7 Reasons to Invest in Property in Luton and Where to Buy

Luton is a town on London’s commuter belt boasting excellent road and rail links and the fifth busiest airport in the UK. In addition, great schools and an increasingly vibrant business environment make investment property Luton an enticing prospect.

Ideal for those looking for a London commuter property outside of the capital. The town is a popular destination for first-time buyers in the UK. In particular, Luton catches the eye of property investors looking for decent capital gains. But with a lower entry point than the capital.

Read on to find out why investment property Luton is increasingly appealing. As well as the areas of the town that property investors might want to consider.

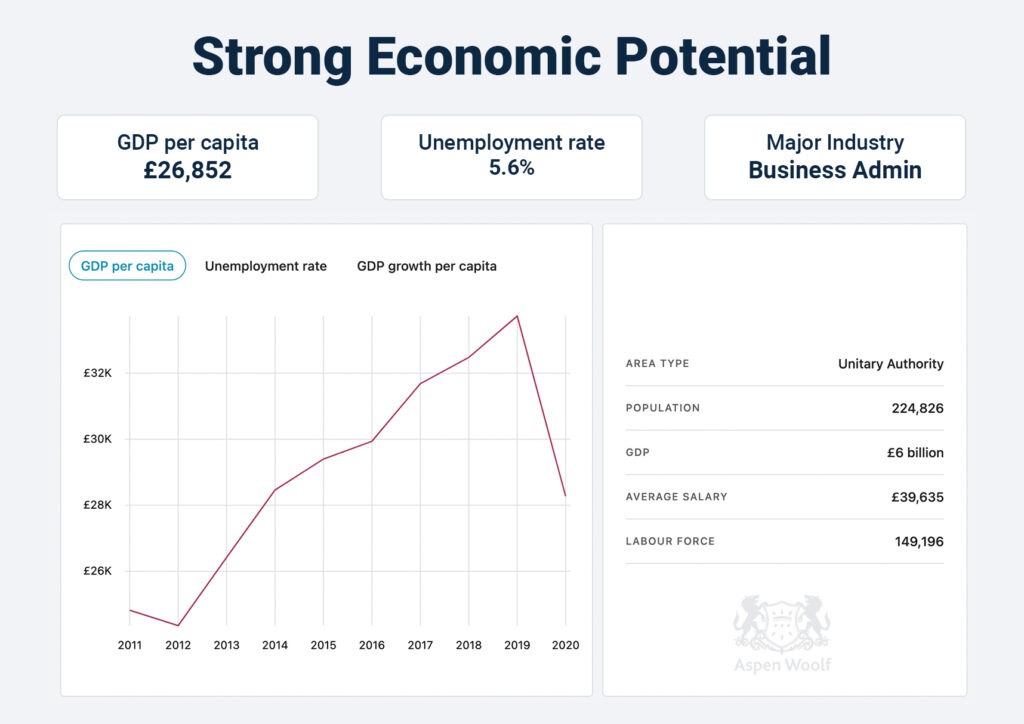

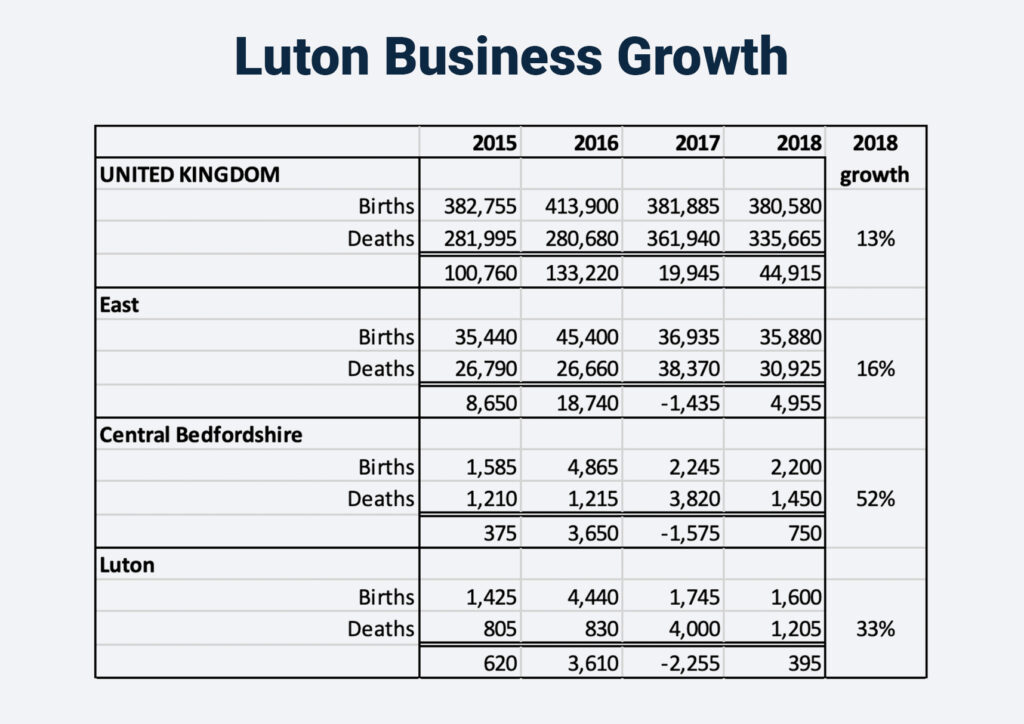

1. Strong Economic Potential

Luton sits at the heart of the Golden Triangle, formed by London and the university cities of Oxford and Cambridge. The town is ideally located to support impressive economic growth across a range of sectors like digital technology, sustainability, research and finance.

In 2016, Luton launched the Luton Investment Framework (LIF), a 20-year plan for the town’s transformation. So far, the LIF has secured a total of £4.5 billion for the local economy, improving the town by creating sustainable growth and making Luton a vibrant place to work and live.

The LIF alongside a number of other regeneration projects is already transforming the town. Examples of developments completed or underway include:

- London Luton Airport – A redevelopment of £160m, set to create 10,000 jobs by 2030.

- LU20N – An award-winning scheme set to add 785 homes and 50,000 sq. ft. of retail space and with rental yield projections of up to 5%. The first phase was completed in November 2021.

- Luton DART (Direct Air-Rail Transit): Completed in 2022, this £225 million mass transit system connects Luton Airport with Luton Airport Parkway railway station.

- The Hat District – Restoring Luton’s former hat factories to create an iconic workspace in the Luton area. The space encourages the growth of businesses and attracts artists, entrepreneurs and starts-ups to the town.

