10 Reasons to Invest in Property in Birmingham and Where to Buy

Has Birmingham caught your attention? If so this article is for you. We’ve compiled a list of our top 10 reasons why you should invest in Birmingham property. Along with a few extra pieces of info you might want to consider before investing.

The UK’s second-largest city after London, Birmingham is becoming a popular buy-to-let and investment property destination.

Affordable housing prices, strong yields, consistent demand from renters and high predicted growth are the key reasons more investors are exploring their options in the city.

Read on to see the full picture and make an informed decision for you & your goals as an investor.

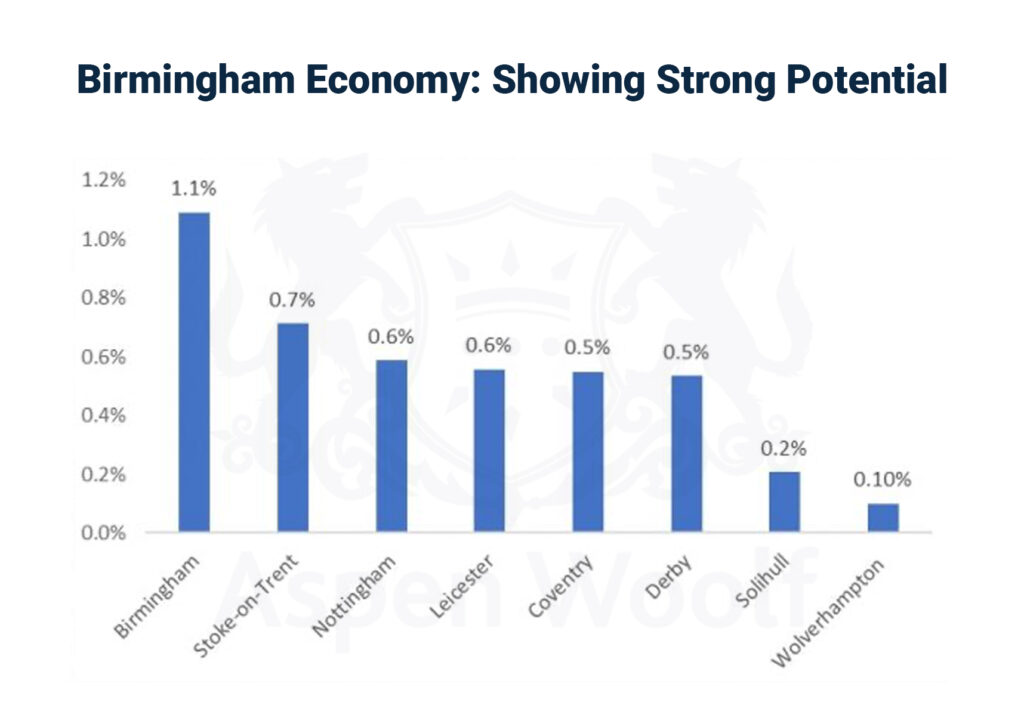

1. Birmingham Economy: Showing Strong Potential

Known as the UK’s second city, Birmingham is the nation’s largest city economy outside of London. Birmingham’s economy is expected to see its GVA grow year-on-year by 1.1% in Q4 2023, rising to £29.6bn.

While the population of the city itself sits at around 1.1 million people, a total of 5.57 million live in the wider catchment area in a West Midlands economy set to match or beat UK average annual GVA growth of 2.1% between 2024 and 2026. The city’s population is on the rise too, predicted to grow 7.8% to 1,230,000 by 2038.

In addition to having the fastest-growing economy in the Midlands, Birmingham also performed strongly in terms of employment. Predictions put head count at 613,800 at the end of 2024 – an increase of 1.4%.

In the last decade, Birmingham’s regeneration and job opportunities have attracted an influx of young professionals. The city itself is one of the youngest in Europe, with 40% of its population under the age of 25. Home to a young, working population, Birmingham presents buy-to-let property owners with a stable tenant market. It’s not difficult to understand why more investors are looking to Birmingham for their next or first UK property investment.

