investment options and understand their potential returns and associated risks.

- Have an emergency fund: Before investing, it’s wise to have a separate emergency fund. Usually, a runway of 6 months of living expenses is a good goal to have liquid cash that can be used in the case of unforeseen events.

- Your financial situation: You’ll need clear visibility on income, expenses, debts and savings to ensure you have a solid base before making any investments.

What to Know Before Investing Your Money

If you’re wondering what to invest in right now in the UK, keep in mind that investment is a long-term game, meaning your cash will be tied up for at least five years.

Making investments means that you will be exposed to some risk. No investment is risk-free, and even those that are low-risk investments mean you’ll need to be comfortable with the fact that your money could drop in value.

The bigger your investment, the more you stand to gain, but the more you stand to lose, too. Diversifying your investment choices is a good idea, so you avoid putting all your eggs in one basket.

Diversifying your investments offers several advantages:

- Risk Reduction: Diversification helps mitigate the risk associated with investing. By spreading your investments across different asset categories, if one investment underperforms, the other investments may offset the losses.

- Potential for increased returns: By including a mix of assets in your portfolio, you can tap into various sources of potential growth. While some investments may have lower returns, others may offer higher returns, meaning you can increase the overall return potential of your portfolio.

Saving vs Investing

Making a distinction between saving and investing is essential when deciding what to do with your money.

- Saving: Savings entails putting aside money over time, whether for specific purchases like a down payment on a home or having a financial safety net for the unexpected.

- Investing: Investing involves allocating money towards assets that are expected to appreciate in value, such as real estate or shares in businesses. The objective is to generate profits when selling these investments.

Investing carries more risk compared to saving money in a bank, and while successful investments can yield substantial returns, there is also the possibility of incurring losses.

If you’re wondering what to do with what to do with savings, let’s dive into the different types of investment and the pros and cons of each.

Buy-to-let Property Investment

First on our list of what to invest in right now in the UK is buy-to-let property. Buy-to-let is considered a good property investment avenue because it delivers a return in two ways:

- Income from rent: Rental income offers a steady monthly cash flow without requiring too much effort (once you have found a tenant). Given the current high demand and limited supply of rental properties, you can expect a relatively short waiting period. According to The Guardian’s report in November 2022, rental demand has surged by 23% in the past year alone.

- Capital Appreciation: A property’s value tends to increase over time. When you decide to sell your investment property, its value is likely to have grown compared to your initial purchase price. While this profit is subject to capital gains tax, if you choose the right property and sell at the right time, you stand to make a significant amount.

The combination of regular passive income and the potential for a lump sum profit all in one make an investment in property a popular avenue for investors. You can make it a relatively hands-off strategy by hiring a property investment firm to handle the day-to-day running of the property and deal with tenant inquiries.