- Luton Town Football Club – The planned New Power Court Stadium is set to have 17,500 seats with the club due to move in by 2024. The stadium will be part of a larger regeneration of the Power Court site that includes new residential apartments, a hotel, retail space, and bars and restaurants.

Luton has an extensive catchment area, with 23 million people based within 2 hours. With its proximity to the capital, Luton is fast becoming a business hub for enterprises in a variety of fields.

With house prices at a fraction of the cost of capital, while still being a 23-minute train ride to central London, investment property Luton is an attractive destination for a wide range of investors.

2. Strategic Location and Great for Business

Capitalising on the opportunity and growing popularity with commuters, over the years a number of business and technology hubs have sprung up in Luton:

- Butterfield Technology Park is an 85-acre parkland and the site of business and technology companies. The Park is set for further expansion, with construction starting on site for a new £20m industrial and office building due for completion in 2023.

- Capability Green is an established business park. Situated near Luton Airport, it offers great air, rail and road connectivity making it an attractive option for companies looking to establish a presence in the south of England.

Synonymous with vehicle manufacturing and high-precision engineering, many British and international firms in high-technology sectors including engineering, defence, pharmaceuticals and automotive call Luton home. Some of the companies with a major presence in Luton include:

- EasyJet

- First Choice

- LaPorte

- Monarch Airlines

- TUI Travel

- Yates’s

Luton is a pioneer in aviation-related tech and industry. London Luton Airport is one of the UK’s fastest-growing airports and one of Europe’s top five private aviation centres. A number of high-value aviation-focused tech, supply chain and engineering companies are making new markets for growth and sustainable supply chain investment.