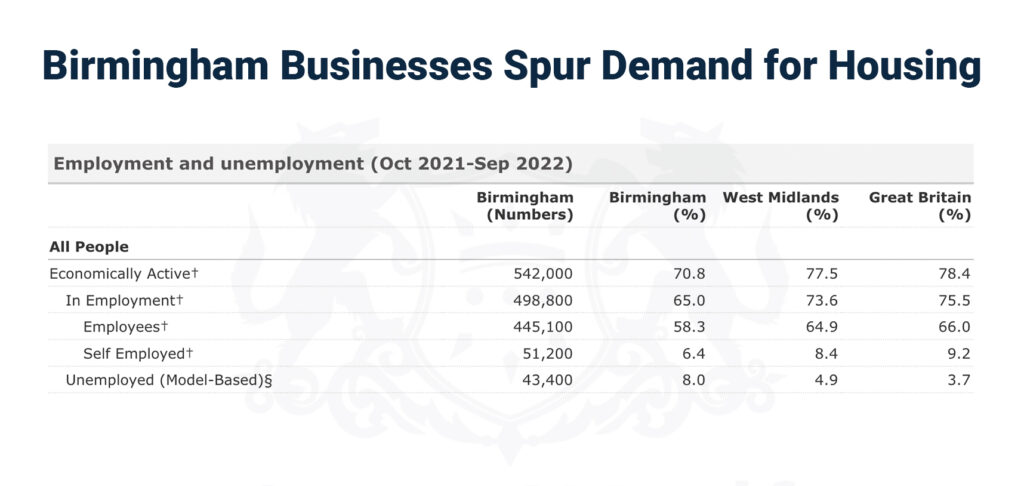

2. Birmingham Businesses Spur Demand for Housing

Birmingham is known as the West Midlands’ regional centre of business, retail, leisure and culture, and ranks highly for future investability. As one of the largest business centres outside the capital 498,800 people are in employment in the city.

While Birmingham has a high number of public sector employers – including Birmingham City Council, the Queen Elizabeth Hospital and the University of Birmingham – in the last decade, the city has put in place policies to rebalance the economy and attract more private employers.

Today, Birmingham plays host to nationally and internationally significant companies. National Express, Sainsbury’s Lloyds bank, Mondelez, Asda, Jaguar, Rolls Royce and RBS each have a presence in the city.

Birmingham and the wider West Midlands region is recognised for its strengths in the mobility and automotive and health and life sciences sectors. The establishment of these high-net-worth industries is fueled by the city’s strong innovation resources and networks.

Birmingham’s 5 universities conduct internationally-recognised research facilities in engineering, creative industries, low carbon fuel technology and medical sciences. These world-renowned academic institutions provide the city’s businesses with a steady stream of talent.

What this means for you as a property investor:

Birmingham’s growing number of businesses, jobs and high net-worth investment opportunities create increasing demand for suitable housing from an influx of workers. Invest in Birmingham property and you could target city-dwelling young professionals who are an appealing rental demographic for landlords.

The city’s growing popularity and economic prospects suggest that real estate investment properties Birmingham will continue to deliver good yields and increasing value in the coming years.

3. Birmingham Property in High Demand

If you’re looking to invest in one of the best buy-to-let areas in the UK, Birmingham should be on your list of considerations. Two elements make investing in property in Birmingham particularly appealing over other UK cities:

- The first factor is the city’s growing population. Already the UK’s second-largest city, by 2030, the population is set to climb to 1.24 million (from 1.1 million today).

- Birmingham is experiencing a growing housing shortfall. Birmingham has a shortfall of 78,415 new homes needed between 2020 and 2042.

An increasing population combined with a shortage in housing supply is likely to result in rising rental demand and property values – appealing prospects for investors.

4. Birmingham Property Market

If you’re looking for the top UK city to invest in property in 2023, Birmingham is certainly a city to consider.

