The Impact of Economic Factors on UK Rental Yields

In the UK, where economic factors are constantly shifting, property investors face a balancing act. Rental yields—the income generated from rental properties relative to their cost—serve as a crucial indicator for investors, reflecting both earning potential and market stability.

With inflation, interest rates and employment trends in flux, rental yields can vary significantly, signaling both opportunities and challenges. By understanding how these economic drivers interact, investors can make more informed decisions and adapt to market conditions effectively.

Whether you’re a seasoned investor or new to property, let’s take a look at key economic indicators that influence UK rental yields.

The Interplay Between Economy and Rental Yields

The economy plays a pivotal role in shaping rental yields, which represent the return an investor earns on a property relative to its cost. For property investors, understanding rental yields is essential because it reflects both the property’s earning potential and the market’s response to broader economic conditions. High or low yields can signal different opportunities or risks, making it crucial for investors to monitor these metrics closely.

Key economic factors, such as inflation, interest rates and employment trends, directly influence rental yields in various ways. Inflation impacts both rent prices and the purchasing power of tenants, while interest rates affect mortgage costs, altering the net returns for investors.

Employment trends, on the other hand, can dictate rental demand, as areas with strong job growth often see increased demand for housing, supporting higher yields.

Key Economic Indicators Explained

Understanding key economic indicators helps property investors anticipate market shifts and make informed decisions to optimise rental yields:

- Inflation

Inflation is the rate at which the general price level of goods and services rises over time, eroding purchasing power. It’s measured in the UK by indices like the Consumer Price Index (CPI).

Trends (2014–2024):

- From 2014 to 2019, UK inflation rates were relatively stable, averaging around 1.5% to 2%.

- In 2020, inflation dipped due to the economic impact of the COVID-19 pandemic.

- By October 2022, inflation surged to 11.1%, the highest in over 40 years, driven by rising energy prices and supply chain disruptions.

- As of September 2024, inflation has moderated to 2.6%, aligning closer to the Bank of England’s target.

Higher inflation can drive up rents but also increases property maintenance and operating costs. Investors often raise rents to maintain yield, but sharp rises can challenge affordability and demand.

- Interest Rates

Interest rates represent the cost of borrowing money, set by the Bank of England’s base rate, influencing mortgage rates and overall economic activity.

Trends (2014–2024):

- Between 2014 and 2016, the base rate remained at 0.5%.

- In August 2016, it was reduced to 0.25% to support the economy post-Brexit referendum. Gradual increases followed, reaching 0.75% by August 2018.

- In response to the pandemic, the rate was cut to 0.1% in March 2020.

- Starting December 2021, the Bank began raising rates to combat rising inflation, reaching 5.25% by August 2023.

- As of November 2024, the base rate stands at 5.0%.

Higher interest rates increase mortgage costs for investors, potentially reducing net rental yields. Conversely, higher rates can dampen property price growth, offering opportunities to acquire properties at more favorable prices.

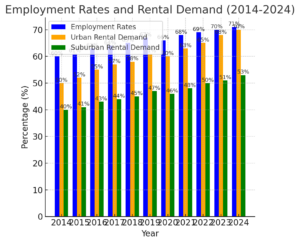

- Employment Rates

The employment rate measures the proportion of the working-age population currently employed. It’s a key indicator of economic health and influences housing demand.

Trends (2014–2024):

- The employment rate rose steadily from 2014, reaching a record high of 76.6% in early 2020.

- The COVID-19 pandemic caused a decline, with the rate falling to 75.6% by January 2023.

- Recovery followed, with the rate increasing to 76.0% by July 2023.

- As of August 2024, the employment rate stands at 75.0%.

Higher employment rates typically boost demand for rental properties, supporting higher rental yields. Conversely, rising unemployment can lead to increased vacancies and pressure to lower rents.

Analysing Current Trends in the UK Economy

Current trends and projections suggest a period of economic stabilsation, with inflation and interest rates expected to decline, while employment remains relatively steady. Property investors should monitor these indicators closely, as they will influence rental yields and property values in the coming years.

Inflation and Purchasing Power

In September 2024, the UK’s Consumer Prices Index (CPI) inflation rate stood at 2.6%, close to the Bank of England’s 2% target, suggesting more stable prices after recent inflation spikes.

The Office for Budget Responsibility (OBR) forecasts that inflation will remain around 2.5% in 2025, suggesting a stabilization in price levels.

- Landlord Perspective: With inflation stabilising, landlords may find it easier to predict operating costs and set rental rates accordingly. However, rising costs in prior years mean many have already adjusted rents upward, potentially leading to tenant turnover as renters search for affordability.