With businesses and growth comes robust property prices, and as Luton continues to appeal to a wide range of enterprises, Luton property investment remains appealing.

3. An In-Demand Housing Market

How does buying a house in Luton rank in terms of a property investment destination? In recent years, Luton ranked as one of the most sought-after areas of the UK for buy-to-let investors and first-time buyers.

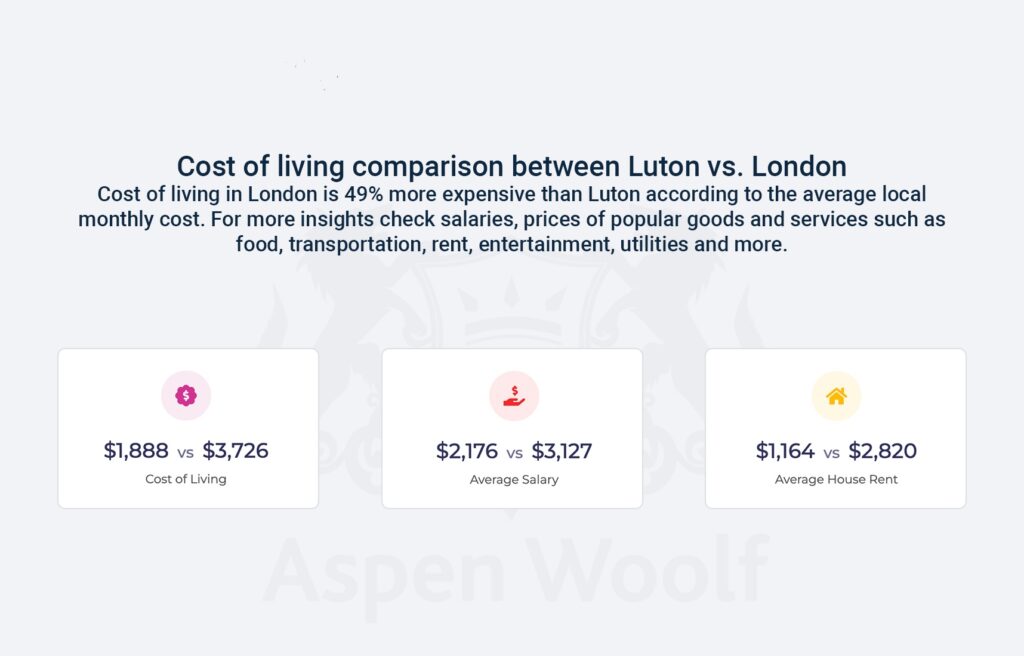

Is Luton cheaper than London?

With London’s sky-high property prices, many first-time buyers are looking further afield. Luton regularly ranks within the top 5 commuter towns for Londoners. With a 26-minute journey into St Pancras International Station, Luton is one of the easiest and cheapest commuter towns.

In 2022, the average house price Luton sat at £297,251, compared to London’s average of £523,666. According to research conducted by Lloyd’s Bank, professionals working in Central London can save close to half a million pounds by commuting up to an hour each day from commuter towns instead of renting homes in London. Luton offers one of the cheapest commutes with trains costing £11.20 with an annual railcard.

In the year prior to January 2023, Luton properties grew in value by 11.3% . Over the same period, the average sale price of property in Luton rose by £29,000. In 2022, first-time buyers in Luton spent £254,000 on their property on average, an increase of £26,000 compared to a year prior.