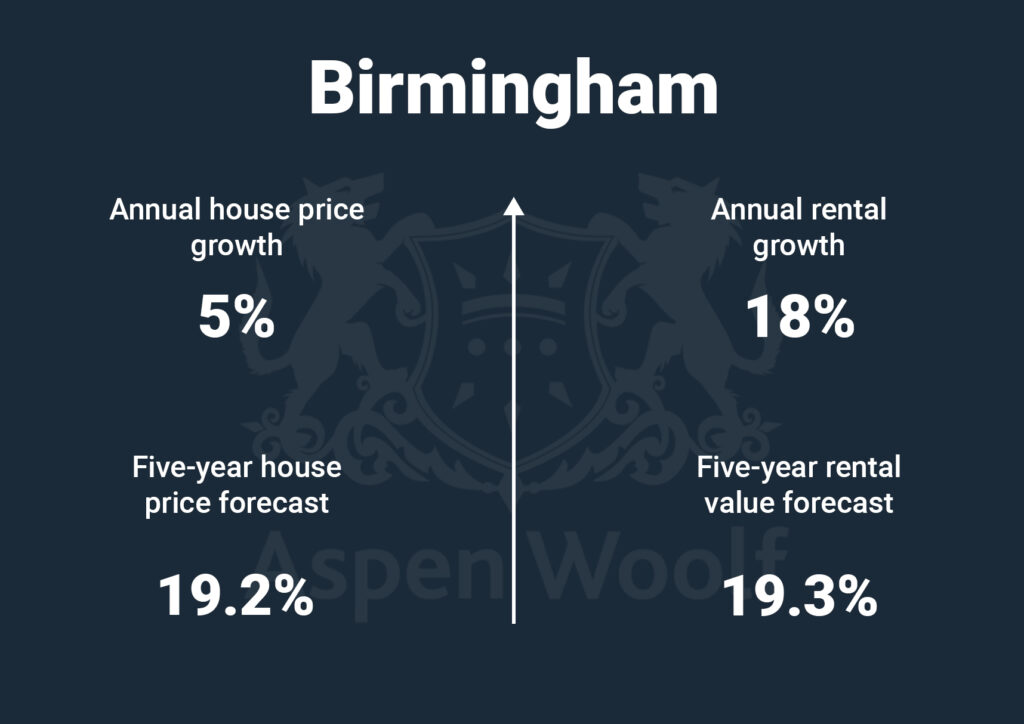

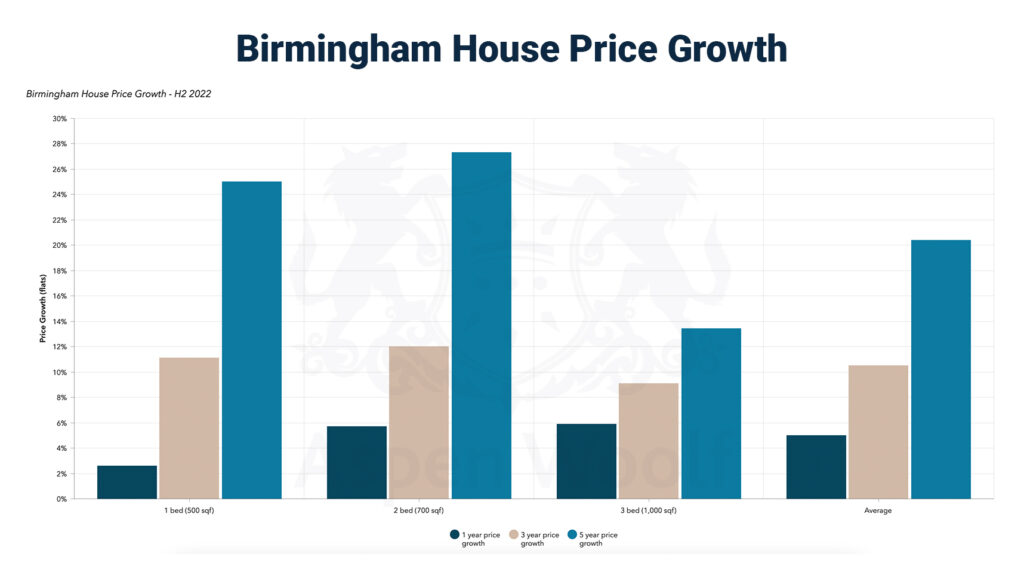

Birmingham has experienced strong house price growth in the past year. Prices for two-bedroom flats are currently 27% higher than they were in 2017. Since June 2021, annual house price growth has averaged 5%, and values are over 10% higher than they were pre-pandemic.

According to another report by Halifax, Birmingham recorded the strongest house price growth in the West Midlands region in 2022. House prices in the city have grown by 13.8% or £32,563 on average in the last year. Average property values in Birmingham are currently £269,385 (based on data from November 2021 to November 2022).

Will Birmingham House Prices Rise?

Why invest in Birmingham property? Because it has some of the most attractive predicted house growth rates. JLL forecasts 9.3% house price growth between 2023-2027 in the West Midlands region, above the UK average of 8.9%. Birmingham alone is forecast to see property values climb 19.2% over the next 5 years making a Birmingham investment properties ideal for investors looking for capital gains growth.

