10 Reasons to Consider Property Investment in Leeds and Where to Buy

Let’s find out more about what makes property investment in Leeds so irresistible to property investors.

A thriving cosmopolitan city with strong economic growth and an increasing population. These factors only scratch the surface of what Leeds can offer.

Already a city of choice for businesses, students and young professionals. As well as current and future investment projects which are set to further transform this ambitious city. And additionally, increase its economic potential and livability.

A great place to live, work and play with affordable housing and high rental yields. There’s never been a better time to invest in property in Leeds.

1. A Solid Economy

The largest city region economy outside of London, Leeds is set to add £1.5bn to its economy by 2026 (compared with 2022). The city’s Gross Value Added (GVA) – the value of goods and services provided in the area – is expected to grow by 2.1% per year on average over the course of 2024 to 2026.

Economic growth often leads to an increase in population and job opportunities. Which in turn creates a greater demand for housing.

Despite the current economically challenging period, employment growth in Leeds is expected to be 1.4% per year on average from 2024 to 2026 – faster than both the national (1.3%) and regional (1.1%) rates.

2. A Large Population

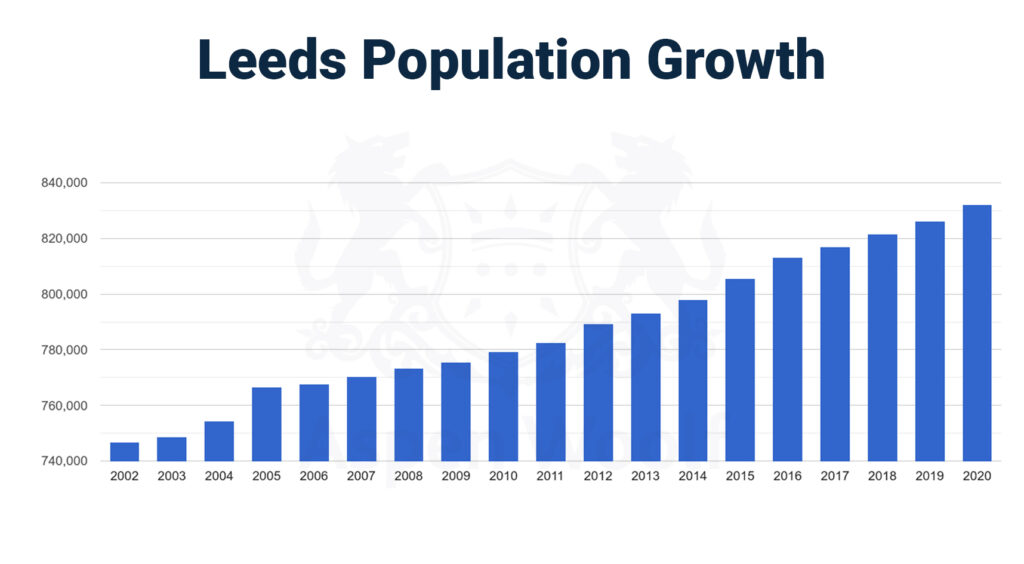

Leeds’ population growth also signals strong property investment potential.

The city’s population size has increased by 8.1%, from around 751,500 in 2011 to 812,000 in 2021 (based on the most up-to-date Census data). The city has a population of 7 million within an hour’s drive, and more people aged under 20 than any other area of the North.

A skilled workforce of 1.4 million people signals strong rental opportunities for investors looking to invest in buy to let in Leeds.

3. Leeds Leading the Way Within the Northern Powerhouse

The Northern Powerhouse Initiative is the UK Government’s strategy to improve economic prospects in Northern cities and also includes Liverpool, Newcastle, Hull, Sheffield and Manchester.

With an ambition for the North of England to be a dynamic counterweight to London and the South-East economy, Leeds is set to thrive in the decades ahead as further regeneration work and investment projects get underway, attracting more businesses to the area.

Over the last decade, large-scale regeneration work has transformed Leeds. Development projects have acted as a catalyst for economic growth, helping property investment in Leeds gain ground amongst buy-to-let investors.

Recent projects include:

South Bank Regeneration:

This £500 million project is set to create thousands of jobs. As well as offer housing options, commercial space and enhance transportation and leisure facilities.