- Renter Perspective: For renters, stabilising inflation could alleviate some pressure on household budgets, as rent increases may slow down. However, the effect of recent hikes in rent and living expenses may still limit affordability and increase demand for budget-friendly or shared housing.

Interest Rates and Mortgage Affordability

As of November 2024, the Bank of England’s base rate remains at 5.0%, following several hikes aimed at curbing inflation. Analysts anticipate that interest rates could fall to between 3.5% and 4% in 2024, and further to between 3% and 3.5% in 2025, as inflationary pressures ease.

- Landlord Perspective: High interest rates have led to increased mortgage payments, especially for landlords with variable-rate loans, reducing net rental yields. Some may need to raise rents to cover costs, while others might consider fixed-rate mortgages to lock in lower rates if projections indicate a decline.

- Renter Perspective: For renters, high interest rates mean fewer people can afford to buy homes, which intensifies demand in the rental market. This heightened demand can push rents upward, further straining renter budgets and potentially leading to longer rental periods or shared living arrangements.

Employment Trends and Housing Demand

In the three months to August 2024, the UK employment rate was estimated at 75.0%, indicating a steady labour market (ONS). The Bank of England projects that the unemployment rate will rise slightly to around 4.5% by mid-2025 as economic growth moderates.

- Landlord Perspective: High employment levels maintain steady demand for rental properties, supporting stable yields, particularly in regions with strong job growth. However, stagnant wage growth may limit the rent increases landlords can charge, as tenant affordability becomes a concern.

- Renter Perspective: Stable employment is positive for renters, as job security supports their ability to pay rent. Yet, with wage growth remaining stagnant, renters may struggle to meet rising rent costs, which could impact their ability to save for eventual homeownership.

These economic factors suggest that property investors may find stability in the market as inflation eases and interest rates are projected to decline, potentially reducing financing costs in the coming years.

However, stagnant wage growth and high renter demand could limit rental price increases, impacting yield potential, particularly in high-demand areas. Investors should assess regions with strong employment growth to balance stable rental demand with affordability considerations, so their investments meets the needs of renters facing rising living costs.

Case Studies: Economic Factors in Action

These case studies illustrate how different economic crises reshaped the UK rental market in unique ways, offering investors both risks and opportunities as demand and financing pattersn evolved.

Significant economic events can reshape the rental market, influencing both property values and rental yields.

- The 1970s Oil Crisis and Its Effects on the UK Rental Market

- Economic Shock: The 1973 oil crisis led to a sharp increase in oil prices, causing UK inflation to surge, peaking at 24.89% in 1975. This rapid inflation eroded purchasing power, affecting both renters and homeowners as the cost of living escalated.

- Housing Market Impact: High inflation and increased construction costs led to rising property prices, making homeownership less accessible and increasing demand for rental properties. Landlords initially benefited from higher rental yields as rents rose with inflation. However, as wage growth lagged behind inflation, renters faced affordability challenges.

- Government Intervention and Market Stabilisation: To combat inflation, the UK government implemented wage and price controls, including rent freezes, restricting landlords’ ability to increase rents.

The Bank of England raised interest rates, reaching 17% in 1979, increasing borrowing costs for property investors.

- The 2008 Global Financial Crisis and Its Impact on UK Rental Yields

The 2008 financial crisis led to a significant decline in property prices, with average UK house prices falling from £190,000 in late 2007 to around £154,500 by early 2009, a drop of nearly 19%.

This depreciation made property purchasing more affordable for investors, though tightened lending criteria and higher mortgage rates posed challenges.

- Increased Rental Demand: As mortgage availability decreased, many prospective homeowners turned to renting, boosting demand in the rental market. This shift led to increased rental yields, as landlords could command higher rents due to the heightened demand.

- Recovery Period: In response to the crisis, the Bank of England reduced the base interest rate to 0.5% in March 2009, aiming to stimulate economic activity. Investors who entered the market during the downturn benefited from subsequent property value appreciation and sustained rental demand as the economy recovered.

3: The COVID-19 Pandemic and the UK Rental Market

The COVID-19 pandemic led to widespread economic disruption, with the UK unemployment rate rising to 5.1% in the three months to December 2020. This uncertainty affected renters’ ability to afford housing, influencing rental yields.

Lockdown measures and the shift to remote work prompted many to seek properties with more space, often outside urban centers. This trend increased rental demand in suburban and rural areas, leading to higher rents in these regions, while urban rental markets experienced a decline.

To support the economy, the Bank of England maintained the base interest rate at a historic low of 0.1% during much of the pandemic. This low-rate environment made borrowing more affordable for investors, who could capitalise on changing rental demand patterns to achieve favourable yields.

