8 Reasons to Invest in Property in Bristol and Where to Buy

Welcome to Bristol, a thriving economic powerhouse and one of the UK’s most desirable living destinations. Offering an excellent quality of life, plenty to do both near and far and a thriving business and tech scene, find out why property in Bristol is a great option for investors.

While property prices are steep, those who can afford it can expect to capitalise on some of the highest demand for a rental property in the country. Particularly from the city’s incoming stream of students and young professionals.

Bristol should become the third-strongest market in terms of house price growth in the UK in the coming years, so now is a great time to get in while you can.

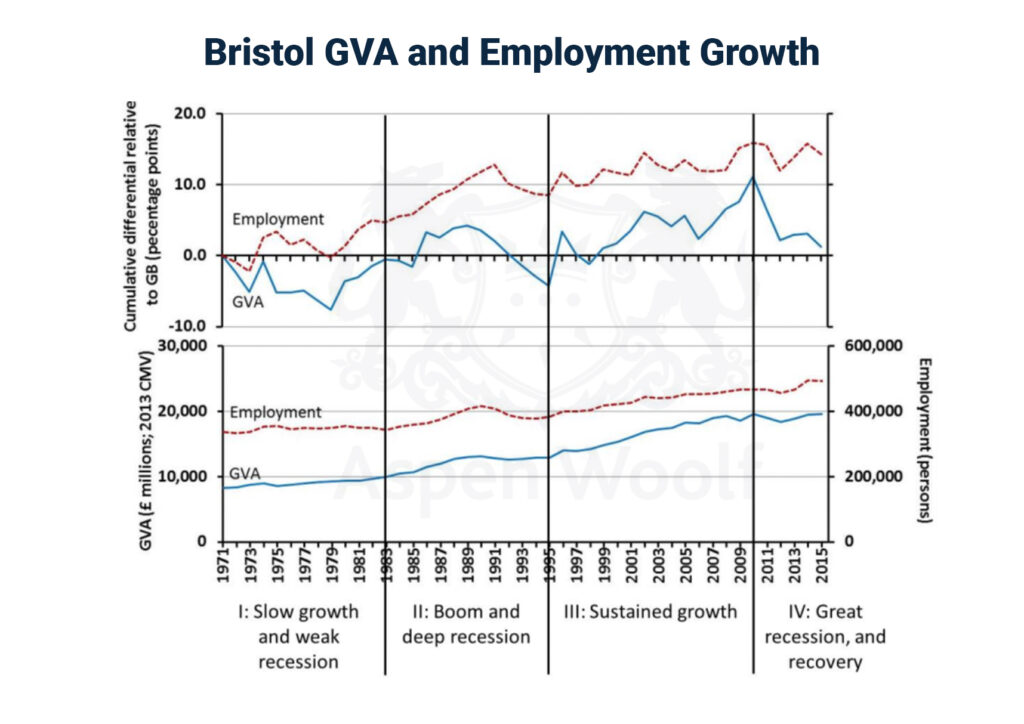

Bristol’s Economy is Still Thriving

It’s no understatement that Bristol is one of the UK’s economic powerhouse cities. Ernst & Young has forecast the Bristol-Bath economy to be 9% larger in 2025 than it was in 2019. This would give the South West the second-largest increase among English regions, behind the East Midlands (9.5%) and London (8.9%).

The city’s highly talented workforce plays a role in driving its economic success. With four world-class universities in the religion, the Bristol-Bath area has the highest proportion of well-educated citizens in the UK and the most skilled workforce of any English core city.

With access to a talented workforce of 42 million people within the 150 miles catchment area, businesses flocking to Bristol know it’s a smart idea. It’s not surprising, then, that over 80,000 jobs should become available between 2016 – 2036 in Bristol and its surrounding area.

With job opportunities and economic growth come an influx of people and an increase in demand for rental properties, property investment in Bristol continues to remain appealing.

Bristol is Home to Diverse Businesses and Industries

Bristol is home to a thriving professional services sector and is a global leader in technology and engineering. Recent years have seen a number of firms open offices, headquarters or announce their intention to increase their presence in the city.

Big players in the engineering and technology scene, include:

- Airbus

- Rolls-Royce,

- Ovo Energy and

- Aardman Animation Studio

The city is rapidly transforming and investing in its infrastructure to support the development of these high-worth industries.

On the financial and professional services side, financial firm Hargreaves Lansdown employs around 1,185 staff in Bristol. Computershare has its UK HQ in Bristol and car leasing firm ALD Automotive has its headquarters at Emersons Green.