Transpennine Route Upgrade:

The Transpennine Route Upgrade is set to leave a lasting and profound impact on the North. Spanning a distance of 76 miles, this route connects York to Manchester, with key stops at Leeds and Huddersfield among its 23 stations.

Two new rail stations are also planned, one at White Rose and the other at Thorpe Park opening in 2023 and 2024, respectively. The first represents a £22 million investment in the city.

2 Springwell Gardens:

Upon completion, the tower will become Yorkshire’s tallest building. Rising to a height of 142 metres, the 46-storey skyscraper will feature 301 square metres of ground-floor retail and leisure space, along with 604 one and two-bedroom flats.

Considered the Capital of the North, Leeds is a vibrant UK city. And plenty of regeneration and investment has put it on the map with property investors in recent years.

So far, you have been able to find out about the opportunities and benefits of investing in properties in Leeds.

If this has caught your attention and you are considering buying a property in Leeds, take a look at what Award-Winning Agency has prepared for you, with a special focus on Sky Gardens, a new high-specification residential development set to become a new icon on the Leeds city skyline.

4. Leeds Offers Business Opportunities

Leeds’ status as one of the UK’s biggest business cities also makes it one of the most attractive ones. Most importantly for property investment. It has a stable employment base thanks to a regional economy powered by some 80,000 businesses and a skilled workforce of 1.4 million people.

A number of big-name businesses have their headquarters in Leeds, including:

- Asda

- Accenture

- Appen

- Jet2

- Tetley’s Brewery

- The Yorkshire Bank

- The Leeds Studios, operated by Yorkshire Television

- Sky Betting & Gaming

- NHS Digital and NHS England

Recently, The Bank of England announced plans to open a new northern hub in Leeds, adding to the growing list of companies that call the city home.

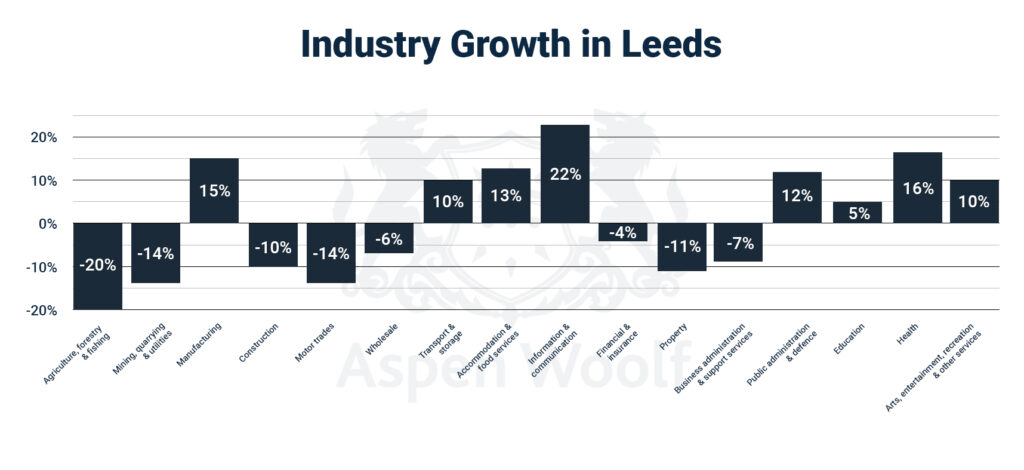

A professional services hotspot, Leeds is a global leader in high-value sectors such as technology, healthcare and manufacturing. It also holds the title as the UK’s second-largest financial services sector and was coined The Financial Centre for Excellence by UK Trade & Investment.

Leeds is also making a name for itself as one of the UK’s top creative cities with a growing media industry. Versa Leeds Studios in Holbeck is a world-class production facility putting Leeds at the forefront of the UK’s film and TV economy.

