Leeds Buy-to-Let Costs Checklist (2026): The “Net Yield” Reality Most Investors Miss

If you’re looking at buy-to-let Leeds in 2026, you’ll see the same thing everywhere: a rent figure, a “projected yield”, and a lot of confidence.

And that’s exactly where most investors get caught.

Because the deal doesn’t live in the headline yield. It lives in what’s left after the quiet costs take their cut: leasehold/service charge, voids, management, maintenance, compliance, and the little “one-offs” that somehow appear every year.

This guide is built for one purpose: helping you stop guessing.

Not with hype. Not with “average yield” charts. With a simple, repeatable checklist you can run on any listing in minutes, whether you’re considering city-centre apartments or something more suburban. Start by looking at real stock on Leeds buy-to-let properties, then use the framework in this article to work out what the deal actually looks like once it hits real life.

Here’s what you’ll learn:

- Why gross yield is a marketing number (and why net yield decides whether you sleep at night)

- The Leeds-specific costs that quietly crush returns, especially in leasehold buildings

- A copy-and-paste net yield model you can run without spreadsheets from hell

- A fast due diligence checklist that stops you from buying a “good-looking” bad deal

No made-up numbers. No fake certainty.

Just investor-grade clarity, so you can keep the winners, kill the losers fast, and build a rental portfolio that holds up in 2026.

The Net Yield Mindset: How Pros Underwrite Buy-to-Let Leeds Deals in 2026

Let’s get one thing straight.

When people talk about buy-to-let yields Leeds, most of the time they’re talking about gross yield. And gross yield is a headline number. Useful for scanning. Dangerous for deciding.

Because buy-to-let Leeds in 2026 is a cost-sensitive game. The winners aren’t the investors who find the “highest yield”. They’re the ones who can predict net yield before they ever reserve a unit.

Here’s the simple mindset shift:

Gross yield tells you what the rent could be. Net yield tells you what you keep.

If you want a quick sanity-check on the difference, read what a good rental yield looks like, but treat it as a filter, not a finish line.

The Leeds-specific trap most investors miss

Leeds has loads of modern stock. Great.

But a lot of city-centre and “amenity-heavy” buildings come with leasehold costs and a service charge that quietly eats the deal. Two flats can have the same rent and completely different outcomes once you model costs.

That’s why you should always start with real listings (not generic averages). Pull up a shortlist of Leeds buy-to-let properties, then run your net-yield check on each one.

Net yield is decided by 6 cost buckets

Keep it boring. Boring is profitable.

- Leasehold + service charge (the silent margin killer in certain buildings)

- Letting fees/management (especially if you’re not local)

- Voids + changeover friction (reletting isn’t free, even when demand is strong)

- Maintenance allowance (small issues compound fast)

- Compliance + EPC realities (costs can be front-loaded depending on condition)

- Financing + stress testing (cashflow matters more than ego)

If any of those terms feel fuzzy, use the property investment glossary so you’re not guessing terminology while making real decisions.

A quick “don’t get blindsided” move

Before you get attached to a deal, run two numbers early:

- Your stamp duty exposure using the stamp duty calculator

- A realistic monthly payment range with the mortgage calculator

Not because calculators are perfect, but because they stop you from building a strategy on fantasy inputs.

The Leeds Buy-to-Let Cost Checklist (2026): What Actually Moves Your Profit

If you take one thing from this guide, make it this:

In buy-to-let Leeds, the deal isn’t “made” when you find a nice postcode.

It’s made when your costs don’t surprise you.

And in 2026, surprises are what kill returns.

So here’s the exact checklist I’d use to underwrite a Leeds rental before getting emotionally attached.

1) Start with the strategy lane (then match the asset)

Different strategies create different cost profiles.

- City-centre professional let → often leasehold + service charge exposure

- Student / sharers → higher turnover + void periods + management intensity

- Family let → fewer voids sometimes, but maintenance realism matters

If you want a fast scan of what’s live right now, look at current investment property in Leeds listings, and you’ll instantly see the “stock mix” you’re actually dealing with.

2) Underwrite rent like an adult (not a brochure)

The biggest mistake I see? People start with the agent’s top-end rent estimate.