UK Property Market Trends 2023

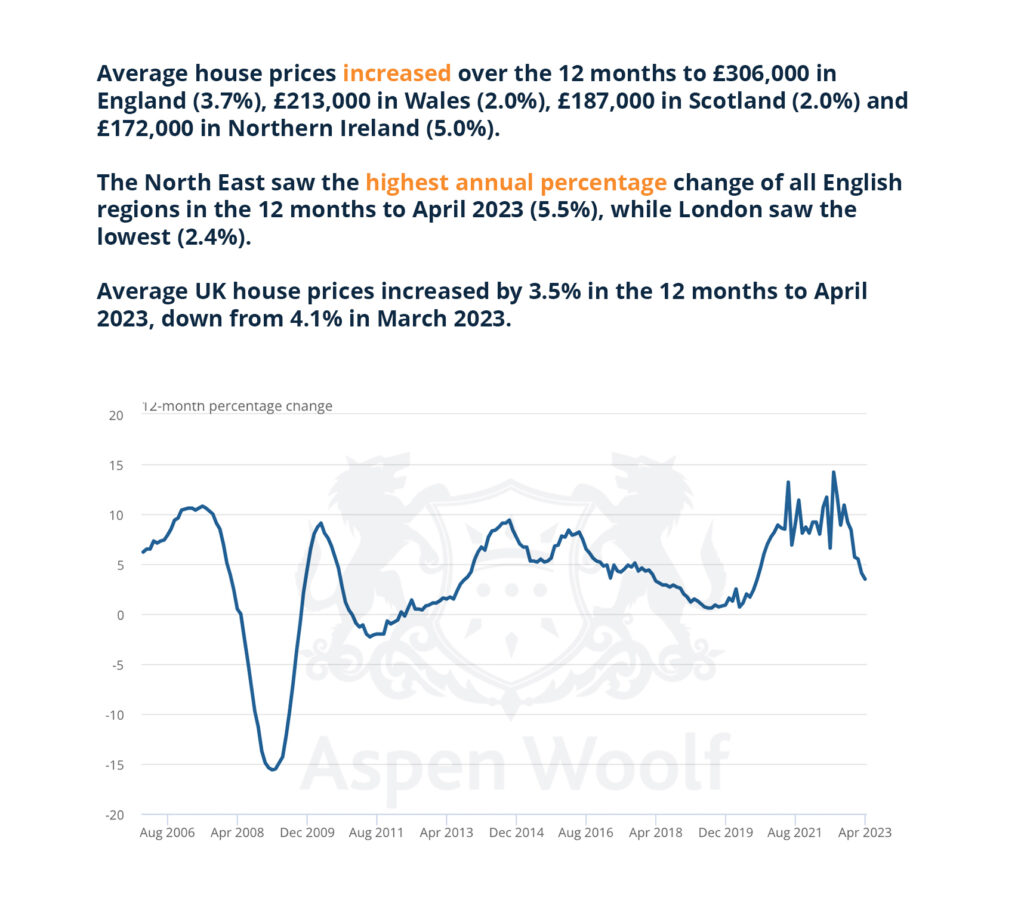

According to the Office of National Statistics, in the 12 months leading up to March 2023, average house prices in the UK experienced a 4.1% increase, slightly lower than the 5.8% growth recorded in February 2023.

The average house price across the UK is now around £285,000. While this reflects an £11,000 rise compared to the previous year, it’s £8,000 below the peak observed in November 2022. England’s South West witnessed the highest annual percentage change at 5.4%, while London had the lowest at 1.5% during the same period.

What do Property Trends Mean for Investors?

The UK property market is undergoing a period of readjustment. While it remains relatively stable so far, some predict property prices to fall in 2023. Investors need to keep these things in mind before making any investment decision.

With regional variations, investors should focus on locations with higher growth rates, for example, cities like Manchester or Leeds, where more lucrative investment opportunities can be found. Areas with lower growth rates, like London, may require a more cautious approach.

In 2023, the Bank of England is expected to raise interest rates. Rates are predicted to peak at around 4.5% as inflation eases and then decline to a “new normal” of around 2% from 2026 onwards. Unless you’re a cash buyer, it’s important for investors to monitor these changes which have a huge impact on borrowing costs and mortgage repayments.

Let’s weigh up the pros and cons of investing in property part of what to invest in right now in the UK.

Advantages of Investing in Property

- A physical asset: As a physical asset, property is generally more stable and less prone to value fluctuations compared to other investment options.

- Cash flow: Property investment provides a steady cash flow through rental income as well as the potential for capital appreciation over time.

- Strong demand: There is a growing demand for rental property across the UK. This creates opportunities for high yields, particularly as rental prices are on the rise.

- Passive income potential: Investors can hire a management company, meaning their investment doesn’t need much work and can essentially be passive income with someone else handling the day-to-day.

Disadvantages of investing in property

- Long-term investment: Property investment is a long-term investment that may require a substantial commitment of time and resources before seeing returns.

- Takes time to earn: It can take time to start earning income from the investment, especially if the property requires renovations or finding reliable tenants.

- Interest rates: Fluctuations in interest rates can affect the cost of financing the investment, potentially impacting profitability.

Investing in Off-Plan Properties

Another property investment option is to invest in off-plan property. Investing in off-plan involves purchasing a property before it is completed. Off-plan properties can be attractive for both buy-to-let and residential purposes, with the potential for below-market rates, strong capital growth, and popularity among renters.

