UK Housing Crisis: Factors Behind the Soaring Prices and Limited Affordability

The UK housing crisis is one of the biggest issues facing the country. The property market is currently characterised by soaring property prices, limited affordability and a shortage of homes.

While homeowners are being hit with sharp interest rates, demand for rental properties has skyrocketed and rents have reached record heights.

In this article, we take a look at the historical context of the housing crisis, societal and market forces at play, what we can learn from other countries and possible solutions.

Read on for the housing crisis explained.

Historical Context: Tracing the Roots of the Housing Crisis

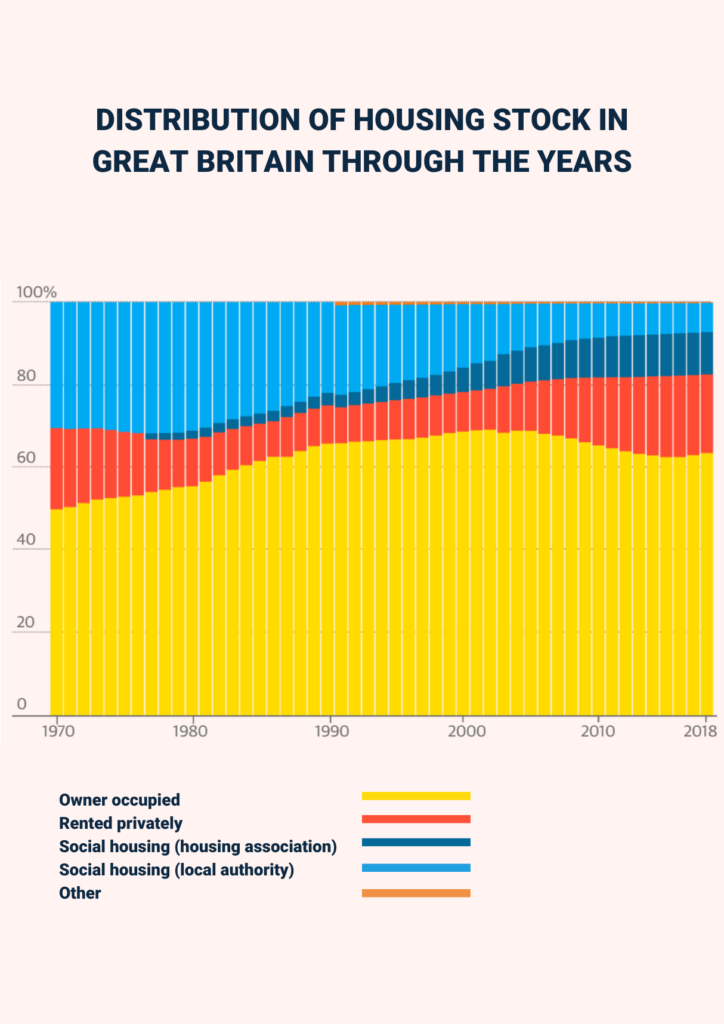

Guardian graphic. Source: Ministry of Housing, Communities and Local Government, Dwelling stock: by tenure, Great Britain (historical series) 1970 – 2017. UK Dwelling Stock, ONS, 2018. Figures are unavailable for Northern Ireland.

The UK’s housing crisis didn’t happen overnight; it’s the result of decades of policy decisions, economic shifts and societal changes. Here’s an overview of the last few decades in the UK property market and the events that have contributed to the current UK housing crisis.

1970s: Social Housing and Cheap Property

In the 1970s, almost one-third of UK homes were affordable social housing provided by local authorities and considered a decent alternative to home ownership. For those who could buy property, the average price was £4,057.

1980s: Right to Buy

The 1980s saw a significant shift in the housing market with deregulation measures, notably the “Right to Buy” policy, spurring increased property ownership and market imbalances.

The Right to Buy policy offered substantial discounts to council tenants purchasing their homes, resulting in the sale of half a million council homes by 1985. However, it led to decreased council housing availability and fewer replacement properties.

Deregulation throughout the decade allowed lenders to set interest rates freely, injecting capital into the market. At the same time, the Housing Act introduced shorthold tenancies, enticing individual investors and contributing to rising house prices.

1990s: Housing Market Volatility

In the early 1980s, a surge in house prices was followed by a recession triggered by a dramatic increase in interest rates, which reached nearly 15%. This recession caused property values to decline in the early 1990s, resulting in negative equity for many homeowners.

Repossessions reached a peak of 75,500 in 1991, flooding the market with reclaimed homes and further depressing prices. Despite fewer mortgage lending controls, the construction of new homes remained low, with just 179,100 completed in 1992.

In 1996, the “buy-to-let initiative” simplified property investment by offering specialised mortgages, launched by the Association of Residential Letting Agents (ARLA) and four lenders. This initiative, combined with declining interest rates and rising house prices, attracted many to invest in the property market.

Early 2000s: The Buy-to-Let Boom

In the early 2000s, the “buy-to-let” trend surged as investors purchased properties for renting, driven by low interest rates and rental income prospects. As a result, average UK house prices soared—by 2007, house prices had tripled compared to values in 1990.