Instead, sanity-check rent using three filters:

- Tenant-fit: Who actually rents this unit type here?

- Rent ceiling: what does the local affordability ratio allow?

- Competition: What else is available in the same micro-market?

If you want extra context on how Leeds demand behaves, the Leeds property investment trends piece is useful, and the same “trend lens” still applies in 2026 (even if costs have tightened).

3) Build your “cost stack” before you do any yield maths

This is where most investors get lazy. Don’t.

Your net yield lives or dies on:

- Service charge + ground rent (especially city-centre leasehold stock)

- Letting / management fees

- Maintenance allowance (assume things break, because they do)

- Voids + tenant changeover (redecorating, marketing, dead weeks)

- Insurance + referencing + compliance basics

- EPC-linked spend (sometimes immediate, sometimes planned)

If you’re unsure what should sit in which bucket, use the property investment glossary and get the language right before you price the risk.

4) The Leeds-specific filter: leasehold and “amenity creep”

A lot of modern Leeds developments look brilliant in photos.

But investor returns don’t live in photos. They live in the lease.

Before you proceed with any leasehold unit, ask:

- Is the service charge stable and clearly itemised?

- Are there major works planned (or hinted at)?

- Does the building have “nice-to-have” amenities that renters don’t pay extra for… but you pay for every month?

If you’re browsing available Leeds developments, this is the filter that separates “looks good” from “works”.

5) Quick underwriting steps (do this in 10 minutes per deal)

You don’t need a spreadsheet obsession. You need consistency.

- Pull rent estimate (conservative)

- Stack costs (realistic, not optimistic)

- Check cashflow under stress-tested financing

- Confirm the leasehold/service charge detail is clear

- Only then decide if it’s worth deeper due diligence

If you want to go deeper on mechanics and taxes that influence net returns, the site’s taxes on UK buy-to-let properties article is a useful background read, but your deal still lives or dies on the cost stack above.

The Net Yield Model for Leeds (2026): A Simple Template You Can Trust

Here’s the uncomfortable truth about buy-to-let Leeds in 2026:

Most “great yield” deals aren’t great.

They’re just gross yield deals with the boring costs conveniently ignored.

So let’s fix that.

This section gives you a clean, repeatable net-yield model you can use on any Leeds buy-to-let properties you’re looking at, without inventing numbers or relying on brochure maths.

Step 1: Stop calculating yield from rent alone

Gross yield is just:

Gross Yield = Annual Rent ÷ Purchase Price

Useful? Sure.

But it’s not investable.

Because your profit is decided by what’s left after the cost stack hits.

If you want a quick refresher on what headline yields miss, this explainer on what a good rental yield looks like frames it properly.

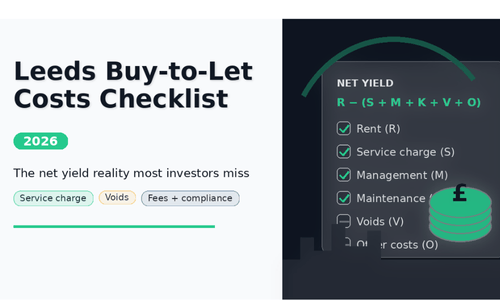

Step 2: Use this net-yield template (copy it mentally)

Use variables so you can plug in your own deal.

Annual Rent (R)

Minus Service Charge + Ground Rent (S)

Minus Management / Letting Fees (M)

Minus Maintenance Allowance (K)

Minus Voids + Changeover Costs (V)

Minus Insurance / Compliance / Other (O)

Net Income = R – (S + M + K + V + O)

Then:

Net Yield = Net Income ÷ Purchase Price

That’s the yield that matters in Leeds property investment.

Because it survives reality.

Step 3: Leeds-specific reality check (leasehold is the swing factor)

In city-centre stock, service charge + leasehold costs can be the difference between:

- a stable, financeable deal

- and a “looks good, bleeds quietly” deal

So when you’re reviewing Leeds buy-to-let properties, treat service charge like a core underwriting input, not a footnote.

Step 4: Financing? Don’t guess, model it

Two deals can have the same net yield… and totally different cashflow.