Advantages of Investing in Off-Plan Property

Off-plan property allows buyers to secure properties at below-market rates, as developers may offer discounts to attract buyers. This can result in significant capital growth if the property is located in an area with increasing house prices.

Off-plan properties are often popular with renters, too, due to their modern design and more environmentally-friendly design, which can lead to higher rental income.

Uncovering Prime Locations: Where to Invest in UK Real Estate Right Now

If property is a good investment option for you, here are some of the best-performing locations in the UK right now:

-

Nottingham

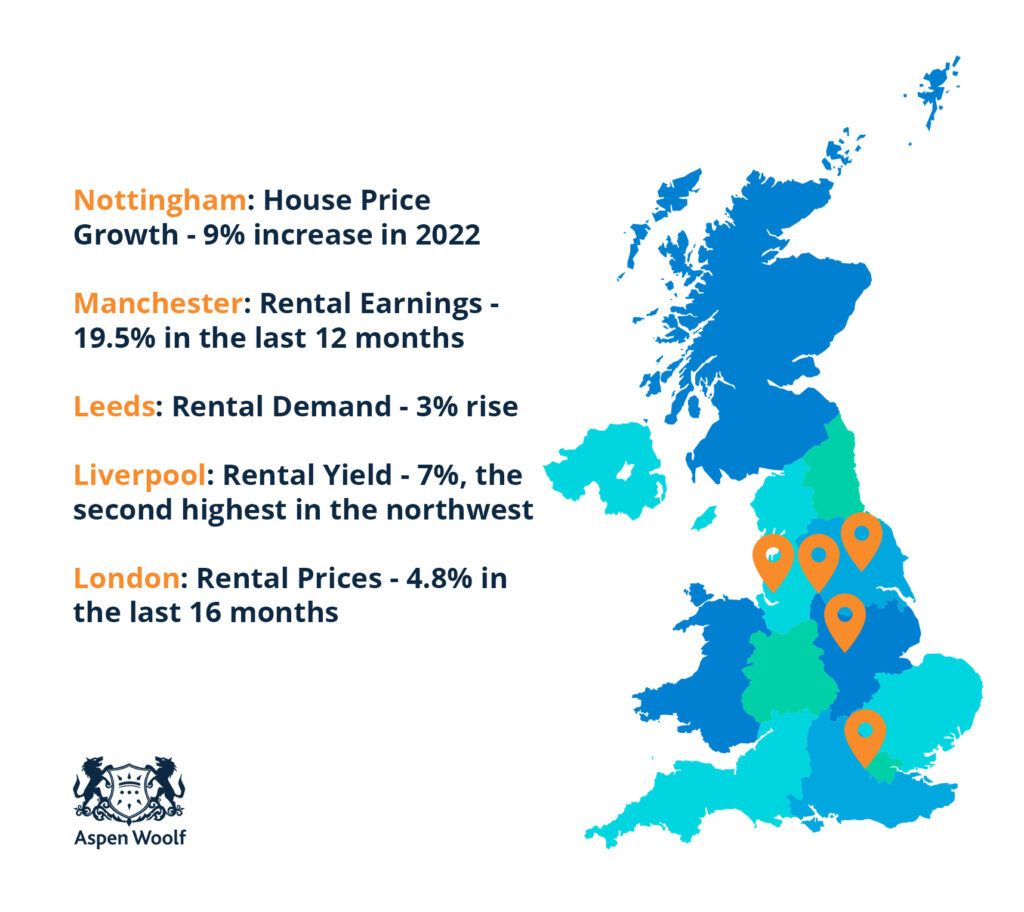

Nottingham, with its impressive rental yields and substantial house price growth, has emerged as a hidden gem in the UK rental market. It has gained popularity and is widely recognised as one of the top destinations for property investment in the country.

Over the past five years, Nottingham has experienced remarkable house price growth, with a significant 9% increase in the last year alone. Since 2018, house prices in the city have surged by 39%, surpassing the national average by more than 12%.