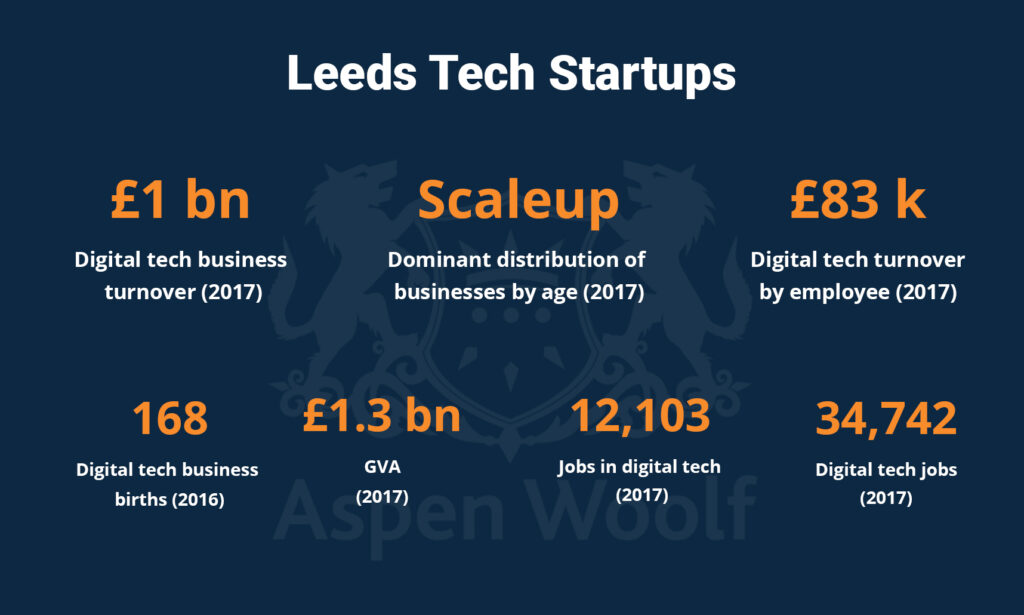

5. A Tech and Startup Hub

With a growing combination of startups and established corporations, Leeds is one of the fastest-growing tech hubs in the UK. With a thriving tech sector worth £1 billion, Leeds is hailed as the UK’s “Digital Capital of the North”.

The region’s digital and creative strengths, in addition to affordable living, make Leeds a compelling alternative to London for entrepreneurs looking to start up and scale their businesses.

Leeds currently holds the crown for the highest concentration of scale-ups outside London and is home to the fastest scale-up growth in the North. The city’s startups attracted £288 million in venture capital investment in 2022– 88% up on the £153 million in 2021 and 585% up on the £42 million raised in 2020.

A place where new and ambitious companies can thrive, a supportive ecosystem of coworking spaces, innovation hubs and incubators are springing up to help the city’s startup and scale up scene go from strength to strength.

For investors seeking property investment Leeds, there are plenty of opportunities to buy apartments and houses with high rental income potential.