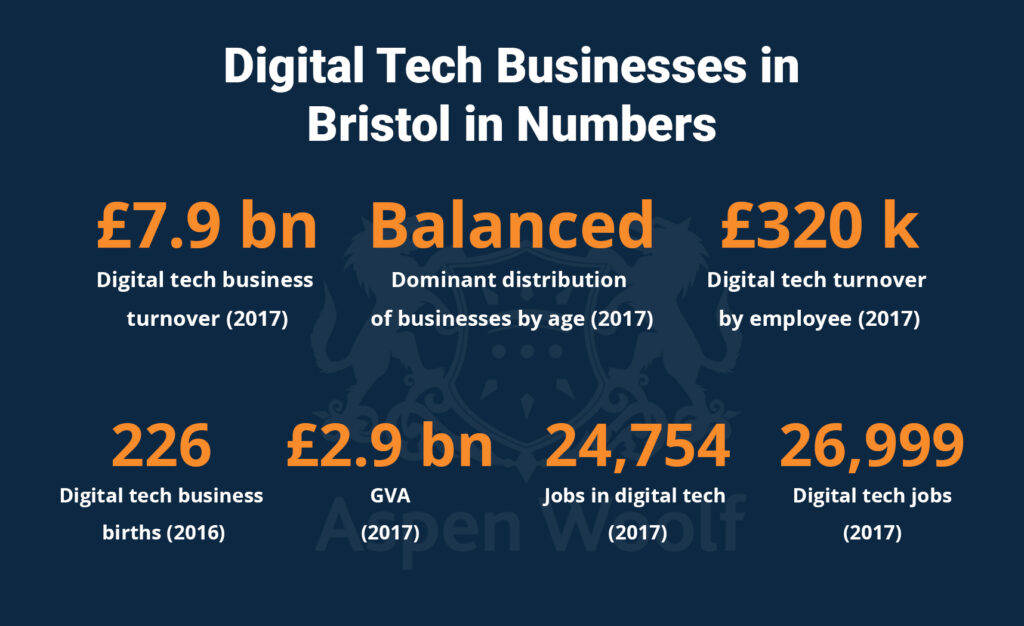

Bristol is a Popular Startup and Tech Hub

Bristol already has a strong heritage for creative industries such as film making. And it is becoming increasingly attractive to startups and entrepreneurs, too.

Bristol startups have a survival rate of 60.6% – one of the highest in the country. Part of their success is down to the steady stream of top talent coming from the area’s world-class education institutions. Thanks to the city’s work-life balance, lifestyle appeal and cultural offering, students tend to stay in the city after graduation giving businesses access to a lot of brainpower.

Another reason for Bristol’s startup success is its supportive infrastructure. The Temple Quarter local enterprise zone, for example, is home to a cluster of tech businesses and startup incubators, including SETsquared and WebStart Bristol, alongside accelerators and access to Angel investors looking to back scaleups.

In 2021, the city attracted more than £100m in venture capital funding. Bristol has been named one of the UK’s fastest-growing tech hubs and has the highest number of tech job opportunities outside London.