However, during the recession, banks reduced lending, making mortgages harder to obtain. With limited social housing and unaffordable mortgages, more people turned to private renting, leading to a decline in owner-occupied properties.

The 2010s: Recovery and New Housing Challenges

Throughout the 2010s, the housing market gradually recovered from the financial crisis but struggled with a critical issue: inadequate supply to accommodate the growing population, leading to rising property prices.

In 2010, the UK saw a significant drop in newly completed houses, hitting just 135,990, the lowest number since 1946. By 2013, this further declined to 135,590.

A turning point came in 2013 with the introduction of the “Help to Buy” scheme, offering loans for new homes and government guarantees to mortgage lenders, reviving 95% mortgages.

In 2015, landlords faced increased tax bills, and mortgage tax relief would be reduced to 20% by 2017, putting an end to landlords being able claim up to 45% in tax relief on mortgage interest.

Further impacting landlords’ profits, a 3% surcharge on second homes began in April 2016.

By 2018, council-provided homes had decreased from 32% in 1977 to 7%.

2020: The Pandemic to Present Day

In March, the pandemic briefly halted the housing market, but upon reopening, house prices surged by 8.5%, driven by a rush to buy during the temporary stamp duty holiday and the demand for larger homes in a “race for space.”

In 2021, UK house prices increased by over 10%, the fastest growth rate in 15 years, reaching a record high of £254,822, up nearly £24,000 over the year and 16% higher than pre-pandemic levels in early 2020.

Throughout 2021 and 2022, the UK experienced a steep rise in the cost of living, with annual inflation reaching a 41-year peak of 11.1% in October 2022. In response to inflation, the Bank of England implemented a series of 14 consecutive interest rate hikes, commencing in November 2021.

Years of continuous house price increases have driven the average home cost to 9 times the average annual earnings, a substantial rise from the 3.5 times ratio in 1997.

In 2023, home sales are expected to be at their slowest in a decade, particularly affecting southern England, where high average house prices require larger mortgages, bigger deposits, and higher incomes to purchase.

Rising Property Prices: Market Forces and Speculation

Multiple factors influence the housing market and house prices. Here are some factors at play that have affected the UK property market.

Government Policies

Housing policies UK, including Initiatives like Help to Buy and Stamp Duty reductions, can drive demand and property price increases. Help to Buy, which supports first-time buyers, can increase property prices by increasing demand.

During the pandemic, stamp duty land tax reductions were implemented to reduce upfront property purchase costs. This encouraged more buyers, leading to increases in specific market segments and a more active property market.

Supply and Demand

Desirable locations tend to have higher house prices, as many buyers compete for the same properties. Sellers often raise their asking prices in competitive markets, and adjacent areas may also see price increases.

Limited Housing Supply

A persistent shortage of new housing construction, particularly in high-demand areas like London, is partly due to planning regulations, land constraints and lengthy development timelines.

Growing Population

The UK’s steadily growing population, driven by immigration, births, and longer life expectancy, increases housing demand. Existing housing stock in the UK has struggled to keep up with this population growth.

Mortgage Interest Rates

Low-interest rates make mortgages more affordable, boosting buyer confidence for larger loans. Historically, low base interest rates set by the Bank of England stimulate borrowing, making homeownership and property investment more attractive.

Buy-to-Let Trends

A thriving “buy-to-let” market with investors buying properties for rental income and potential price appreciation. Investors focus on urban areas with high rental demand, increasing competition and property prices.

Investors competing with owner-occupiers for properties can drive up prices, particularly in areas with strong rental markets and growth potential. The popularity of buy-to-let investments increases demand and competition in the housing market.

Short-Term Lets

Landlords in tourist areas favouring Airbnb and holiday lets over local rentals due to their higher yields reduce long-term housing availability, can drive rental costs. Short-term and holiday lets can present affordability challenges for residents, especially those with lower incomes.

Socioeconomic Factors: Wealth Inequality and Housing Accessibility

Socioeconomic factors complicate the UK housing crisis, magnifying supply-demand imbalances, government policies and market dynamics.

Wealth gaps separate property investors from first-time buyers trying to enter the market, and limited housing, especially in high-demand zones, makes property unaffordable.

- Wealth Inequality

Disparities in wealth can create substantial variations in purchasing power. As property prices surge, driven by heightened demand from wealthier buyers, it becomes harder for individuals with lower incomes to access the housing market. This can result in a shortage of housing choices for middle and lower-income households.

- Speculation and Investment

Wealthier individuals may also engage in property speculation and investment, further driving up prices, particularly in sought-after locations. This speculation can lead to market volatility and make it difficult for first-time buyers to compete, contributing to a housing affordability crisis.

- Regional Differences

Housing accessibility fluctuates across different UK regions. Some areas offer more affordable, while in densely populated urban zones, unaffordable housing is more prominent. This can lead to population shifts as people seek more affordable housing options—something we saw during the pandemic when many left London for cheaper northern cities like Manchester and Leeds.

International Perspectives: Lessons from Other Countries

According to the Lincoln Institute of Land Policy, in 2019, 90% of the 200 cities around the globe were considered unaffordable, based on average house price in relation to median income.

