Taking a Look at UK Rental Rates

The Office for National Statistics’ latest release of the Index of Private Housing Rental Prices names Yorkshire and the Humber as one of the highest growth regions for rental rates in the last year. Rates increased 1.9% over the twelve months up to December 2019. That puts rental rates in the region above that of London (1.2%) and England’s national average of 1.4%.

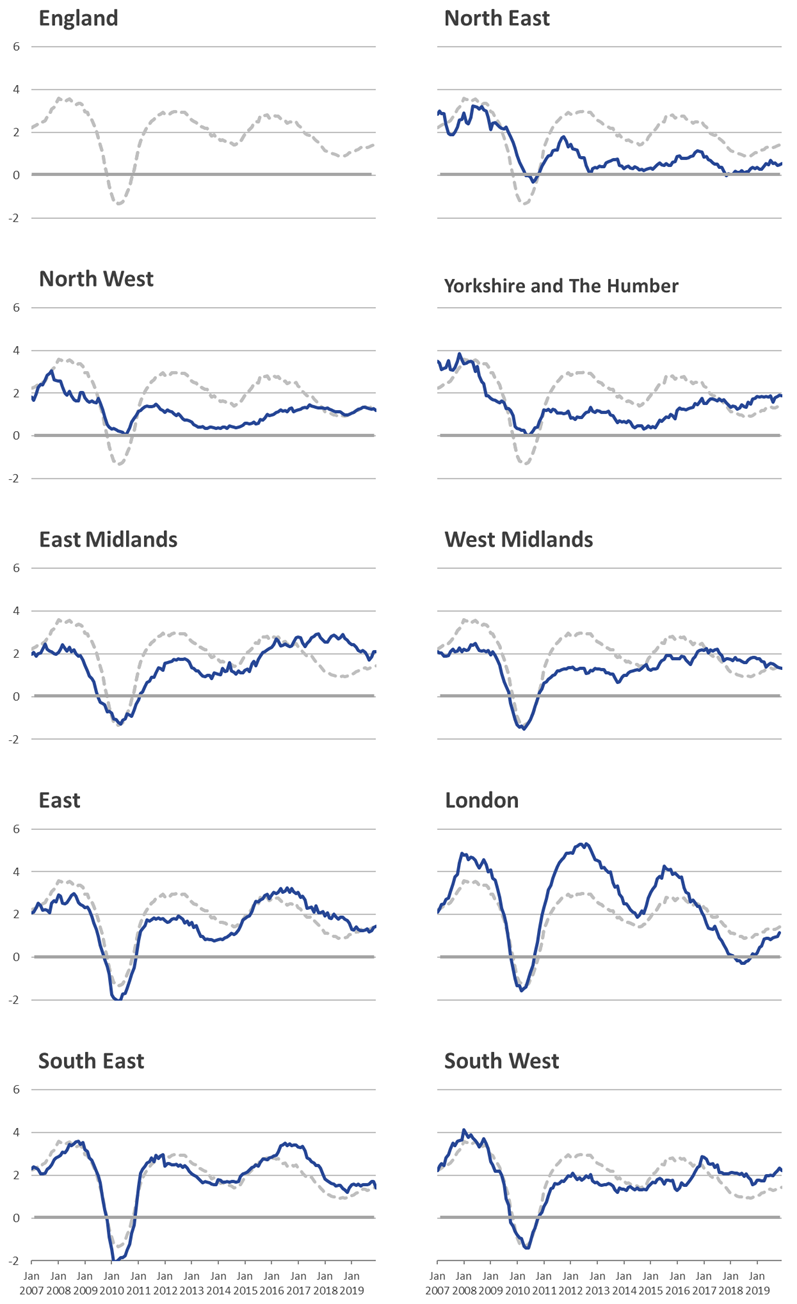

London was also home to the most volatile rental market over the 12 months up to last December, whereas Yorkshire was one of the most stable. Have a look at the below charts from the ONS:

Source: ONS 2019

It is usually understood that rental rates are fairly closely coupled to inflation rates. Once again, according to the ONS, inflation in the UK up to the year end December 2019 was 1.5 percent, making Yorkshire rental growth 0.4% above the inflation rate. Yorkshire is one of the very few regions to possess a rental growth rate above that of inflation.

But what does the future hold? The Royal Institute of Chartered Surveyors (RICS), in their December Residential Market Survey, expect rents to rise in general across the UK as a @consequence of the imbalance between rising demand and falling supply”. The survey report goes on to claim that projections indicate an estimated 2% rental growth over the next 12 months, with an uplift to 3 percent per annum over the next 5 years.

The last residential forecasts supplied by industry experts JLL for Northern England, in February 2018 marked out northern regions as the highest forecast rental growth areas in the UK, with the cities of Manchester, Liverpool and Leeds to perform far above the national average over 5 years.

All in all forecasts for the northern regions look strong for rental growth in the UK. Here at Aspen Woolf we specialize in in offering high yielding, high growth investment opportunities all over the UK, but especially in Northern England. Have a look at what we have to offer…