6. A Strong Property Market

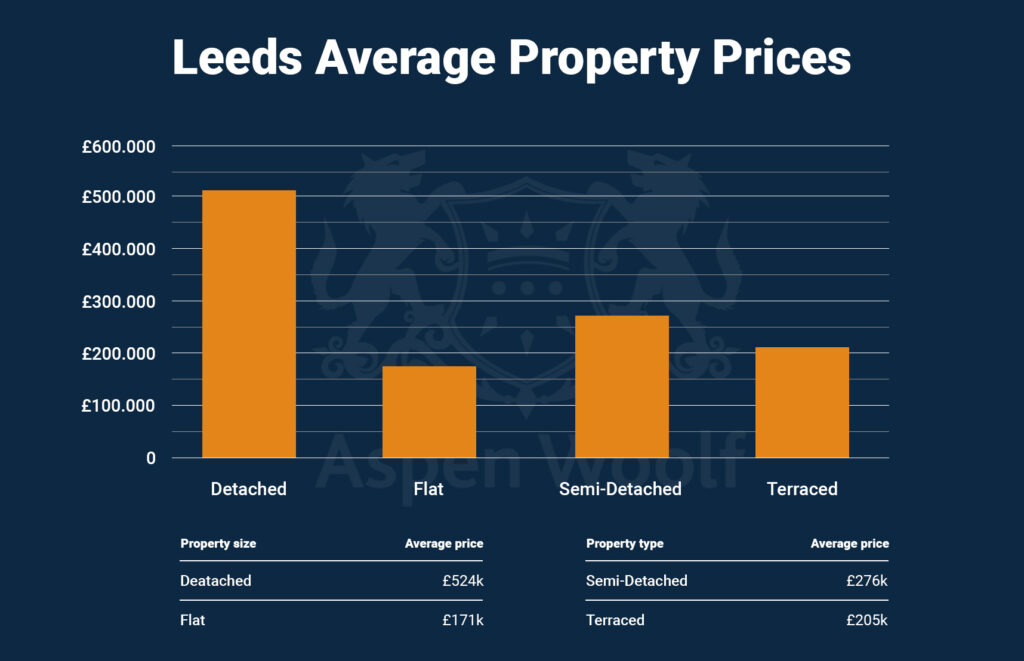

With a growing population and economy, the Leeds property market has grown to become an exciting destination for investors. The average price of a property in Leeds is currently £266,917.

According to JLL, house prices in Leeds have risen 19.2% in the three years since December 2019. In 2022, Leeds recorded the highest annual growth in new build prices of out the UK’s cities (compared with London, Manchester, Bristol, Birmingham, Edinburgh and Glasgow).

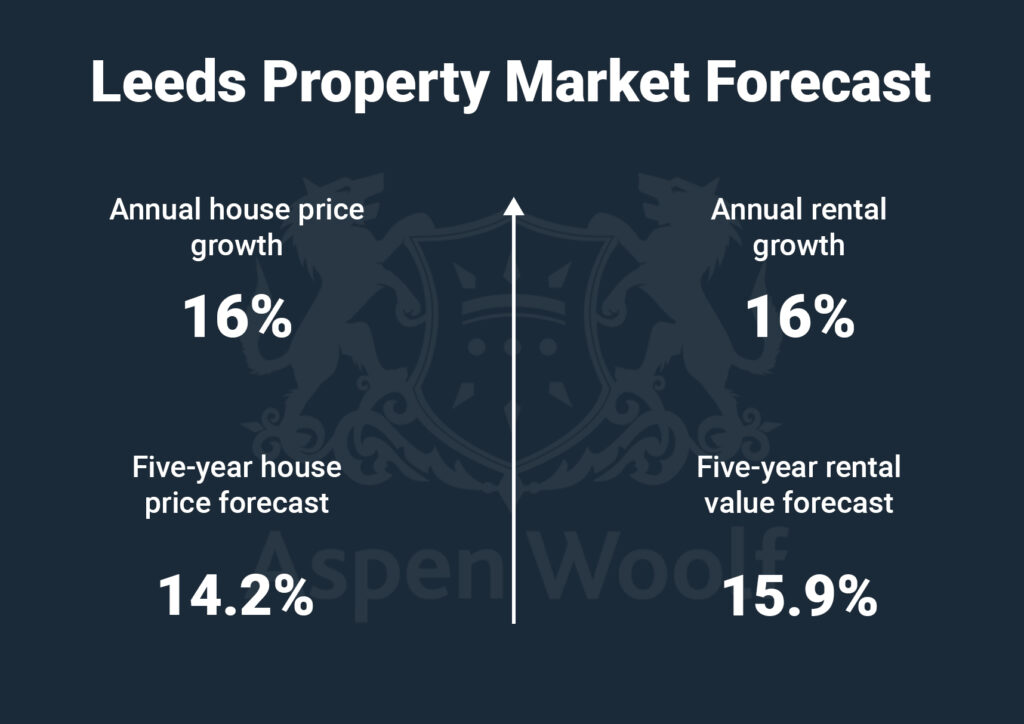

Prices for new prime property in Leeds averaged £200,000 for a one bedroom flat, £320,000 for a two bed and £540,000 for a three bed. JLL’s five-year predicted house price growth for Leeds between 2023 – 2027 is 14.2%.

7. Attractive Rental Growth

Leeds witnessed a remarkable 16% increase in rents throughout 2022. This was fueled by a resurgence of tenants flocking back to the city. The demand consistently outpaced the available housing stock, contributing to this upward trend. Notably, one-bedroom flats experienced the highest annual growth, soaring by an impressive 26%, according to the JLL Cities Index.