5. Birmingham and Rental Growth

The high demand for rental properties is set to remain in 2023. With the current cost of living squeeze and higher mortgage rates, more aspiring homeowners are likely to delay the purchase of their first home.

At the end of 2022, average rents for new one-bed city centre flats in Birmingham were £900 per calendar month, rising to £1,200 for a two-bed flat – a 16% and 20% rental growth, respectively, compared to the same period in 2021.

Areas close to public transport for quick commutes as well as a large number of students returning to study are likely to be a strong source of demand in Birmingham. JLL predicts that in 2023, rental growth in Birmingham city centre could increase by 5%. This figure trumps other cities like Leeds at 3.5% and Bristol at 4%, another reason to invest in Birmingham property.

In the 12 months through to December 2022, Birmingham rents rose by an average of 15.8%.

The same report predicts that average rents in Birmingham could increase by 19.3% between 2023 and 2027.

What is a Good Rental Yield in Birmingham?

Property investment in Birmingham presents plenty of opportunities for investors. Yields in the city are on average 5.5% but vary by location, with popular student areas delivering significantly higher yields. While property prices are on the rise, rents are too, meaning there are plenty of opportunities for landlords to make good returns.

6. Birmingham Regeneration Means Investment Property Prospects

Birmingham is undergoing regeneration at a steady pace across all corners of the city. The cityscape is unrecognisable compared to a couple of decades ago.

Birmingham continues to rank as one of the most popular places to invest in Europe, attracting billions in retail, infrastructure, residential and commercial projects.

Regeneration and investment projects present a great upside for landlords and investors. Not only does the city become a more appealing place to live, but the standard of rental property and amenities continues to rise, which generally increases property and rental values.

A few of the key projects both completed and in the works include:

103 Colmore Row Tower

This 26-storey building is the tallest new office building outside London. It features Grade A office space, restaurants and unrivalled 360-degree views of the cityscape as well as a 4-storey winter garden.

Colmore Row has long been the business centre of the city. New Street and Snow Hill stations are only minutes away, putting it in close proximity to London via train, while the newly extended Metro offers intracity connectivity.

Paradise City Redevelopment Project

A mixed-use development of office, residential and commercial space, Paradise Redevelopment Project represents a £700 million investment in the city. When complete it will offer 10 new buildings, 3 new public squares and act as a hub for events, restaurants and cafes.

Birmingham Smithfield

Birmingham Smithfield is a £1.5 billion project that will see the development of the area south of the city into a new urban quarter. The project will bring a boost for the whole city and include a new home for Birmingham’s historic Bull Ring Markets, leisure and cultural facilities and more than 2,000 homes around a new public square.

Birmingham Eastside and HS2

Eastside is known as Birmingham’s ‘knowledge hub’ and is home to a thriving number of tech and innovation businesses. Once a major industrial quarter, the area is now home to Birmingham Science Park Aston, The New Technology Institute, Millennium Point and a new Engineering Academy.

One of the most exciting developments for the area is that Eastside is set to be home to the HS2 rail connection at Curzon Street Station. The project puts London just 45 minutes away, bringing financial and commercial opportunities even closer.

Huge growth is expected from the number of commuters coming in and out of the capital. HS2 is set to bring 30,000 new jobs and play a key role in rejuvenating the area.

Eastside Locks

Eastside Locks is a £450 million canalside regeneration scheme heralded as the most “exciting and important city centre regeneration scheme in Europe”. The redevelopment will see the canalside environment completely transformed and feature new apartments, hotels, shops, bars and restaurants and courtyard spaces.

SOHO Wharf

Birmingham City Council recently approved a £165 million project on The Soho Loop, a 1.2-mile section of the eighteenth-century Old BCN Main Line canal in Birmingham. The proposed plan will feature new homes, one and two-bed apartments and 10,000 sqft of commercial space.

7. Birmingham Location: Strategic Opportunity for Investors

Invest in Birmingham property and you can take advantage of its geographical position. 90% of the UK’s population and businesses fall within four hours travel time from the city. Strong rail, road and air connectivity brings plenty of opportunities for local and international businesses and the Birmingham economy.

Birmingham Airport is the UK’s third-busiest and recently underwent enhancement. Today, it welcomes nearly 13 million passengers each year and flies to more than 140 locations worldwide.