-

Manchester

Manchester has established itself as an enticing destination for property investment. Over the past five years, it has delivered impressive capital appreciation returns, placing it among the top three locations in the North for price growth.

Rental earnings have seen a significant increase of 19.5% in the last 12 months, further adding to Manchester’s appeal. With a thriving economy and a rapidly growing population, Manchester’s future growth prospects remain strong, with a projected 17% rise in property prices over the next four years.

The city’s vibrant job market and its young population make it an attractive rental market. Moreover, improved transportation infrastructure through projects like the Great North Rail has enhanced connectivity and boosted tourism, further enhancing Manchester’s investment potential.

-

Leeds

Leeds is a key city for investors seeking rental returns. With a population of 812,000, it ranks eighth for rental growth in the UK. Savills predicts 28% growth in Yorkshire by 2025, driven by rental demand and build-to-rent schemes. Leeds is expected to be among the top ten employment cities in the UK by 2023, creating over 19,000 new jobs.

Leeds’ regeneration developments exceeding £3.9 billion in the last decade and a projected £7.3 billion in the future positively impact property prices and rental incomes.

-

Liverpool

Liverpool remains a top contender for property investment in 2023, with strong rental yields of 7%, the second highest in the northwest. Over the past five years, property prices in Liverpool have experienced significant growth, increasing by 42%.

JLL predicts a 21% increase in property prices in Liverpool over the next four years, following a similar growth trend as Manchester.

Despite this growth, the city remains affordable. Liverpool also boasts a favourable income-to-house price ratio. The ongoing Liverpool Waters scheme, a £5 billion, 30-year plan, is set to have a significant impact on the city, creating new spaces, attracting tourism, and generating approximately 17,000 new jobs.

-

London

Investing in property in London has always been and continues to be a favoured choice for both domestic and international investors due to its attractive rental yields, long-term capital appreciation and stable economic environment.

Following the pandemic and the easing of travel restrictions, central London property prices recovered swiftly. The prime London property market is projected to remain stable in 2023, but the rise in mortgage rates has affected properties in less central areas and lower price brackets.

The long-term growth of London’s property market will be driven by factors such as limited supply and London’s status as a global business and cultural hub, ensuring its ongoing desirability as a prime investment location.

Investing in Stocks

Next up on what to invest in right now in the UK are stocks. Besides real estate, stocks are an investment avenue popular with investors. When you buy shares of a company’s stock, you become a partial owner and are entitled to a share of the company’s profits proportionate to your number of shares.

Shares are typically purchased on the stock exchange, with their value influenced by the company’s performance. When a company achieves strong profits, the price of its stock tends to rise. On the other hand, if a company faces financial difficulties, the value of its stocks is likely to decline.

Investing in stocks involves both the potential for gains and the risk of losses for investors. Investors will need to carefully research a company, the financial health and diversifying your stock portfolio is a good way to mitigate risk and boost the chance of positive returns.

-

Dividend Stocks

Investing in dividend stocks allows you to acquire additional shares in a company, increasing your stake and potential profitability. When choosing dividend stocks, it’s advisable to choose financially stable companies, for example, large companies like Google or Amazon, that offer stability and consistent performance.

Higher growth stocks present a greater opportunity for substantial gains but come with increased volatility and risks.

-

Mutual Funds

These collective investments bring together contributions from multiple investors and distribute them across a diverse range of stocks and shares, spanning various industries and sectors.

Mutual funds provide an attractive option to build a well-rounded portfolio. By pooling resources, investors can gain exposure to a broader market without requiring substantial capital.

-

REITs

Like stocks, Real Estate Investment Trusts (REITs) offer individuals the opportunity to acquire shares in companies that own and oversee diverse investment properties.

By investing in REITs, individuals can partake in the earnings generated by the underlying real estate portfolio.

Let’s weigh up the pros and cons of investing in stocks:

Advantages of Investing in Stocks

- Short-Term Option: Stocks provide a convenient option for short-term investments. Stocks are easy to buy and sell.

- Long-term Investment: Long-term investing in stocks involves holding onto shares for an extended period. As long as the stock prices continue to rise, investors can receive dividends as a source of income.

