There is no search results.

Why Investment Properties in Wakefield?

Why Investment Properties in Wakefield?

Following in the footsteps of other Northern powerhouses, Wakefield is fast becoming a desirable location for both living and investing. With the city’s impressive economic growth in recent years, Wakefield was named one of the ‘most chic’ cities in the UK – beating London.

Now let’s take a look at the benefits of owning a property in Wakefield:

- Regeneration– The coming years will see new projects come to fruition. City Fields, just north of the city centre, is launching in 2022. Which will bring a new community of two and three-bedroom homes to the area. The regeneration of the River Calder Waterfront will see the arrival of a multicultural space in 2023. This is set to uplift the area’s cultural sector and attract new businesses and jobs.

- Population Growth – Thanks to regeneration, alongside the ripple effects of Leeds’ economy, incoming investment and the noticeable shift of people moving out of big cities to more affordable commuter towns, Wakefield is becoming a vibrant hub where people want to live, work and visit.

- Commuter hotspot – Wakefield has a surprising lifestyle and cultural offering and a growing visitor economy. Wakefield’s central location means it can fully reap the benefits of the UK’s connectivity network. It has impressive transportation networks, with swift connections by road, rail, and air.

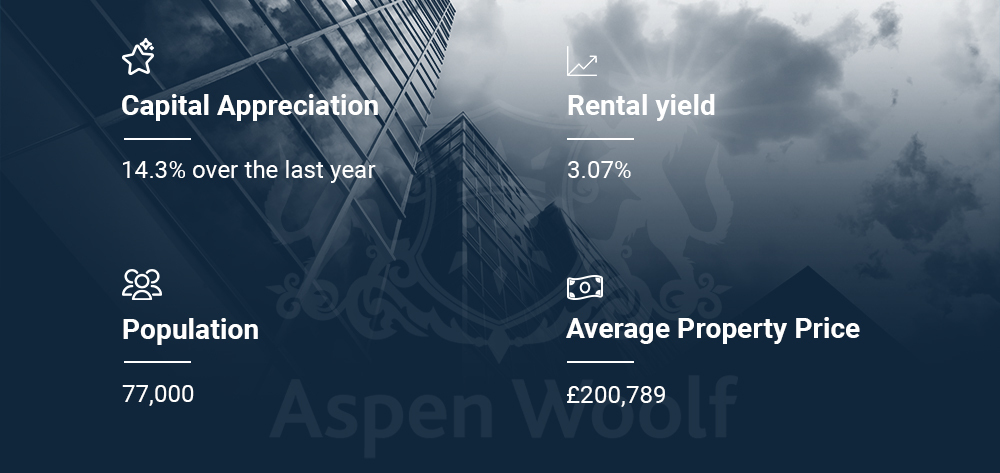

- Low Property Prices– Over the last year, properties in Wakefield had an overall average price of £211,478. Which is still far lower than many other competing markets. The average property price increased by £5.1k (3%) over the same time period. Wakefield is the 15. cheapest postcode area out of 105 England and Wales’ postcode areas.

- Tremendous Growth– Wakefield is definitely not falling behind when it comes to price growth. Especially when compared to much more popular cities, such as Leeds. Over the last ten years, the house prices in Wakefield have grown by an astounding 35.12%. So if you’re interested buying one or more Wakefield properties, this city can offer even higher levels of capital growth and growing rental yields.

Where to Look For Flats for Sale in Wakefield?

Even though Wakefield is still considered an up-and-coming location and hasn’t been popularised as much in the property investment world, that’s not a reason to write it off. It is an opportunity to explore what it can offer though. And these locations are exactly where you should be looking for a Wakefield property:

- Wakefield City Centre– with great amenities and easy access to Wakefield Westgate and Wakefield Kirkgate railway stations this is the most popular choice for both buyers and tenants alike. With average property prices ranging between £90,000 – £150,000 property investors have a number of property types to choose from. From budget terraced houses and smart townhouses to Wakefield new builds. The new developments might especially appeal to buy-to-let landlords. Rental yields here are around 4.3%.

- Northern Suburbs – North Wakefield suburbs are an amazing location for commuters travelling to Manchester and Leeds. Not only that, but the Wakefield 41 Business Park is also where many large employers are located. This means that if you’re interested in rental Wakefield properties, this area should be of interest to you. You can expect yields of around 3.8% to 4.3% with average property prices of £140,000 – £250,000.

- Eastern Suburbs– this area is considered as a lower price location which includes include Eastmoor, College Grove, Pinders Heath and Stanley. You can expect yields of around 4.3% and good value property with prices of £90,000 – £190,000.

- Southern Suburbs– this area offer traditional terraced houses and good-value properties for buy-to-let landlords. It’s also a family-friendly area which is also very appealing to commuters. The prices in this Wakefield area range from £120,000 – £300,000 and yields are around 4% to 4.4%.

- Western Suburbs– an area typically popular with family buyers and tenants, it offers offering cheap property investment opportunities. With prices ranging from £150,000 – £260,000 and rental yields of about 3.3% to 4.4%