London Investment: An Alluring Property Landscape

As well as the city’s position as an economic, financial, cultural and entertainment hub and the enviable lifestyle it provides, London investment delivers long-term capital appreciation and a stable economic and political environment, making it a prime destination for those looking to grow their real estate portfolios.

London has always been a popular property market for homebuyers—both domestically and internationally.

In this article, we take a closer look at London’s property market, where to invest in London property and predictions for the UK market and capital to understand the risks and rewards of investing in London.

London Property Market Trends

Before getting into detail about London investment opportunities, potential investors need to get an overview of what the London property market offers and its performance over the years. Here’s a wrap-up of recent trends:

2008 – 2012 London Property Market

Before the worldwide financial crisis of 2008, London’s real estate market underwent a swift price surge fueled by readily available credit. In 2008, London’s property market faced a period of adjustment. However, it gradually recovered, with property values rebounding.

2012 Olympics

The hosting of the 2012 Olympic Games in London had a notable impact on the property market, particularly in East London. Infrastructure improvements and a boost in the area’s reputation attracted investment.

Pandemic Race for Space & London Real Estate

While the South East of England saw one of the most significant price hikes across the UK – partly attributed to the “Race for Space” phenomenon spurred by the pandemic – the London real estate market slowed somewhat, experiencing slightly lower property price growth than other areas of the UK.

2022 & London Property Investment

Throughout 2022, the London property market proved to be relatively safe and highly robust regarding property prices and demand, despite several factors despite the rising cost of living and increase in interest rates.

Only at the end of 2022 did London property prices fall slightly (by 1.3%), but still leaving prices 3.9% above pre-pandemic levels, according to Savills. The city also saw some of the highest levels of tenant demand across England in the last quarter of 2022. According to Foxtons, there were 32% fewer rental properties on the market than in 2021, while demand for property was 14% higher. Increased demand and a lack of available rental properties saw average rents increase.

In the prime property market, Knight Frank reported a 16% increase in the number of exchanges in 2022 based on the five-year average. There was a 59% increase in demand for Lonon property, driven by newly built properties—particularly apartments with high energy efficiency.

2023 and Beyond

Savills analysed the UK rental market and found that London experienced the largest annual rental growth at 14.2% in March 2023. Average monthly rents in the capital exceeded £2,500 for the first time in the first quarter of the year. With increasing rental prices and demand, the outlook is good for the London rental market.

The Controversial Side: Is London Property Investment Risky?

London remains one of the most lucrative property locations in Europe. Values have risen by 50% over the last five years. However, UK London property is not cheap, so investors will need to find properties with room for price growth.

Before we dive into the potential rewards, it’s crucial to address the perceived risks associated with investing in London’s property market.

London Investment Risks:

- Sky-High Property Prices: London has a reputation for its high property prices. While this has yielded substantial profits for investors in the past, it has also raised concerns about affordability and a potential market bubble.

- Taxes: The UK government’s stamp duty policies have evolved over the years, with additional taxes levied on second homes and high-value properties. Second and additional residential properties carry a 3% surcharge on top of the standard rate of Stamp Duty.

- On 23 September 2022, the government increased the nil-rate threshold of Stamp Duty from £125,000 to £250,000 for all purchasers of residential property. These costs can significantly impact an investor’s bottom line.

- Economic Fluctuations: Recessions and economic crises can impact property values and rental yields. Inflation and rising mortgage rates are putting pressure on landlords with buy-to-let properties.

- Changing regulations: The Renters Reform Bill will mean landlords are restricted from raising the rent more than once within a 12-month period. They are also required to provide tenants with a two-month notice. London’s 90-day rule means that a property can’t be let out on Airbnb for more than 90 days of occupied nights per year, something owners of buy-to-let properties in London should keep in mind.

- Slower Growth: House price growth is slowing. This could make it harder for landlords to repay their mortgages. Landlords may have to choose between selling their properties or raising their rents.