That’s why you always run the debt side with a tool like the mortgage calculator before you commit emotionally.

You’re not trying to be clever here.

You’re trying to avoid buying a “technically profitable” deal that still drains you monthly.

Step 5: A fast “deal survives?” test

If you do nothing else, do this:

- Model net yield with conservative rent

- Add a realistic void + maintenance allowance

- Stress-test the financing

- Only proceed if the deal still works after costs

Next up, we’ll go one level deeper: the Leeds costs that quietly destroy profit (and exactly how to model service charge impact without guessing).

The Leeds Cost Stack (2026): What Actually Moves Your Profit

If you want to get buy-to-let Leeds right in 2026, you need to stop obsessing over the yield headline… and start underwriting the cost stack.

Because this is what separates “looks good on paper” from “works in real life.

Here are the costs that quietly decide profit for property investment in Leeds, especially if you’re looking at city-centre leasehold stock.

1) Letting + management fees (the “margin tax”)

When yields are tight, fees don’t feel like a small percentage.

They feel like a direct hit to your net return.

Even if you self-manage, you’ll still pay for time, tenant messaging, inspections, compliance admin, and contractor coordination. That’s a cost too. Just not on an invoice.

2) Voids + changeover friction (the cost nobody models properly)

Most investors account for “a void” as if it’s a rare disaster.

It’s not. It’s a normal operating reality.

Voids show up as:

- lost rent days between tenancies

- cleaning/refresh costs

- minor repairs that become “urgent” because a new tenant is waiting

- letting agent re-listing activity (sometimes with extra fees)

If you want a practical baseline for Leeds-specific landlord thinking, skim recent buy-to-let Leeds insights, and you’ll see the same themes repeat: demand is strong, but the operational details decide profit.

3) Maintenance allowance (even new builds don’t escape it)

This is where “hands-off” investors get surprised.

New build or not, you’re still paying for:

- appliances wearing out

- small leaks and callouts

- redecorating cycles

- tenant-caused damage that deposits don’t fully cover

You don’t need exact numbers to model this.

You just need to admit it exists and include a sensible allowance.

4) Compliance + insurance (boring, but non-negotiable)

Compliance isn’t optional in 2026.

The mistake is treating it like a one-time tick-box instead of an ongoing cost and admin load, especially when rules tighten, or EPC expectations shift.

If you ever need plain-English definitions while you model, the property investment glossary helps you keep terms consistent (and stops misunderstandings when you speak to agents/lenders).

5) Leasehold + service charge (Leeds city centre reality check)

This is the big one.

A leasehold flat can look like the “best yield” deal in the city… until:

- service charge rises

- major works appear

- ground rent/terms create resale friction

- The building’s costs don’t match the tenant’s rent ceiling

So if you’re browsing investment property Leeds options, treat the service charge line like you’d treat interest rate changes: it directly affects whether the deal still works after costs.

Quick model (use variables, not guesses):

Net Income = R – (S + M + K + V + O)

If the service charge (S) moves up, your net income drops every year, whether rents rise or not. That’s why it matters.

Leeds Rental Strategies Compared (Choose Your Lane)

There isn’t one “best” strategy for buy-to-let Leeds in 2026.

There’s the best strategy for your budget, your risk tolerance, and your appetite for management.

Pick your lane first. Then pick the property.

1) City Centre Professional Lets (property investment Leeds city centre)

Who it’s for: You want liquidity, steady tenant demand, and a simple “rent it, manage it, repeat” model.

When it works: You buy the right unit type in a building where the costs don’t eat the rent ceiling.

What quietly kills returns: Leasehold/service charge inflation + void risk if you buy the wrong layout or an awkward micro-location.

Unit/tenant fit in one sentence: A clean 1–2 bed that matches how professionals actually live will rent; a “weird” unit will sit.

If you’re comparing options, start by scanning live Leeds buy-to-let properties and look at the cost profile alongside the rent potential, not after.

2) Student Property Investment Leeds

Who it’s for: You’re comfortable with higher management intensity and you want demand driven by university catchments.

When it works: You buy where the tenant pool is deep, and you run it like a business (process, inspections, maintenance plan).