In the last half of 2020 and the first half of 2021, housing prices across the world have dramatically increased, and cities across the globe face housing issues:

- In the US, prices rose by 11% during the 2021-2022 period (and 40% since 2000), the fastest pace in 15 years. The median home in 200 US cities is $1m.

- In New Zealand, house prices were up by 22 % in the 2021-2022 period.

- Vancouver has been viewed in recent decades as a place abroad for the wealthy Chinese to keep their assets, pushing up property prices.

- In 2020, Hong Kong retained the title of having the world’s least affordable housing market for the 11th consecutive year, with the average price for a home 20.8 times the annual household income.

Four countries in particular—Singapore, Japan, the Netherlands and France—have taken different approaches with respect to providing solutions to their housing crises. While no country has the answer, there are lessons to be learned.

Japan: Loosened Planning System

Japan’s approach to housing is characterised by loose planning and quick construction. In Japan, a national planning board, rather than local authorities, facilitates construction.

Housing is viewed as a depreciating commodity (by law), not an investment, and homes are typically rebuilt instead of retained for value appreciation.

- Permissive Planning System

Japan’s zoning system categorises areas for commercial or residential development, allowing companies and individuals considerable freedom in building. This results in rapid and extensive development.

- Abundance of Housing

While freedom of building led to a significant surplus of housing during Japan’s 1990s, it has effectively reduced homelessness due to the availability of lower-quality accommodation. Japan’s homelessness rate is exceptionally low, with only 0.003% of the population registered as homeless, compared to many Western countries with significantly higher rates.

Singapore: More Government Control

The Singaporean Housing and Delivery Board (HDB) operates under a unique system where government-built flats are directly sold to citizens on 99-year leases. This system provides flat owners with lifelong security while enabling the government to reclaim and resell flats after this lease period.

- Government Influence on Housing

With 78.3% of Singaporeans residing in HDB flats, the state wields extensive influence over housing development. This results in one of the world’s most equitable housing markets. Moreover, there are strict restrictions on foreign ownership, and an annual property tax is levied based on hypothetical rental income.

- Challenges with Housing Supply

Despite this, material and labour shortages have hindered the government’s capacity to provide homes promptly. This has given rise to a thriving resale market in the city, where HDB flats are now fetching prices exceeding S$1 million (£604,000) for the first time.

The Netherlands: Sustainability

The Netherlands’ housing approach focuses on sustainability and strict building standards. New sustainable housing developments feature triple-glazed windows, solar panels, energy-efficient design, high-quality materials and spacious living spaces.

The country’s commitment to energy efficiency contributes to its reputation for sustainable real estate. Additionally, the Dutch government’s dedication to a circular economy encourages the use of recycled building materials and high-quality new materials with recycling potential.

France: The 15-minute City

France takes a unique approach to addressing housing challenges by focusing on making existing communities more livable through the “15-minute city” concept.

The 15-minute city model aims to create tighter-knit communities, reduce pollution and enhance residents’ quality of life by ensuring that essential services are easily accessible within a 15-minute walk.

This approach doesn’t involve building new communities but maximising the use of existing spaces to provide more services closer to where people live. In Paris, initiatives include repurposing school playgrounds as parks on weekends and using school buildings as social meeting spaces after school hours.

Addressing the Crisis: Proposed Solutions

How can we solve the housing affordability crisis? There’s no silver bullet, and the reasons for the UK’s buy-to-let housing crisis are nuanced and complex. Here are three ways that could help to alleviate the current situation:

- Increase Supply

Increasing the supply of houses could include initiatives like promoting quicker land identification and simplified planning by local authorities. This would incentivise developers to construct new homes, including affordable and social housing.

- Improving Renting Conditions

Initiatives like stricter regulations to enforce minimum living standards in rental properties, promoting tenant rights and controling rent prices, as well as promoting long-term rental solutions like build-to-rent schemes could help improve renting conditions.

- More Funds for Public Housing

Increasing public funding for affordable and social housing construction is essential. Additionally, addressing regional disparities, improving transportation, discouraging empty properties and providing financial support to low-income households could help to alleviate the UK housing problem.

How Will Inflation Affect the Housing Market UK?

When inflation increases, property prices often follow suit. While this might seem a good thing for homeowners, it means rising costs for goods and services. Which puts a squeeze on household budgets. When homeowners opt to stay put, it can constrict the housing supply, compounding difficulties for prospective first-time buyers.

However, inflation can also have the opposite effect. In cases where inflation triggers an upturn in mortgage interest rates (as we are currently experiencing), many potential buyers encounter difficulties securing loans. This is primarily due to higher monthly repayments and the need for a heftier deposit. This diminished demand for properties can lead to a decline in house prices.

Conclusion

The UK housing crisis is one of the most pressing challenges facing the country. With skyrocketing property prices, limited affordability and a persistent shortage of homes, it has has far-reaching implications for homeowners and renters. Addressing the crisis requires multifaceted solutions, including increasing housing supply and boosting public funding for affordable housing. To find out more about the UK property market get in touch with our experts.