As of December 2022, the average monthly rent for a one-bedroom flat in Leeds climbed to £850, while two-bedroom flats commanded £1,250 per month, and three-bedroom flats reached £1,850 per month. These figures reflect the robust rental market in the city, demonstrating the steady rise in rental prices.

Looking at Leeds as a whole, according to Landlord Today, the average house price in Leeds last year was £246,876, a 14.9% increase from 2021. The average rent in Leeds has increased by 13.6% to £795 per month. These figures translate to an estimated gross rental yield of approximately 3.9 %, highlighting the attractiveness of the rental market in Leeds for property investors.

Rental prices have increased significantly more than house prices and some areas of Leeds are seeing much stronger growth. In the LS2 area, yields currently average an impressive 10.5% and 9.18% in the LS4 district. Looking ahead, Leeds rental value forecast for 2023 -2027 shows a 15.9% growth in the rental market.

8. Rising Demand for Student Accommodation

The Leeds City Region hosts the largest cluster of higher education institutions outside London and each year its nine universities produce 39,000 skilled graduates.

The University of Leeds alone welcomes over 9,000 international students from more than 170 countries worldwide, and the number of students in the city continues to grow each year.

The popularity of Leeds as a student city is good news for buy-to-let property investors. With a high proportion of students looking for places to rent during their studies, investing in student accommodation is a worthwhile avenue.

Lack of available rental properties and increasing student numbers have led to an increase in rental costs for students. In Leeds, the average cost of a room in the private market is now £125 a week per person, an increase of nearly 8% in the last year. In Leeds generally, rent is up 10.4% from £104 a week to £115 a week.

With great employment opportunities thanks to the area’s growing economy, many graduate students choose to stay in Leeds after university. This thriving young professional scene increases rental demand and makes purchasing buy-to-let properties in Leeds a lucrative option.

9. An Attractive Lifestyle Destination

Another factor making Leeds one of the best UK cities for property investment is its attractive lifestyle offering.

As well as one of the UK’s most economically strong cities, Leeds has something for everyone and has its sights set on becoming the Best City in the UK by 2030.

Those investing in property in Leeds are greeted with top-class museums, a thriving music scene, plenty of retail options, vibrant nightlife and a strong gastronomic offering thanks to diverse bars and restaurants.

The city itself is the gateway to the wider Yorkshire region, meaning the countryside is never far away. There are plenty of historical sites to discover, from Fountains Abbey to the Yorkshire Dales – one of the highest-rated national parks in the world.

10. An Advantageous Location in the North

Leeds’ central location means residents are never far from other UK cities:

- A high-speed train service puts London only 2 hours away.

- Leeds-Bradford Airport flies to Heathrow five times a day – with flights taking under an hour – and beyond to key European cities.

- Excellent road connections such as the M62 and M1 mean easy access to the east and west coasts of Northern England and London, respectively.

- Looking ahead, the city’s Local Growth Deal with the UK Government will help fund transport projects designed to improve connectivity across the region and make even easier connections across the UK.

With strong cultural offerings, an excellent standard of living and affordability, and being well-connected by air, road and rail, Leeds has a strong live and work appeal. High demand for quality homes and apartments presents plenty of opportunities for property investment in Leeds.

Which Areas in Leeds Are Best for Property Investment?

Whether you’re looking for a buy-to-let property in Leeds or a home for yourself, there are a number of factors to take into consideration. Such as local amenities, transport links, price growth, rental value and yields.

Here are some areas to consider for Leeds property investment:

Leeds City Centre

A prime location, buying an investment property in Leeds City Centre puts you in the heart of the action. Having undergone significant regeneration over the years, the centre boasts all the amenities. As well as transport links and convenience you’d expect from a top European city.

The city centre is popular with young professionals and students, making it one of the best areas to invest in a buy-to-let property.

The majority of property sales in Leeds City Centre during the last year were flats, selling for an average price of £172,135, with prices up 9% on the previous year.

Meanwood Leeds

An up-and-coming area on the northern fringe of the city, Meanwood is a bustling suburb that still retains a local village feel.