What quietly kills returns: Turnover/voids + management intensity + compliance sensitivity if the strategy depends on higher occupancy.

Unit/tenant fit in one sentence: Student stock wins when it’s built around demand patterns, not your personal taste.

If you want the investor-specific view (not the glossy version), read student property investment in Leeds and note how often “operations” is the real differentiator.

3) Family Lets in Suburban Leeds

Who it’s for: You want longer tenancies, fewer tenant changes, and a calmer cashflow profile.

When it works: You buy a home that fits real family needs (schools, transport, parking, storage).

What quietly kills returns: Maintenance realism (wear-and-tear + bigger-ticket repairs) and buying a house that tenants like… but not at your required rent-to-price ratio.

Unit/tenant fit in one sentence: Families rent stability, so the property needs to feel “livable” more than “instagrammable”.

4) New Build Investment Leeds

Who it’s for: You value lower early maintenance and a modern spec that lets you go fast.

When it works: The pricing premium is sensible, and the building’s running costs don’t cap your net yield.

What quietly kills returns: Rental estimate optimism + service charges + lease terms that reduce resale demand later.

Unit/tenant fit in one sentence: New build works when the tenant pool will pay for the spec and the numbers still hold after costs.

Now let’s zoom in on yields by property type, because the unit you buy matters as much as the postcode.

Leeds Buy-to-Let Yields by Property Type

Different units produce different returns because they attract different tenants, and behave differently when you factor in voids, costs, and how easy they are to re-let.

Here’s the investor reality for buy-to-let Leeds in 2026:

- Studios

Suits: budget-led investors chasing affordability and low entry price.

Upside: can rent fast if demand is there.

Hidden risk: narrower tenant pool + the “rent ceiling” shows up quickly, especially once leasehold costs and service charges are added. - 1-beds

Suits: city-centre professional strategy and steady tenant demand.

Upside: strong liquidity when the layout is practical.

Hidden risk: net yield gets squeezed if the building is expensive to run (service charge, sinking fund, management). - 2-beds

Suits: sharers, couples, and slightly longer tenancies.

Upside: wider tenant pool than studios/1-beds.

Hidden risk: the rent-to-price ratio can worsen if the purchase premium isn’t matched by rent uplift. - 3-beds

Suits: family lets, and outer-area stability plays.

Upside: longer tenancies can reduce void periods.

Hidden risk: maintenance profile is higher, and “little things” become real cashflow events. - HMOs (general only)

Suits: Investors are comfortable with management intensity.

Upside: strong demand when structured properly.

Hidden risk: compliance sensitivity + turnover + operational workload. This is not passive.

If you want a clean baseline for how investors sanity-check returns (without headline-yield nonsense), use what a good rental yield looks like as your starting lens, then apply it to real stock like Leeds buy-to-let properties, where you show the full cost picture.

Which unit types rent fastest (demand-fit logic)

Fastest-to-let units aren’t “best” units. They’re the ones that match what the dominant tenant pool can actually afford.

So ask:

- Is this a young professional market (walkability, transport, work hubs)?

- Or a family market (space, schools, parking, liveability)?

- Or a student market (catchments, layout, management tolerance)?

Get that match right, and void risk drops. Get it wrong, and your gross yield becomes a trap.

Where Yields Are Won or Lost: Area + Tenant Fit

Chasing the “best area” is the wrong question.

The right question is: “What tenant am I serving, and what unit economics will I live with to serve them?”

In buy-to-let Leeds (and any serious rental investment), returns come from the combination:

- Area (demand depth, affordability, rent ceiling)

- Tenant type (stability, turnover, sensitivity to price)

- Unit economics (net yield after unavoidable costs)

A few quick examples:

- A city-centre 1-bed can work brilliantly for professionals… until leasehold/service charge costs cap your net yield.

- A family-sized home outside the centre can be “boring”… and that’s the point: longer tenancies, fewer void periods, steadier cashflow.

- The same 2-bed can be liquid in one pocket and slow in another if the tenant pool and amenities don’t match the rent ask.

Use live listings as a reality check, not a daydream, start by filtering investment property Leeds options by unit type and building cost profile, not just postcode.

