Leasehold Property: Understanding the Basics and Key Terms

For beginner and even advanced property inventors, one aspect of the property market that often causes confusion is the leasehold property.

Understanding leasehold ownership and the terms surrounding this type of property is essential for making an informed investment decision.

In this blog post, we take a look at the leasehold properties, the difference between leasehold and freehold, the rights are responsibilities of leasehold owners and whether investing in one is a good investment decision.

What is Leasehold Property?

In England, there are two different forms of legal property ownership:

- Freehold: you own the property and the land it’s built on.

- Leasehold: you have a lease from the freeholder (landlord), which allows you to use the property for a defined number of years. Even though you have bought the property, the leasehold essentially means you still have a landlord.

Leasehold vs Freehold Property: What’s the Difference?

Leasehold Property

In England, most flats are leasehold. Houses can be leasehold, usually when bought through a shared ownership scheme, but this is rare. With a leasehold, you are the owner of the property, i.e. your individual flat. The freeholder owns the building and land.

What does leasehold mean for investors? Basically, buying a leasehold is buying the right to use the land for a set period of time, usually 100 years or more.

Freehold Property

With a freehold property, you buy the land outright and it is yours forever (you’ll still need to pay to maintain the property as usual).

Read more about the differences between freehold and leasehold properties right here.

Rights and Responsibilities of Leasehold Property Owners

Leasehold owners have specific rights and responsibilities outlined in the lease agreement according to relevant laws and regulations.

Here are some common rights and responsibilities of leasehold property owners:

The Leasehold Agreement

A leasehold agreement will outline the length of the lease – It usually starts off at 125 years or 1000 years. Essentially, this means you rent your property on a 125 or 1000 year contract. Unlike a normal rental property, you own this lease and have the right to sell it to someone else.

Payment of Ground Rent

Leasehold property owners are responsible for paying ground rent to the freeholder. This is a rental fee which is usually a small amount (£100 or so) paid annually.

Ground rent is used to establish legally that the property is, in fact, a leasehold on which you are paying rent. If ground rent is not charged, it could be argued that after a certain amount of years, the property has defaulted to a freehold.

Service Charge and Maintenance Fee Payments

When you own a leasehold, you will need to pay a maintenance fee to the freeholder. This usually covers the cost of maintaining the building and paying for common areas, lifts and spaces like the concierge and gym.

Lease Extension and Enfranchisement

With a leasehold you have the right to occupy and use the property for a specific period of time, however, you do not own the land or the building outright. Leasehold enfranchisement gives leaseholders the opportunity to either purchase the freehold of their property or extend the lease term on their existing lease.

- Lease Extension: As the lease term gets shorter, the value of the lease drops, and it can become more difficult to sell or mortgage the property. Leaseholders can request a lease extension from the freeholder to gain more security and control (terms will apply and you may need to pay a premium).

- Collective Enfranchisement: As most leaseholds apply to flats, a group of leaseholders in the building may come together to collectively buy the freehold from the current freeholder (as outlined in the Leasehold Reform Act 1967).

This means they become the owners of the land and the building collectively, giving them more control over the property (as well as building management and maintenance etc.)

Leaseholder Rights and Responsibilities

Your lease will outline the terms and conditions you’ve agreed to. It will outline how much you’ll need to pay to maintain the property and whether you or the landlord are responsible for repairs and dealing with any issues such as noisy neighbours.

- Occupancy and Use: Leasehold property owners have the right to occupy and use the property according to the terms of the lease agreement and have possession of the property for the duration of the lease term.

- Property Improvements: Leasehold property owners generally have the right to make improvements or alterations to the property. Usually with a leasehold, you’ll need permission to make alterations, particularly if it’s anything structural. Your solicitor will need to advise you on what’s in the lease and any restrictions.

Is it Good to Buy a Leasehold Property?

There is nothing wrong with buying leasehold property providing you are fully clear on the terms. Some of the terms to be aware of include:

Ground Rent and Maintenance

When buying a leasehold, be aware of the ground rent and maintenance fees you will need to pay and any restrictions in the lease that may impact your plans for the property (e.g. some agreements may prohibit changes that may impact the look and feel of the building).

Lease Length

You should make sure the lease isn’t due to expire anytime soon. If it’s under 100 years, you will have to pay a few thousand pounds to renew the lease at some point in the next 10-15 years.