- Potential for profit: Investors can purchase stocks at low prices and sell them at higher prices for profit.

- Diversification: Investors can spread risk across their portfolios by buying stocks in different companies and sectors.

- Liquidity: Stocks provide high liquidity compared to other investments, enabling investors to buy and sell to get their cash out quickly.

- Income potential: Dividend stocks can generate regular income as they distribute a portion of company profits to shareholders.

What are the Disadvantages of Stocks?

- Volatility and market risk: Stock prices can fluctuate significantly due to various factors, exposing investors to market risk.

- Possibility of loss: Investing in stocks involves the risk of capital loss with no guaranteed returns. Poor stock performance or market downturns may lead to a drop in investment value and potential capital loss.

- Time and effort required: Successful stock investing requires ongoing monitoring, research and analysis. Identifying promising opportunities, staying ahead of market trends, and company news can take up a lot of an investor’s time.

Savings Accounts

Opening a savings account is another place to put your money. If you’re wondering “what is safe to invest in right now?”, high-interest saving accounts may be a good option. Investors can profit from savings accounts through the interest the account generates.

While interest rates on savings accounts are not always that high, they are a secure and safe place to put your money. Unlike cryptocurrencies or stocks, you do not need to worry about losing your investment.

Money made from savings accounts can go towards your tax-free allowance of £12,750. Investors also get a £5,000 tax-free allowance as a starting rate of savings, so they earn some returns without needing to worry about tax.

Let’s weigh up the pros and cons of investing in savings accounts:

Advantages of investing in savings accounts:

- Safe: Savings accounts provide a secure place to store your money, as government-backed programs typically insure them.

- Easy access to funds: Savings accounts offer convenient access to your funds, allowing you to withdraw money when needed.

- Interest earnings: Savings accounts often provide an interest rate, allowing your money to grow over time.

- Low risk: Savings accounts are considered low-risk investments since they are not subject to market fluctuations and usually offer a stable return on investment.

- Separation of funds: Having a savings account is a good way to separate spending from long-term savings helping you budget your money better.

Disadvantages of savings accounts:

- Low-interest rates: Savings accounts offer lower returns than other investment avenues, limiting the potential for earnings compared to other investment options.

- Inflation: If the interest rate on your savings account does not keep pace with inflation, the purchasing power of your money may decrease over time.

- Opportunity cost: By allocating funds to a savings account, you miss out on higher returns that could be achieved through other investments like stocks or real estate.

- Limited growth potential: Savings accounts don’t provide substantial long-term growth opportunities, especially compared to investments offering higher risk and potential rewards.

The drawback of investing in savings accounts is that it is hard to make a serious profit. If you deposit £10,000 in a savings account with today’s average rate, you would only see profits of around £5,000 in 20 years.

If you’re looking for one of the safest investments UK, and your main goal is to keep money aside for a rainy day or keep your money somewhere risk-free, savings accounts are a good option. But if you are looking to invest and get returns on your money, it’s better to look at alternative options.

Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security. It operates on decentralised networks known as blockchains. Cryptocurrencies serve as a medium of exchange, just like traditional currencies, but exist solely electronically.

There are many different types of cryptocurrency. Some examples include:

- Bitcoin: The first and most well-known cryptocurrency.

- Altcoins: This category consists of all cryptocurrencies other than Bitcoin. Some examples include Ethereum and Stellar.

- Stablecoins: These cryptocurrencies are designed to maintain a stable value by pegging their price to a fiat currency like the US dollar or a commodity like gold. Examples include Tether and Binance.

When it comes to how to invest your money, the point of cryptocurrencies is to provide decentralised, secure and transparent digital currencies. They aim to eliminate the need for intermediaries like banks.

The advantages of cryptocurrencies include faster and cheaper money transfers, decentralised systems and the potential for generating returns through trading and investing.

There are also disadvantages to cryptocurrencies. The market can be volatile, and cryptocurrencies have been used for scams and hacks. There are also concerns about expensive energy consumption for mining.

