There is no search results.

Is an Investment Property for Sale in London Worth it?

Is an Investment Property for Sale in London Worth it?

London, as UK’s capital, has long had a reputation as a ‘safe haven’ in the international property market and the city remains one of the most coveted worldwide. Even though the cost of living is much higher than in most other UK cities, that doesn’t diminish the appeal of living there.

Here are a few things that you should now before looking into new build flats for sale in London :

- Great House Price Predictions– London property has always been considered as a safe investment. Even though it has suffered some hard times during the national lockdowns. It’s slowly coming out with a changed and renewed market. Meaning, the time to seize a London property while the prices have not yet recovered fully, is now. Over the next 10 years, the average property price in London is expected to be worth £931,000 – up from around £535,174 now.

- High Demand for Rental Properties– London is still in high demand by young professionals not only in the UK but internationally as well. Considering the steep prices of new build properties in London, many of these professionals are more likely to rent rather than buy a London property themselves. Which in turn offers a great opportunity for returns to buy-to-let investors.

- Business & Investments– regardless of the remote work trend, London offices are awakening and offering more employment opportunities than ever. Not only that, but London also offers some of the best luxury new-build properties on the market. What this means for you as a property investor is that you can get an even greater return of your investment by snatching up one of these properties for yourself.

- Dependable Market-the London property market is one of the most dependable and safe markets in the world. Not just because there’s consistent demand, but also because the London property market is one of the most transpired ones, which is something that every investor can appreciate.

- Inflation Resistant– London properties offer a hedge against inflation and great returns regardless of economic changes. Moreover, property investment in London never stalls. Also, it offers an exit strategy no matter the times, you can always find a willing buyer for your property.

What to Expect From New Build Apartments for Sale in London?

London properties remain one of the best worldwide amongst property investors. Regardless of the uncertainty over the years- starting with the 2009 financial crash all throughout Brexit and Covid, the London property market remains robust.

Even though many expected property prices to plummet, and due to the above-listed reasons the market did experience a standstill. Although, thanks to the Stamp Duty holiday and now that everything seems to be going back to normal, it’s coming back to its rightful place.

What this goes to show is a very important resilience and safety many property investors look for before investing. Even in the worst of market conditions, a London property can always find a buyer.

Another important note is that demand for housing still exceeds supply. This means that buying a property in London will give you a much sought-after piece of property. If you’re an international investor, the good news is that you’ll be on an even playground with UK property investors. Meaning the buying process is more or less the same as for UK nationals and features few restrictions.

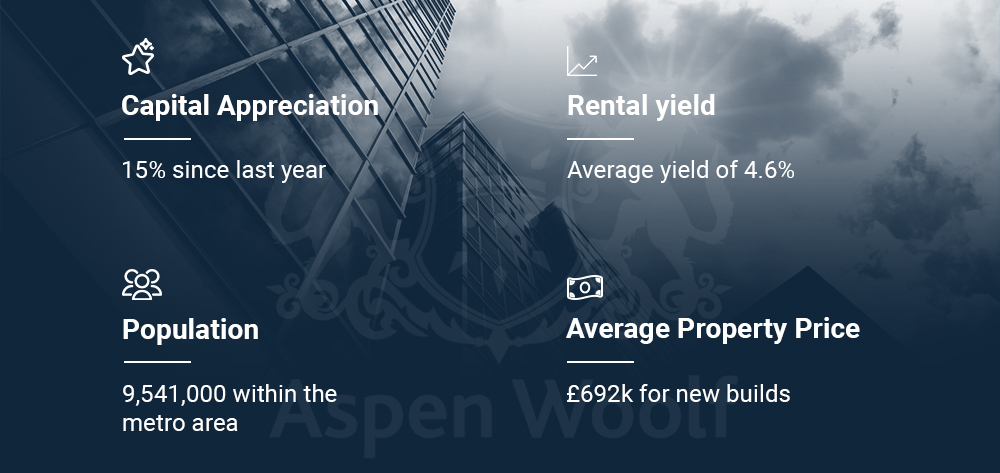

One of the greatest benefits of buying an investment property in London is the rental income. While rents throughout the UK are on the rise, they’re still no match to the UK’s capital. This goes to show, that as a buy-to-let investor you’d be looking at an average of £1,572 a month.

Another important note about London investment properties is the capital appreciation. London property has always been a bullet-proof investment. It is unlikely this will change any time soon. As current predictions indicate, the chances of your property losing value over the years are close to none.

Who Should Look For Investment Properties for Sale in London & Where?

Considering buying a London property is no small investment, anyone interested should know the entry price points beforehand.

The overall average price for a London property stood at £718,731 with the majority of sales being flats which sold for an average of £550,886. Of course, these prices differ from one area to another so choosing the most profitable one is of top priority.

Having said that, the London property market also benefits from a large number of tourists, overseas workers, and a lot of new investments. Which, for you as a property investor, can only mean one thing- brilliant occupancy rates. Nevertheless, London is not only a great market for buy-to-let investors or international investors, but it’s also a great opportunity for long-term ones.

Now, let’s take a look at the best property investment areas in London:

- Tottenham– with regeneration projects underway, this area offers significant room for equity growth. The average price for a property in Tottenham is £551,492 which is still on the affordable end when looking at the market as a whole.

- Seven Sisters– is thought to be an up-and-coming area od London. Over the last year the Seven Sisters Station had an overall average price of £555,918.

- Edmonton– this London area offers great transport links, a a vibrant multicultural community and great potential rental yields. The average sold price for a property in Edmonton was £451,084.

- Barking– this area is already one of the cheapest places to buy properties in London. It also offers great opportunity for growth thanks to its connectivity and regeneration efforts. The average price for a property in Barking was £368,730 over the last year.

- Ilford– with the completion of Elisabeth Line, this London area is also one to watch. Considering its affordable prices, great yield and tenant demand you should definitely consider it. Properties for sale in Ilford had an overall average price of £476,188 over the last year.

- Chadwell Heath– with healthy rental yields, great connectivity and proximity to many buzzing retail and leisure hubs, this is an area that shouldn’t be ignored. The average price for a property for sale in Chadwell Heath stood at £393,073 over the last year.

There are many areas of London that investors should keep a close eye on. Having said that, on our website, you can find a special selection of properties for sale in London that have the best chance for a high return on investment.

Start your smart investment with the help of Aspen Woolf.