A great option for property investors in Leeds, Meanwood has undergone gentrification and modernisation and boasts great transport links into the city with easy access to the outer ring road. Local amenities include plenty of green space, eateries, shops and bars, as well as schools, making it a great option for families.

The majority of sales in Meanwood during the last year were semi-detached properties, selling for an average price of £275,050, up 7% on the previous year.

Headingley

Neighbouring Meanwood, Headingley is just two miles from Leeds City Centre and has long been a popular area for student accommodation.

Hosting a plethora of restaurants, bars and shops, this self-contained suburb is also a popular rental area for young professionals looking for city-centre amenities a little further back from the hustle and bustle.

One of the best-served areas by public transport, getting to the city and back is easy by road or rail, making Headingley an advantageous location for an investment property in Leeds.

The majority of sales in Headingley during the last year were semi-detached properties, selling for an average price of £282,006 over the last year. Flats sold for an average of £177,597.

Woodhouse, Burley and Hyde Park

Sandwiched between the city centre and Headingley, the neighbouring areas of Woodhouse, Burley and Hyde Park are becoming hugely popular with students thanks to their central location.

All these areas are close to Leeds’ main universities with good transport links and plenty of eateries and amenities like supermarkets, making them ideal locations for a student investment property.

The main campus of Leeds University is less than a mile from Burley and Hyde Park is a stone’s throw from Leeds Met as well as the University of Leeds.

Woodhouse is home to a large park and a restaurant and pub scene that makes it attractive for graduates staying in the city.

Over the past year, the average house prices in these areas were as follows:

Woodhouse £251,197

Burley £207,400

Hyde Park £225,031

Armley, Hunslet and Beeston

Located south of the city centre, Armley, Hunslet and Beeston have some of the lowest property prices in Leeds.

Proximity to Leeds City Centre and new residential developments are making these areas ones to watch. That is to say, from a property investment perspective. And additionally, each boasts strong transport links. Improvement plans, such as the redevelopment of Armley’s high street, mean buying property in these areas could be a great investment for the future.

Over the past year, the average house prices in these areas were as follows:

Armley: £163,378

Hunslet: £147,825

Beeston: £141,830

Roundhay, Moortown, Alwoodley, Adel and Horsforth

These suburbs in the north of Leeds are popular with families. Easy access to the city centre and plenty of good schools put these affluent residential areas as the city’s most expensive in terms of Leeds property prices.

Roundhay is known for its park, which hosts popular local events. Alwoodley is home to the Eccup Reservoir and two golf courses, and, alongside Moortown, is home to some of the most appealing properties in Leeds thanks to their stunning architecture.

Adel is popular with families and young professionals, thanks to great pubs and parks and schools. Horsforth is one of the most popular locations in Leeds. This is due to convenient commuter networks to the city centre, York and beyond.

Over the past year, The average price of Leeds investment property in the areas was as follows:

Is Leeds a Good Place to Invest in Property?

Leeds is a vibrant city with a strong economy and job opportunities which positively impact property demand and rental yields. The city’s regeneration projects, infrastructure developments and growing student population create a strong rental market. Especially near its renowned universities, offering plenty of opportunities to capitalise on the buy to let market.

Compared to cities like London or Manchester, Leeds offers relatively affordable property prices. This is therefore making it an attractive option for investors seeking a lower entry point.

What are the Predictions for Leeds House Prices?

Between 2023-2027, JLL predicts annual house price growth in Leeds could reach 14.2% and see 15.9% rental growth. Leeds is predicted to have the highest annual growth in 2023. Namely a growth of 16% in both house price growth and the rental market.

What is the Problem with Housing in Leeds?

In Leeds, the supply of housing has struggled to keep up with demand. Consequently, this is contributing to a shortage of available housing options. This has additionally led to increased competition. Particularly in the rental market, which has led to rapidly rising rents – a pattern seen throughout the UK.

____________________________________________________________________________________________

Conclusion

Leeds is a city with strong economic potential, exciting future investment and regeneration projects and a strong rental market supported by a growing student population and influx of young professionals. There’s no denying now is a great time to make property investment in Leeds. If you’re looking to buy property in Leeds, get in touch. We’ll help you find the ideal property and location.