Despite some challenges in the London property market, holding onto a property can be a wise decision if you have a solid financial cushion and can manage mortgage payments. The capital’s historic performance, potential for high returns and its general resilience mean London tends to remain a popular market for investors.

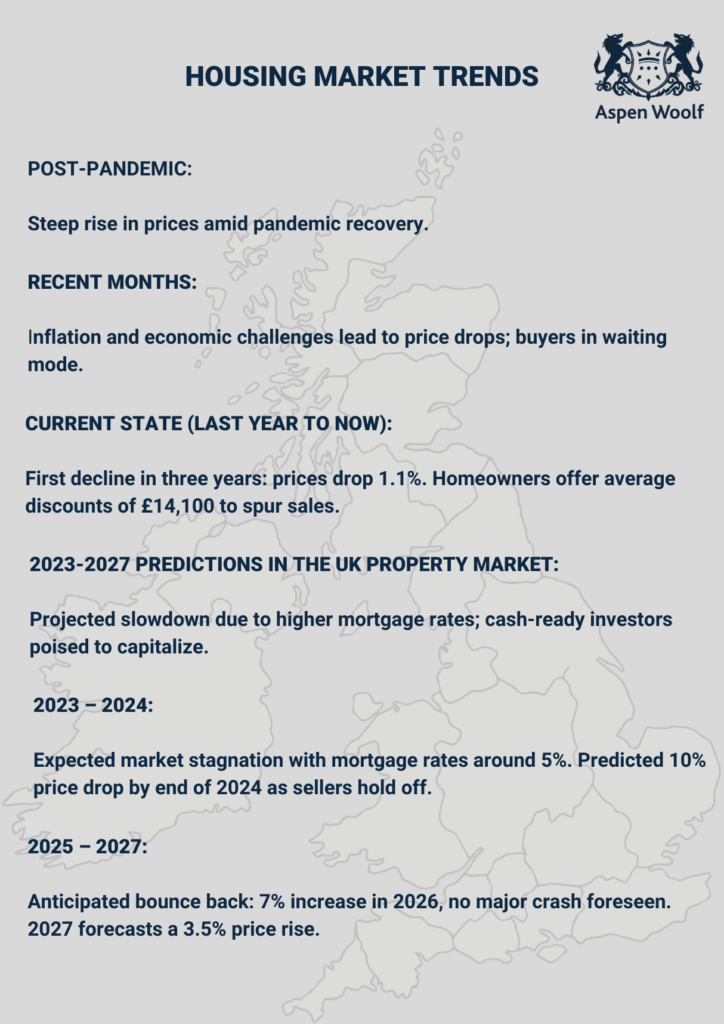

UK Housing Market Trends

Before we dive into London trends, let’s take a closer look at the UK market as a whole. Post-pandemic, UK house prices have been on a steep upward trajectory. However, they have dropped in response to inflation and economic challenges in recent months. Many potential homebuyers have paused their plans to wait for a more stable market.

The current state of the UK housing market

In the past year, UK house prices dropped 1.1%, the first decline in almost three years and reaching the lowest point since November 2012. According to Zoopla, homeowners are now offering discounts on their properties to secure a sale, with an average reduction of £14,100—a third of the gains witnessed during the pandemic.

2023-2027 Predictions in the UK Property Market

The housing market is predicted to slow down over the 2023-2027 period. Today’s higher mortgage rates mean fewer buyers can afford homes, leading to a drop in house prices. However, understanding the cyclical nature of the housing market and cash-ready investors can make the most of opportunities in the market.

2023 – 2024

Higher mortgage rates of around 5% are expected to remain standard for the next two years. This is expected to result in a slowdown in the housing market, with Savill’s predicting a drop of 10% by the end of 2024. With falling house prices, sellers will be more reluctant to sell, fueling the market’s slowdown.

2025 – 2027

Into 2025, house prices are expected to bounce back, and Savills predicts an increase of 7% in 2026. A crash is not expected. While a drop is likely, most predictions don’t expect it to last, and a housing market crash is unlikely. Savills predicts a 7% increase in house prices in 2026. In 2027, the Office for Budget Responsibility (OBR) predicts a property price increase of 3.5%.