If a lease is under 80 years, you need to approach the property with more caution. You might struggle when selling a leasehold property in the years to come if you cannot renew the lease.

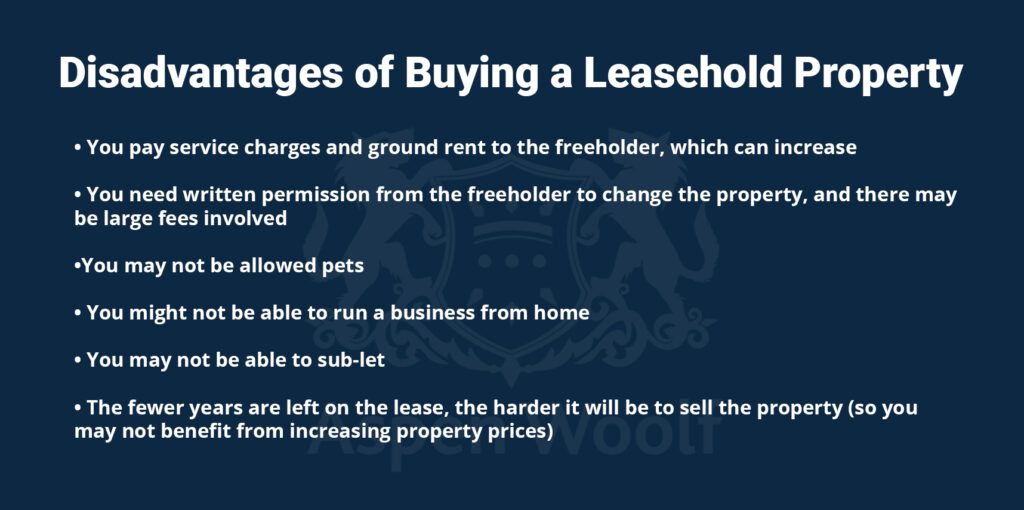

What are the Disadvantages of Buying a Leasehold Property?

Having to pay ground rent and maintenance fees to the freeholder are some of the minor disadvantages of buying a leasehold property. You may also be limited in the refurbishment or extension work you can carry out, which may require consent from the freeholder.

Another disadvantage is that as a lease gets closer to expiration, the value of the property may drop. A crucial part of your research into the property will be knowing how long is left on your lease and the renewal cost.

Do Leaseholds go up in Value?

The value of a leasehold flat reduces as the term of the lease gets shorter. The remaining lease term can have a significant impact on the property’s marketability and value. This makes it more difficult to sell or obtain a mortgage.

Negotiating a lease extension will add value if the lease drops below the desirable amount of years (usually under 80 years). Properties in desirable locations are likely to experience less depreciation in value.

Is it Hard to Sell a Leasehold Property?

If you are purchasing a leasehold, the best advice is to make sure you get one with a long lease – usually 90 – 120 years if possible. Leasehold properties with longer lease terms, typically those with 90 years or more, may be considered more attractive and can retain their value better.

Can a Leasehold Property be Sold or Transferred to Another Person?

With a leasehold property, you don’t sell the property back to the freeholder. You buy and sell it on the open market to someone who wants to buy a flat. The price will depend on what someone is willing to pay, as it would for any property, depending on market conditions.

The lease may require that the new leaseholder has to notify the landlord when the ownership of the flat changes hands. Usually the buyer’s solicitor will send a notice of transfer to the landlord.

Leasehold Explained: What Happens When the Lease on a Property Expires?

If the leasehold of your property does expire, then the property will revert ‘back’. Meaning, back to being a freehold instead of a leasehold. This will therefore mean ownership of the land and building will go back to the freeholder.

Even if you have paid your house repayments in full, the property’s ownership will still revert to your landlord. Which is why it’s important to get a house with a longer lease.

However, with a leasehold purchase, you have the right to seek a renewal or extension before the lease expires. This allows leaseholders to extend their occupation and ownership rights beyond the original lease term.

Conclusion

Understanding the basics and key terms of leasehold property is crucial for property investors at all stages of their property investment journey. Leasehold property differs from freehold property. Where you own the land outright, and owners have specific responsibilities, such as paying ground rent. While there are potential disadvantages, including lease expiration, leasehold properties can still be a good investment. Especially if the lease is long and the property is in a sought-after location. If you’re wondering how to buy a leasehold property, get in touch with our experts.