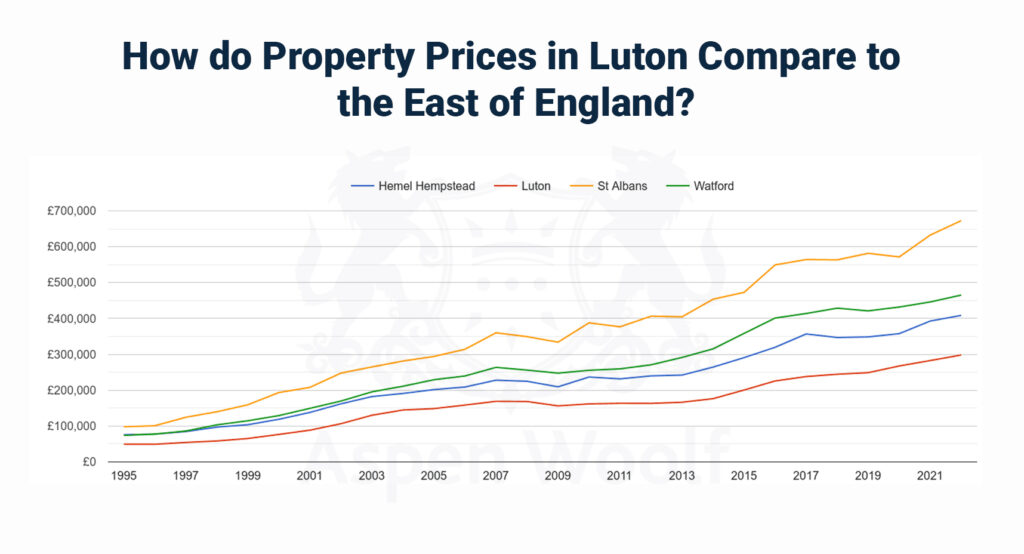

How do Property Prices in Luton Compare to the East of England?

Compared to the average price of a property in the East of England, which is £365,000 (November 2022), buyers in Luton paid 20.5% less for their property. The most expensive properties in the East of England were in St Albans, with an average price of £620,000, more than twice that of Luton.

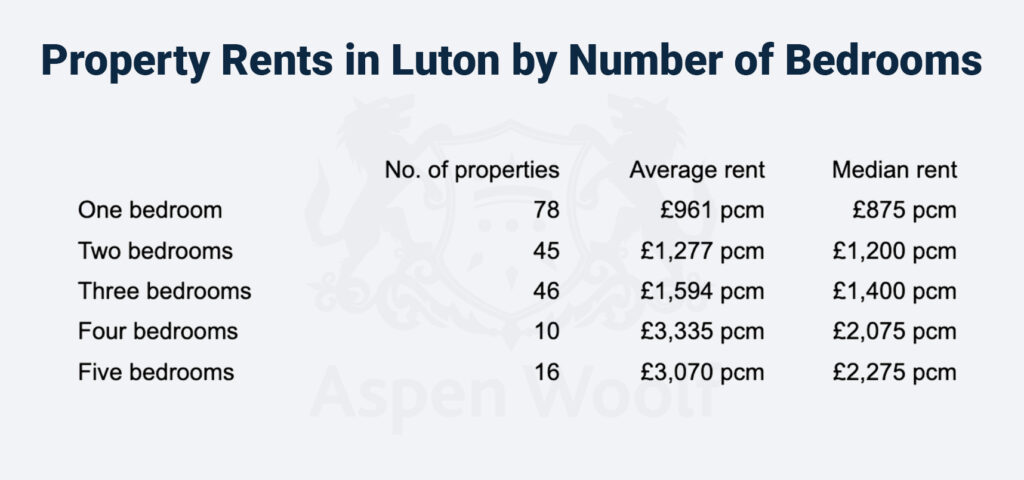

4. Rental Demand for property in Luton is on the Rise

Another appealing aspect of investment property Luton is the fact that the town is experiencing a housing shortage. Post-pandemic many landlords sold their rental properties to cash in on sky-high property rates, this has left the town with a housing shortage pushing up rents. According to Home, average property rents in Luton are £1,449 per calendar month.

5. A Steady Student Rental Market

Home to the University of Bedfordshire, Luton’s student rental market presents property investors with the potential for strong returns. The student population includes around 20,000 students from over 100 countries.

The university is feeling the benefit of the town’s wider regeneration. The academic institution received £46 million investment in a state-of-the-art library and a £37 million STEM building which opened in 2019.