Trends in the UK Rental market

In 2022, rental enquiries across the UK were 46% above the 5-year average, and supply is 38% below the 5-year average, according to Zoopla’s Rental Market Report. This mismatch between demand and supply is expected to continue, with rental demand predicted to remain high in 2023.

UK-wide rents are expected to increase annually by 3 – 4% between 2023 and 2026. However, rental growth in city centres is predicted to be as high as 6% in London.

The London rental market is undergoing a number of transformations, particularly due to construction activities and housing projects. The rise of Build-to-Rent (BTR) developments, offering professionally managed rental properties with a range of amenities, is a trend set to reshape the city’s rental landscape.

Future Predictions: A Divergent UK Market

In 2023, UK house prices are forecasted to decrease by 10% as interest rates reach their peak. However, prime real estate markets are expected to experience more modest declines and outperform other sectors over the subsequent five-year period. As borrowing costs rise, a divergence is anticipated in the housing market, separating mortgage-dependent mainstream markets from the prime markets.

A noticeable divide is set to widen between cash-rich and equity-rich buyers on one side and other groups on the other. The mainstream housing market and prime markets will also diverge: prime central London is anticipated to experience a marginal decline of 2% in 2023, followed by a net increase of 13.5% by the end of 2027.

London’s Cash Buyers

London is dominated by cash buyers. According to Knight Frank, 52% of purchasers fell into this category in the first quarter of 2022. These buyers are less affected by interest rate increases.

London’s Overseas Buyers

Historically, prime real estate in Central London has been a magnet for international buyers, thanks to its potential for substantial long-term value growth and the lifestyle it offers. In 2022, nearly half of all property acquisitions in the heart of London were made by international buyers (48%).

Where to Buy Property in London?

London is vast, and not all neighbourhoods are created equal regarding investment potential. Let’s explore some of the best investment areas in London right now:

Central London

Kings Cross

Famous for its iconic King’s Cross and St Pancras railway stations, this historically significant area has undergone a significant transformation. As this redevelopment nears its conclusion, major employers like Google have selected it as their headquarters. With its strong commercial appeal and abundant employment opportunities in the area, King’s Cross is as an attractive destination for property investors.

North London

Tottenham Hale

Significant regeneration efforts are underway in Tottenham Hale, with 2,000 new homes, offices, retail spaces, cafes, and a modernised station underway. Adding to its appeal, the area enjoys convenient Victoria line connections to central London, all while being close to green spaces surrounding the River Lea and the Walthamstow Wetlands. Tottenham Hale is an enticing prospect for London investors.

North East

Walthamstow

As Londoners from Hackney and Stoke Newington were priced out of the market, many headed out to E17, which began a rejuvenation with developers quickly gentrifying the area. New homes have boosted the area and its popularity continues to climb.

In 2021, Walthamstow was the country’s second most popular location for active house hunters. In June 2023, 60% of properties for sale in the competitive E17 postcode were already under offer or sold subject to contract (according to market analyst PropCast).

East London

Leytonstone

The E11 postcode just to the south covers areas such as Laystone and Wanstead. In the first part of 2023, 57% cent of properties for sale were under offer or sold subject to contract. According to Rightmove, properties in Leytonstone had an overall average price of £595,169 over the last year. Leytonstone has a strong rental market, excellent transport links and close proximity to the bustling city centre, making it a good location for investors.

Prime Central London

Despite their hefty price tags, prime central London neighbourhoods such as Mayfair, Kensington, and Chelsea have consistently delivered remarkable capital appreciation over time. These areas are magnets for wealthy buyers and, are areas of prestige that offer long-term growth. Low supply and strong demand mean prices are likely to withstand any possible economic shocks in the near future.

Emerging Hotspots

Areas like Clapham, Balham and Brixton have experienced revitalisation in recent years. Young professionals and families are driving demand and potential for growth. The average cost of a home is £518,235—13.4% below the London average.