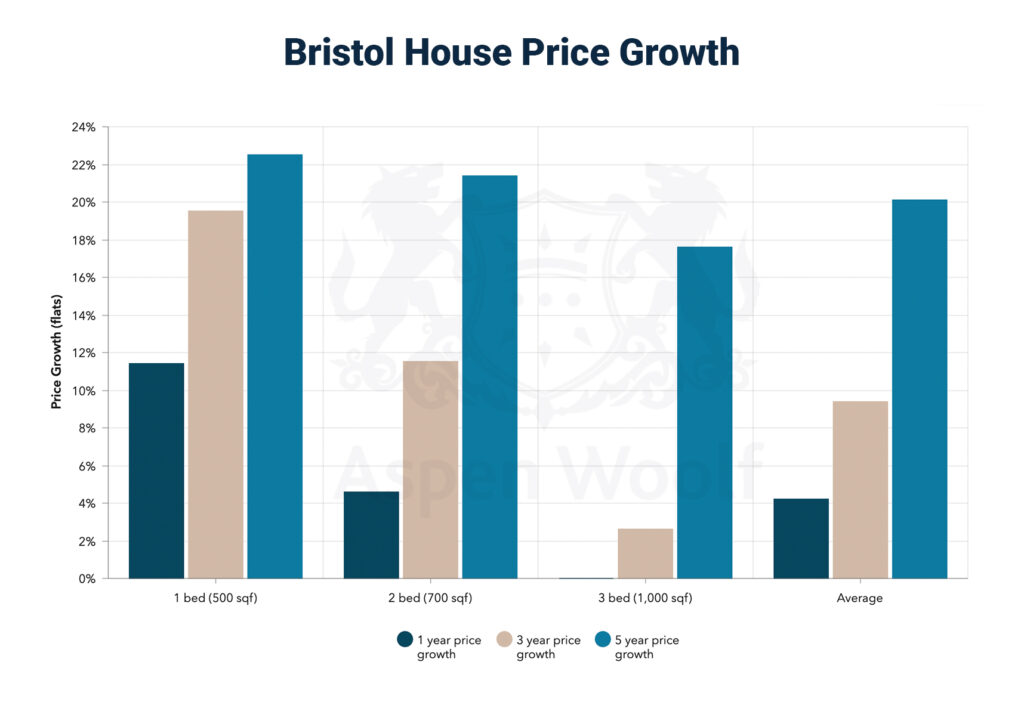

Bristol Housing Market: In Full Bloom

With its strong economic growth, attractive lifestyle offerings and thriving business scene, Bristol is one of the most attractive places in the UK for property buyers.

Average asking prices in Bristol increased 60% over the past decade and homeowners in Bristol’s Easton area have experienced the UK’s biggest increase in house prices in the last 10 years – up 120%.

JLL states that new build prices in Bristol have risen 20% in the last five years. At the end of 2022, average prices for a one bed flat in the city were £245,000, £340,000 for a two bed and £400,000 for a three bed flat.

Looking ahead, Bristol is forecast to experience house price growth of 17% between 2023- 2025. If you’re looking to purchase an investment property in the area, it might be better to invest sooner rather than later.

Properties in Southville had an overall average price of £427,498 over the last year. The majority of sales in Southville were terraced properties, selling for an average price of £500,635. Flats sold for an average of £269,868.

Take advantage of this Off Market Opportunity!

We are introducing you to an exciting new community perfectly positioned just outside the amazing city of Bristol.

We are introducing you to an exciting new community perfectly positioned just outside the amazing city of Bristol.

Don’t miss the exclusive 10% discount!

25 luxury one and two-bedroom apartments located close to Bristol city centre are provided just for you.

Want to know more about what off-market/off-plan properties are? Click here

High Demand for Rental Property

As the relatively high cost of buying a home continues to increase, so does rental demand. As people are priced out of buying a house, they turn to the rental market, creating a scarcity of rental accommodation as demand outstrips supply.

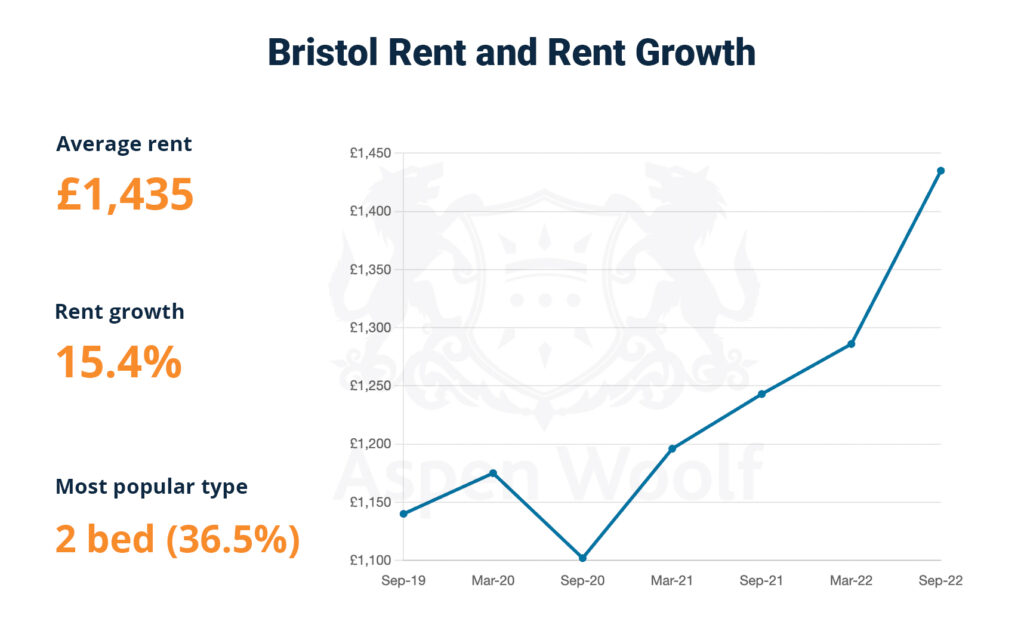

According to Money.co.uk, Bristol ranks joint top best location to purchase rental properties in the UK, alongside Leeds. Bristol recorded a 14.3% increase in average rent between 2021 – 2022. The average rental yield of a property in Bristol at 3.9%.