The HS2 high-speed railway is set to bring Birmingham even closer to London and could turn the city into a commuter hotspot overnight. With the two cities set to be just 45 minutes from one another, Birmingham is expected to become increasingly popular.

8. Birmingham & Student Accommodation: Key Rental Market

Birmingham is the UK’s second-largest student city and home to five universities:

- Aston

- Birmingham City University

- The University of Birmingham,

- University College Birmingham

- Newman University College

The city and surrounds are home to a thriving student population. The scope and lifestyle offerings of the city continue to make it a popular destination for local and international students.

The number of students in Birmingham jumped by 10% between the 2018-19 and 2020 – 21 academic year. This has led to a higher demand for student accommodation in the city, and around 6,000 extra beds needed by 2025-26.

With the city’s student population sitting at around 76,850, Birmingham is an ideal location to invest in a student property. The number of students currently outnumbers the number of beds available. For that reason, demand for student housing is a major part of Birmingham’s rental market.

The city’s graduate retention rate has continued to grow over the past decade to reach 41% today – fourth highest in the UK. With so many students choosing to remain in the city after their studies, landlords can capitalise on a steady stream of renters. As well as young professionals seeking accommodation.

9. Attractive and Active Lifestyle

Buying a house in Birmingham means you have access to world-class museums, night-life and historical and cultural attractions.

Birmingham is becoming an increasingly liveable city. Attractions like Cadbury’s World, Birmingham Museum and Art Gallery, Brindley Place and the Canal Quarter attract a number of visitors each year. The city is home to plenty of parks and botanical gardens and other nature lies on the doorstep.

Birmingham Commonwealth Games held in 2022 put the city in the international spotlight. The global spectacle reached over 1.5 billion people on television alone. The Games also contributed at least £870 million to the UK economy and provided a £453.7 million economic boost for the West Midlands.

Benefiting business and communities, in addition to new sports venues and improved transport services, the Games acts as a springboard to further grow the reputation of the city.

10. Best Areas to Invest in Birmingham

With regeneration taking place across the city, those looking to purchase an investment property in Birmingham have many areas to consider. The best place to invest in Birmingham depends on your goals and budget. But the city has a number of hotspots that can provide attractive rental yields and house price growth in the coming years.

Birmingham City Centre

As a key target for regeneration in the last 10 years, Birmingham City Centre offers diverse property options for investors. Buy-to-let property Birmingham City centre postcodes present landlords with good returns and strong rental yields. Particularly from one and two bedroom flats.

With development projects like HS2, the Paradise Development, as well as The Big City Plan, properties in the City Centre can be a lucrative investment. Properties in Birmingham City Centre had an overall average price of £233,349 in the last year.

Digbeth Birmingham

One to watch for future growth potential due to investment projects and regeneration, Digbeth offers an alternative to more established property investment hotspots like the Jewellery Quarter.

Digbeth is known for being the city’s creative centre and attracts a young crowd in the city’s former industrial heartland. Its proximity to the main shipping areas, the city’s emerging Creative Quarter, not to mention within walking distance to Curzon Street Station – the location of HS2 – Digbeth has high growth potential and attracts both renters and investors.

The average price for a property in Digbeth was £210,130 over the last year.

Selly Oak Birmingham

For investors looking to capitalise on Birmingham’s student rental demographic, Selly Oak is a key area to consider.

Composed of terraced houses, most of which are occupied by students, the area is known as the “student village”. This is where most second and third-year students choose to live after their first year in university halls. Most sales in Selly Oak during the last year were terraced properties with an average price of £264,404.

Aston and Nechells (B6 and B7 Birmingham)

If you’re looking to buy a flat in Birmingham, north of the city centre, Aston (B6) and Nechells (B7) have some of the city’s lowest property prices. Aston attracts a large student population from Aston University and offers landlords decent yields while remaining affordable. Average property prices in the Aston area are £195,232. In Nechells, average property prices sit at around £154,250.

Is Birmingham Good for Property Investment?

One of the UK’s most popular cities being transformed by regeneration and investment with a strong student population and young professional rental market, we think Birmingham is one of the best places for property investment. With rents and property values predicted to rise by 2027, there is plenty of opportunity for investors.

Invest in Birmingham property and you have all the benefits associated with HS2, regeneration and ongoing investment that is set to transform the city and bring economic and cultural opportunities. Now is a great time to consider investing in property in Birmingham. Get in touch today to find out more about property investment opportunities in the city, including buy-to-let and student property investments.