Practical Tips for Investors

Here are five practical tips for property investors looking to mitigate risks associated with economic fluctuations:

- Diversify Property Types in Your Portfolio: Consider a mix of residential and commercial properties or multi-family units to spread risk across different income sources.

Economic shifts affect these segments differently; for instance, demand for residential rentals often remains stable during economic downturns, while commercial demand may fluctuate. This diversification provides a buffer if one property type underperforms due to economic conditions.

- Target Emerging, High-Employment Regions: Focus on areas with strong job growth in industries less impacted by economic downturns, such as tech hubs or healthcare centers.

These regions often maintain housing demand and rental yields even during recessions, as employment remains relatively stable. Investing in these areas also positions you to benefit from rental price growth as the region’s economy expands. - Opt for Fixed-Rate Mortgages During Interest Rate Volatility: Locking in a fixed-rate mortgage can safeguard your investment against rising interest rates, which could otherwise reduce your rental yield.

Fixed rates allow you to predict expenses over the long term, giving you consistent control over cash flow. During periods of rate hikes, this stability is crucial for maintaining profitability. - Build Flexible Lease Terms: Offer adaptable lease options like short-term rentals or multi-year leases with rent adjustments based on inflation or market trends. Short-term leases allow you to adjust rents more frequently, aligning with the market, while multi-year leases can ensure tenant stability and reduce vacancy.

- Invest in Community-Oriented Properties: Properties with shared spaces, such as co-living units or properties in community-focused developments, are becoming popular, especially with younger renters.

Community-oriented spaces often have lower vacancy rates due to their appeal and provide a sense of stability even in fluctuating markets. These properties also allow for creative income streams, such as charging fees for shared amenities or organising paid community events. - Embrace Green Building Upgrades: Environmentally friendly properties with energy-efficient features, solar panels or sustainable materials appeal to a growing demographic of eco-conscious renters.

These upgrades often reduce maintenance and energy costs, benefiting both the landlord and tenant financially. Additionally, green properties may offer tax incentives or rebates, helping to offset economic fluctuations.

Long-Term vs. Short-Term Rental Strategies in an Uncertain Economy

Long-term rentals offer consistent income, with average tenancy lengths in England around 4.3 years, providing landlords with predictable cash flow. In contrast, short-term rentals can yield up to 30% more profit due to flexible pricing and higher nightly rates, especially in tourist-heavy areas. Short-term rentals are subject to seasonal demand fluctuations, which can lead to periods of vacancy and income variability.

- Regulatory Considerations: Short-term rentals often face stricter regulations, such as London’s “90-night rule,” limiting short-term lets to 90 days per year without planning permission. Additionally, from April 2025, the UK government plans to remove tax advantages for landlords of short-term furnished holiday properties, aligning them with long-term rental taxation.

- Operational Demands and Costs: Short-term rentals require more active management, including frequent tenant turnover, cleaning and marketing, leading to higher operational costs.

Conversely, long-term rentals involve less frequent tenant changes, reducing turnover costs and management efforts. Investors must weigh these operational demands against potential income to determine the most suitable strategy.

Regional Economic Factors and Property Market Resilience

Regions with robust employment growth: Places like Manchester and Edinburgh have seen increased rental demand, supporting higher yields. For instance, Manchester’s population grew by 9.7% between 2011 and 2021, driven by job opportunities, leading to a surge in rental demand. Investing in areas with strong job markets can provide more stable rental income.

Economic Diversification and Stability: Areas with diverse economies including sectors like technology, finance, and education, tend to be more resilient during economic downturns. For example, Cambridge’s economy benefits from a mix of tech companies and educational institutions, contributing to a steady rental market. Diversified local economies can buffer against sector-specific downturns, maintaining rental demand.

Infrastructure Development and Property Values: Investment in infrastructure, such as new transport links, can enhance a region’s attractiveness, boosting property values and rental yields.

For example, the Crossrail project, now known as the Elizabeth Line, has significantly impacted property values along its route. For example, in the W1 postcode area, which includes stations like Tottenham Court Road and Bond Street, average property prices have increased by 215% since the project’s announcement in 2008, rising from £725,603 to nearly £2.3 million.

Similarly, areas such as Woolwich (SE18) have seen property values climb by 128% during the same period. These substantial increases demonstrate how infrastructure developments like can enhance regional attractiveness, leading to higher property values and rental demand.

In a constantly shifting economic landscape, understanding the impact of inflation, interest rates and employment trends is essential for property investors seeking stable rental yields. Practical strategies—like diversifying property types and choosing high-employment regions—can help mitigate risks. By closely monitoring economic indicators and adapting investment approaches, investors can navigate market fluctuations. To find out more about investing in property, get in touch with our experts.