Luton currently suffers from a student accommodation gap, and students are increasingly seeking quality private accommodation that can meet their needs. Luton’s student demographic makes investing in student rental property an appealing prospect.

6. Inbound Investment Makes Luton Increasingly Attractive

Over the past decade, Luton has undergone a transformation and external investment continues to provide a boost to the town.

The town’s Cultural Quarter, located near the main railway station, was improved through a £3.9 million upgrade creating studios, art venues and theatre space. A 70-acre commercial area, New Century Park, is set to deliver 4,000 jobs and in Marsh Farm, a £25 million shopping centre is in the pipeline alongside regeneration work underway at the former Vauxhall car plant. Bartlett square is another development set to bring in 2,000 jobs while across the town mixed-use development schemes have been given the green light.

Is Luton Developing?

Investment in infrastructure projects continues to support Luton’s development. The town has attracted over £20 million of Levelling Up investment. Prior to the pandemic, the town’s economy was worth £6.3 billion per year and the town is investing in key sectors. These include aviation and transport as well as emerging sectors like the green economy and digital and creative industries.

The Luton 2023 – 2040 vision sets out a plan for sustainable growth to create 12,000 new jobs and an additional £1.6 billion of economic activity per year, while simultaneously making Luton a hub for green technology, research and finance. By 2028, new major developments will include the competition of Power Court Stadium, The Stage and Hat Gardens.

7. Luton’s Strategic Location

Just off the M1, close to the M25 and 30 miles from London, Luton boasts great transport links. With its proximity to London and the South-East, Luton offers proximity to the capital with the advantages of more affordable living costs.

London Luton Airport is one of the town’s best assets, connecting passengers and businesses to Europe and further afield. To leverage its potential, airport expansion plans recently saw the annual number of passengers increase from 10 million to 18 million.

Which Areas of Luton Should Property Investors Consider?

Life in Luton means easy access to the best that London has to offer. The best but without the high housing price tag. But which areas of Luton should property investors pay most attention to?

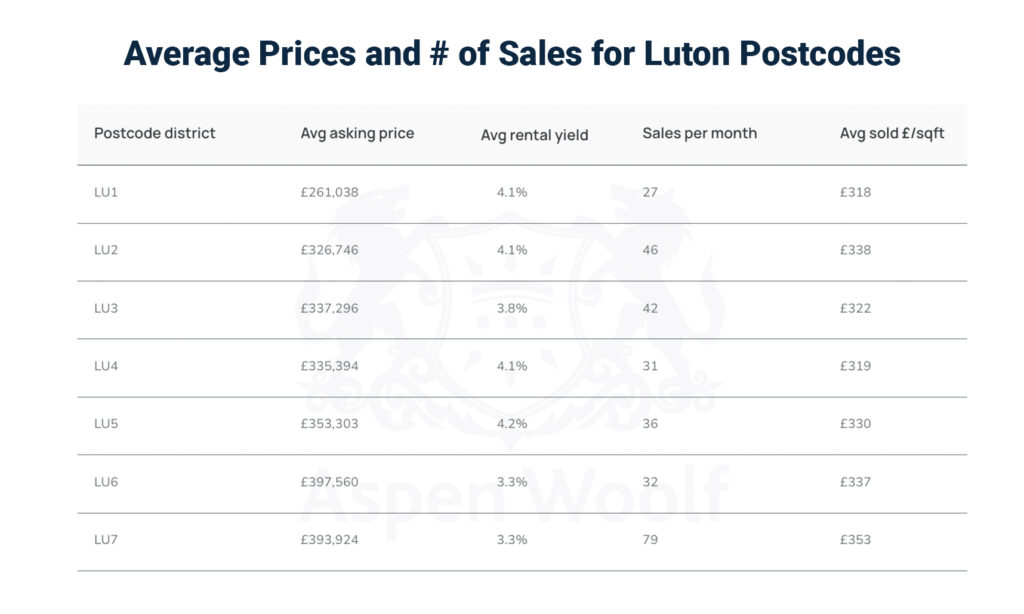

Central Luton

LU1 is a key area for property investors and in the last year properties in the area had an average price of £295,601 – 7% down on the previous year and 2% down on the 2020 peak of £302,512.