According to JLL, average rents for a new build one bed flat in the city in December 2022 were £1,250 per calendar month, £1,600 per calendar month for a two bed and £1,900 per calendar month for a three bed flat.

Regeneration and Investment Projects Transforming the City

Already one of the UK’s most thriving cities, Bristol City Council is investing in a number of development projects to build the necessary infrastructure to support the city’s growth. So far, £1 billion is earmarked for a range of projects.

Temple Quarter

Over the next 25 years, the Temple Quarter development is set to rejuvenate more than 130 hectares of underutilised land and transform them into vibrant mixed-use communities.

This ambitious regeneration project will result in the construction of 10,000 new homes and the creation of over 22,000 new jobs. As a result of this regeneration initiative, the city’s economy is anticipated to receive a boost of £1.6bn in annual income.

Western Harbour

The Western Harbour regeneration project is a £450 million urban rejuvenation scheme of the former Dockland. It includes plans to construct up to 2,500 new homes, with 40% of them designated as affordable housing. The development will also include new commercial space, community facilities and improved public transport links.

Bristol Arena

Bristol’s highly-anticipated YTL Arena will open in 2025. The arena, which is being constructed by converting the Brabazon Hangar at the former Filton Airfield, will host its inaugural event in late 2025 or early 2026.

With plenty of projects contributing to the city’s thriving development, purchasing a buy-to-let property in Bristol is likely to deliver strong returns for investors.

Bristol Universities Create Rental Demand

One of the most educated areas in the UK, Bristol’s status as a thriving university town contributes to its appeal and economic strength.

Home to a top 10 university with 3 other universities in the surrounding area (the University of the West of England Bristol, University of Bath and Bath Spa) this puts a large number of students in the catchment area.

While there are new student accommodation developments in the city centre, the estimation is that the city will need an extra 6,400 student beds by 2028. This creates plenty of opportunities in the property market Bristol.

Now is a great time for those interested in investing in student property to act as early as possible to reap the rewards, and an HMO investment in Bristol is likely to provide a steady stream of tenants.

Culturally Rich Quality of Life

On the lifestyle and quality of life front, in 2017, Bristol was voted the best place to live in the UK. Additionally it continues to offer a great food scene, community spirit and combination of lifestyle and cultural attractions.

The city’s waterfront area offers bars, shops, restaurants and Bristol is home to a number of historic attractions, including the world-famous Clifton Suspension Bridge, Bristol Cathedral, Clifton Observatory, as well as plenty of arts and cultural and festival events taking place throughout the year.

Further afield, Stonehenge, Bath, Salisbury, the Brecon Beacons in Wales, The Cotswolds and Devon are all just a day’s trip away, making Bristol convenient for exploring the surrounding area.

Which are the Best Areas to Invest in Property in Bristol?

When looking to purchase a buy-to-let property in Bristol, the city offers several highly profitable locations in the city. Average house prices in each area vary and buyers can find a diverse range of housing stock from flats to HMOs to large houses.

City Centre

Having undergone much regeneration, particularly around the harbourside, the city centre is becoming an attractive place to live for those that can afford it. Historic properties in the BS1 area can sell for a small fortune. And in addition, an increasing number of properties are being added to office and retail developments.

According to Rightmove, Properties in Bristol City Centre sold for an overall average price of £411,069 over the past year.

Clifton and Redland

To the west of Bristol’s city centre, Clifton has seen a number of houses converted into flats and houses of multiple occupancies (HMOs) in recent years. Along with Redland, the area is home to dedicated student accommodation and both are popular locations for investors looking to capitalise on the Bristol rental market targeting students.

The majority of sales in Clifton during the last year were flats, selling for an average price of £390,009. Sold prices in Clifton over the last year were 2% up on the previous year. As well as 14% up on the 2020 peak of £511,484.

Properties in Redland had an overall average price of £527,455 over the last year, up 11% on the previous year.

Easton

Homeowners in the Easton area, one of the more affordable areas in the city, have a current average asking price of £348,525, 8% up on the previous year and 19% up on the 2020 peak of £293,479.

An up-and-coming neighbourhood, the area boasts some of the best bars, restaurants, things to do as well as much of the city’s famous street art.

Southville

South of the river, this is one of Bristol’s most famous areas, known for its colourful terraced houses. Full of independent shops and vibrant street art, Southville has become one of the trendiest suburbs in south Bristol. And in addition, for better or worse, continues to undergo rapid gentrification.

Conclusion

Whether considering purchasing Bristol buy to let properties, student property, a flat in the city centre or one of the larger homes Bristol has to offer, now is a great time to explore investment options. Get in touch to learn more about buying a property in Bristol.