Here are the main benefits of investing in cryptocurrency:

- Potential for high returns: Cryptocurrencies have experienced significant price appreciation in the past, offering the possibility of profits for early investors.

- Decentralisation: Cryptocurrencies operate on decentralised networks, providing removing the need for intermediaries like banks. This can lead to more efficient and cost-effective transactions.

- Diversification: Investing in cryptocurrencies can provide diversification in a portfolio. Their value is not closely tied to traditional financial markets like stocks or bonds.

Here are the main disadvantages of investing in cryptocurrency:

While there are advantages to investing in cryptocurrency, there are also drawbacks:

- Volatility and risk: Cryptocurrencies have a reputation for their price volatility, with values experiencing rapid fluctuations. This volatility can lead to substantial losses if the market turns against an investor.

- Regulatory uncertainties: The regulatory landscape surrounding cryptocurrencies is still evolving, and changes in regulations can impact the market.

- Complexity: Cryptocurrency requires technical knowledge to navigate exchanges and digital wallets.

Why is Property Investment an Attractive Option in the UK?

When it comes to what to invest in right now in the UK, property is attractive for a number of reasons. The UK boasts a resilient and robust property market, with consistent price growth over the years. Property also makes one of the best long-term investments. Here are a few of the reasons that make property investment in the UK an attractive option:

- Strong Property Market: The UK property market generally delivers consistent price growth due to factors like population growth and strong demand for property in its cities.

- Attractive Rental Yields: The UK offers relatively high rental yields compared to other countries, providing investors with substantial income opportunities.

- Stable Political and Economic Climate: The UK’s stable political environment and resilient economy contribute to a safe and reliable investment destination.

What are Some Low-Risk Investments in the UK?

If you’re wondering what to invest in right now, every form of investing carries some level of risk. Risk free investments UK are few and far between. However, some low-risk investment options in the UK include things like bonds, gold, high-interest savings accounts and the property market.

Savings accounts offer a low-risk way to grow your capital, although the returns are typically low. Bonds are viewed as carrying a slightly higher risk than savings accounts but are lower risk than stocks.

Where is the Best Place to Put Money Right Now?

Investment goals vary for each individual and the best thing to invest in right now will expend on your circumstances. The best investments UK will depend on factors like budget, risk tolerance and timeframe.

However, when assessing various investment options, property presents an ideal balance of attractive returns, relatively low-risk levels and the potential for long-term results. This combination is likely to appeal to a wide range of investors seeking stable and profitable investments.

Before investing, it is essential to clear any outstanding debts. Once debts are settled, consider your short-term, medium-term and long-term goals to determine whether saving or investing is more appropriate.

Investing requires careful consideration and understanding of the risks involved. It could include options like stocks and shares, bonds, funds and property. Diversification is key to mitigating risk by spreading investments across different assets.

What is the Best Way to Invest Money in the UK?

Investing in property can be a highly favourable option for individuals looking to invest their money in the UK.

Investing in property one of a number of good investments right now and carries a number of advantages, including:

- Potential for returns. Property has the potential to provide attractive returns over the long term in the form of rental income from tenants and price appreciation over time.

- Property is a tangible asset, unlike other forms of investment such as stocks or bonds.

- Investing in property allows for diversification – investors can add different types of houses to their portfolio and spread investments across different locations to reduce risk and enhance returns.

- Investing in property provides the opportunity for passive income from rent, which can cover things like wear and tear and mortgage payments or serve as an additional source of income.

- Strong demand for housing: Demand for rental accommodation remains high in the UK and rents are rising at record rates. The ongoing demand can provide investors with a stable market and a steady stream of tenant demand.

- Stable investment: Property investment is a stable and long-term strategy. While there may be fluctuations in the market, property values tend to increase over time.

Conclusion

When it comes to where to invest your money, there are many different options, each with its own set of advantages and risks. Whether you’re considering property investment, exploring the stock market or cryptocurrencies, it’s crucial to approach investment decisions with the right knowledge. Out of all investments, property investment is one of the most stable with the potential for profit. If you’re wondering what I should invest in right now in the UK, find out more about investing in property by getting in touch with our experts today.