Fit checks (fast scan):

- Who is the tenant?

- What unit do they actually rent (not what you hope they rent)?

- What’s the rent ceiling here?

- What costs are unavoidable (service charge, management, voids)?

Why the “best areas to invest in Leeds” depends on strategy

Because “best” changes with your lane:

- If you want liquidity, you prioritise demand depth and re-let speed.

- If you want stability, you prioritise longer tenancies and lower churn.

- If you want yield, you prioritise net return after costs, not vibes.

For more Leeds-specific context as you apply this in 2026, keep an eye on how buy-to-let Leeds commentary frames costs and tenant demand, it’s usually the missing piece in ROI debates.

Next, we’ll look at off-plan vs completed stock, and how to forecast yield without guessing.

Off-Plan vs Completed Stock: Yield Expectations and Risk

Off-plan can work. Completed stock can work. The mistake is assuming they behave the same.

With off-plan, your upside is often “buying tomorrow’s product today.” Your risk is paying for that story without protecting the numbers.

With completed stock, you’re buying proven rentability — but you still need to validate costs, condition, and resale demand.

Rental estimate sanity checks

Don’t guess. Model it.

- Take 3 comparable rentals: same micro-location, same unit size, similar spec.

- Stress-test your rent: “If rent is 5–10% lower, does the deal still work?”

- Run payments through the mortgage calculator and keep a buffer for voids + maintenance.

Exit liquidity: who buys this later?

If you needed to sell in 3–5 years, who’s your buyer?

- Another investor? Then net yield + building costs matter.

- An owner-occupier? Then layout and liveability matter.

If the only buyer is “someone who believes the same brochure,” that’s not liquidity.

Leeds Property Market (2026): What Investors Should Watch (Signals)

No predictions. Just signals worth tracking:

- Employment density shifts (where jobs concentrate)

- Regeneration milestones that change amenity “gravity”

- Supply vs absorption (what’s being delivered vs what’s being taken up)

- Tenant affordability (rent ceiling pressure)

- Rent-to-price ratio changes (yield compression/expansion)

- Lending sentiment (how strict stress testing feels in practice)

Due Diligence Checklist (Before You Buy a Leeds Rental)

Quick checklist:

- Validate tenant fit + unit type (not vibes)

- Confirm lease terms, ground rent, and restrictions

- Map unavoidable costs (service charge, management, insurance)

- Test rent with comps + conservative assumptions

- Check the EPC position and realistic upgrade pathway

- Build a void/maintenance buffer into net yield

“Red flags” list (fast scan)

- Service charge unclear or “TBC”

- Layout mismatch (awkward studios, compromised 2-beds)

- Rent estimate based on different spec/location

- Restrictive lease terms or a poor management company signal

- Capex needs to be dismissed as “minor”

Worked Examples: 3 Leeds Investment Scenarios

- City centre 1-bed (leasehold focus): Rent works on paper… until service charge + lease terms compress net yield. Your win is buying a clean, lettable layout with manageable costs.

- Student-let scenario (operations focus): Demand is strong, but turnover + management intensity decides profit. If you can’t run it like a system, you’ll feel every void.

- Suburban family let (stability focus): Often steadier cashflow with longer tenancies, but maintenance realism matters. Budget for wear-and-tear like an adult.

How to Choose a Property Investment Company in Leeds (Without Regret)

- Fee clarity (what you pay, when, and for what)

- Evidence of due diligence (not just “it’s a good area”)

- Transparency on costs (service charge, leasehold, management)

- Rental assumptions grounded in comps, not optimism

- You get straight answers to straight questions

- They can show you options, not just one deal

(If you’re unsure on terminology, a quick skim of the property investment glossary stops you getting boxed in during calls.)

Request Leeds Buy-to-Let Opportunities + Yield Breakdown

If you want a shortlist that’s numbers-first (net yield, costs, tenant fit), start by browsing Leeds buy-to-let properties and pick 3–5 that match your budget and strategy.

Then request a yield breakdown and a quick call. You’ll get clarity fast, and avoid the “headline yield” traps that quietly kill ROI.