London’s commuter belt, including towns like Reading, Guildford and St Albans, are also attractive to investors, particularly with remote working trends and workers commuting to the office a few days a week.

Areas Under Regeneration

Areas undergoing regeneration are great locations for property investment due to the potential for capital appreciation and increased rental income from improved infrastructure and heightened demand.

Early investment in these areas can offer advantages. Here are some areas investors might want to consider:

Thamesmead

The Thamesmead neighbourhood is seeing 8,000 new homes, 4,000 jobs and improvements to 5km of riverbank and 7km of canals. The Elizabeth line runs from Abbey Wood, and there are plans to expand the DLR, too. These factors collectively make Thamesmead a promising location for long-term investment.

Canada Water

Canada Water is one of the largest mixed-use regeneration projects in London. Covering 53 acres, the regeneration project will deliver around 3,000 new net-zero homes, with 35% allocated for affordability. 2 million square feet of workspace is capable of accommodating up to 20,000 workers and 1 million square feet is allocated for retail, leisure, entertainment and community space.

Analysing Capital Appreciation in London

For investors who maintain their buy-to-let property in London for extended periods, a recent analysis of the regions with the most robust capital appreciation shows that the capital takes the top spot, despite a lacklustre performance during the pandemic.

One of the primary attractions of London’s property market is the potential for capital appreciation. Over the years, property values in many parts of the city have seen impressive growth.

In 1997, the average valuation of a London home stood at £83,066 (£160,864 when adjusted for inflation). Fast forward to 2023, and this figure has surged to £510,102, representing an inflation-adjusted gain of £349,238 or a 217 % increase . This translates into an average annual increase of £13,970 over the course of a 25-year mortgage term.

London stands out as the top investment choice in terms of long-term market performance in the UK. In light of the recent downturn in London’s house price performance, this market is likely to make a robust comeback in the short to medium term and see decent growth through 2027.

Other reasons that made London a solid investment choice:

Historical performance

London’s property market has shown resilience and consistent growth over the long term. Despite periodic downturns, property values have generally appreciated over time.

Rental Yields

Rental yields in London can vary widely depending on the area and property type. Despite notable increases in average prime gross yields across London over the past three years, they stabilised during the first quarter of 2023.

Savills predicts that prime rents will increase by an average of 5.0% in 2023 and by

3.0% in 2024. Flats continued to show growing returns as rental income growth for these properties continued to outpace the appreciation in their capital values across all regions.

In the future, it’s anticipated that regulatory and financial pressures may curtail activity. However, the upward trajectory of yields might stimulate additional interest from investors with available cash. This will likely concentrate on smaller properties where the potential for returns is most promising.

Foreign Investment

London has historically attracted foreign investors seeking a safe haven for their capital. This international demand has contributed to price growth and helps to stabilise the market from economic shocks. International and cash buyers will most likely remain a key part of London’s investor market.

Market Fluctuations and Economic Uncertainty

While London’s property market has proven resilient, it has its vulnerabilities. Investors should be aware of the potential risks and strategies for mitigating them:

Market Cycles:

Property markets go through cycles of expansion and contraction. Understanding where London stands in the cycle can help investors make informed decisions.

Historical trends suggest that we are just over halfway through the second half of a housing market cycle. In practical terms, investors should keep in mind the potential shift in market conditions. If the historical pattern holds, rapid price appreciation seen in the earlier stages of the cycle will slow down or stabilise—much like we are seeing in 2023.

Investors should focus on factors such as the affordability of properties and the potential for sustainable returns as they plan their investment strategies in the coming years.

Economic Factors:

Economic factors like interest rates and employment levels can impact property demand and values.

Employment:

Rising unemployment can lead to decreased demand and potential downward pressure on property values. Investors should monitor local and national employment statistics to assess market conditions.

Affordability:

As mentioned earlier, affordability is becoming increasingly important in the London property market. Property prices relative to income levels can impact demand, especially for first-time buyers. Investors should assess whether properties in their target market are within reach for potential buyers or renters.