There are plenty of new builds in Luton town centre, which also boasts superb transport links, with the capital just 24 minutes away and national rail connections to Leeds, Sheffield and a direct service to Gatwick and Brighton.

LU1 is also home to the University of Bedfordshire and presents investors with opportunities to target the student rental market. Shared student properties featuring a garden are in high demand from students.

LU2

Properties in Luton area LU2 had an overall average price of £332,679 over the last year – 7% up on the previous year. LU2 is the site of Luton Airport, one of the area’s main employers. London Luton Airport is one of the capital’s five main airports. It is also the UK’s fifth busiest serving destinations across the UK and Europe.

Properties in LU3

North Luton is a green and leafy area of the town including Lower Sundon, Streatley and Sundon. Housing tends to be semi-detached from the 1920s and 1930s, making the area ideal for families. Properties in LU3 had an overall average price of £315,532 in the last year – 9% up compared to one year previously.

Properties in LU4

Luton’s LU4 area covers the west of the town, including Chalton and London Farm. The area is home to a number of listed buildings and borders the M1. Properties in LU4 had an overall average price of £301,926 over the last year – 10% up on the previous year.

Is Luton a Good Place to Invest?

Investing in property in Luton means capitalising on the opportunities of a commuter town. With effortless connections to London and property prices of around half of those in the capital, it’s not hard to see why Luton remains a popular place for a wide range of investors and buyers.

According to Aldermore’s buy-to-let city tracker, properties in Luton offer the best return for long-term investment, with house price growth over the past decade coming to more than 5.7% Luton takes the second spot with 5.9 percent average annual increase in house prices in the last 10 years, with Southend taking the top position and Bristol coming in third.

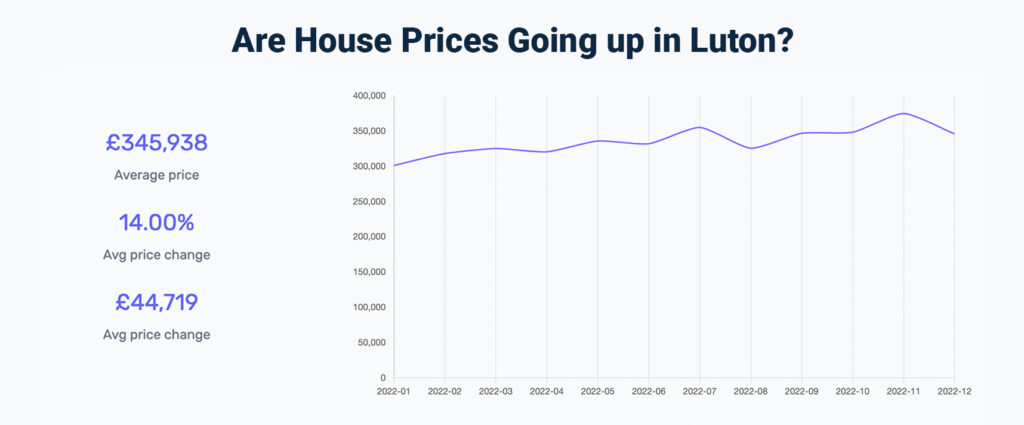

Are House Prices Going up in Luton?

In November 2022, house prices in Luton took a slight dip of 0.4%. However this dip does not reverse the longer-term trend which has seen property prices grow by over 11% in the past year.

Property house price trends in Luton align with trends across the UK. Which saw house prices fall 0.6% in January 2023. Savills expects house values to further fall in 2023 due to restraints on affordability. Generally speaking, the property market in Luton is slowing. This means it is becoming more favourable for buyers as rates stabilise following a bumpy year in 2022.

__________________________________________________________

Luton is a popular commuter town and popular with property investors due to its proximity to London and regeneration and investment that is making the town a more attractive place to live. To find out more about investment property Luton opportunities and where to buy, get in touch with us today.