Tips for Successful Property Investment in London

- Risk Management: Given the potential volatility in property markets driven by economic factors, investors should diversify their portfolios and consider investment strategies that could include the following:

- Long-Term Rentals: Investing in properties for long-term rental income can provide a stable cash flow. Tenants in long-term properties often sign leases for a year or more, offering a predictable income stream.

- Short-Term Rentals: Short-term rental platforms like Airbnb offer flexibility and potentially higher returns. However, they can be more sensitive to economic changes and fluctuations in tourism.

Investors may need to adjust pricing and occupancy strategies throughout the year. Landlords should also take note of London’s 90-day rule when it comes to renting out properties, as mentioned above.

- Commercial Properties: Commercial properties like serviced apartments offer longer lease terms and stable income. The serviced apartment market is growing, and short-term rentals are generally more profitable, attracting up to 30% higher yields. Read our guide to the serviced accommodation market in this article.

Take a Long-Term Perspective

London’s property market has historically gone through cycles of expansion and contraction. Be prepared to hold onto your London investment properties for several years to maximise returns.

While capital appreciation is a key driver of long-term returns, rental income can also be a substantial income source for property investors in London. The city’s high demand for rental properties, fueled by its diverse population and job opportunities, means that long-term investors can generate steady rental income while waiting for property values to appreciate.

Work with Local Experts

Working with local experts in the London property market is a smart strategy for property investors. By working with local experts, investors can identify potential pitfalls, advise on risk management strategies and make sound investment choices that align with their goals and risk tolerance.

- Market Knowledge: London is a vast and diverse city with a wide range of neighbourhoods, each with its own market dynamics. Local experts can provide invaluable insights into which areas are currently experiencing growth and where potential opportunities and risks lie.

- Off-Market Deals: Local experts often have access to off-market property listings which are not publicly advertised. These hidden gems can give investors a competitive advantage, more favourable terms or unique investment opportunities.

- Regulatory Expertise: The London property market is subject to various legal and regulatory complexities, including zoning laws, tenant rights and tax regulations. Local experts can help investors navigate the legal landscape, ensuring their investments comply.

- Property Management Services: Local property management companies can handle day-to-day operations, including tenant screening, rent collection, maintenance and property marketing, giving investors a hassle-free experience.

What is the ROI on Property Investment in London?

Rental yields vary across different areas. In the broader London area, the average yield hovers around 4.6%. However, certain locations witness investors reaping substantial returns, emphasising the role importance of choosing the right location and property selection when considering investments.

Is London Property a Good Long-Term Investment?

London real estate investment is a top choice for a reason, and London property has historically proven to be a solid long-term investment. While property cycles do impact the market, London has demonstrated resilience over time. It has consistently shown growth and value appreciation, making it a favourable choice for those looking to invest for the long haul.

London’s global financial and cultural hub status has contributed to its property values. Factors like population growth and ongoing infrastructure improvements further support the city’s real estate market. In turn, making it a compelling option for long-term investors.

Is it a Good time to Buy a Flat in London in 2023?

London presents a promising landscape for potential flat buyers, particularly those considering smaller properties. Smaller properties are often more affordable and deliver substantial appreciation. This is because they meet the growing demand for living spaces driven by urbanisation and changing lifestyles.

London’s ongoing new developments across the city allow investors to tap into emerging neighbourhoods. Cash buyers stand to benefit significantly from purchasing property in London. Especially now, with higher interest rates in 2023, cash buyers avoid the costs associated with financing. Which means, saving money over the long term.

The Final Verdict: Is London Investment Worth the Risk?

Investing in London’s property market offers both potential rewards and risks. The city’s historical performance, diverse neighbourhoods and economic resilience continue to attract investors worldwide.

Investors must conduct thorough research, consider their financial goals and work with experienced professionals to make an informed decision. London’s property market can be rewarding for those who approach it with a long-term perspective. If you’re considering investing in London real estate, contact our experts today.