Buying Property Through a Limited Company: Pros and Cons

We all know that property can be a great way to invest your money. Something both established and potential investors will want to consider is the ownership structure of their property investments. Buying property through a limited company can be more advantageous for some investors. From tax breaks to estate planning, a limited company can offer benefits that positively impact your financial situation and long-term goals. What you stand to gain will depend on the size of your property portfolio and your tax bracket.

In this article, we look at the pros and cons of buying property through a limited company and what investors need to be aware of before making any investment decision.

What are the Advantages of Buying a House Through a Company?

Depending on an investor’s specific circumstances, buying a property through a limited company can present the following advantages:

Tax Efficiency and Savings

One of the primary factors driving investors to establish limited companies is the difference in taxation of income. While individual property investors are subject to income tax rates ranging from 20% to 45%, profits retained by a company are subjected to Corporation Tax.

As of April 2023, the flat rate for Corporation Tax is 25% (an increase from the previous rate of 19%). While the savings may be insignificant for taxpayers falling within the basic-rate bracket, individuals in higher tax brackets or those with several properties can save significant sums of money by investing in property through a limited company rather than as an individual.

Asset Protection and Liability Limitation

When you hold property within a limited company, your personal assets are generally safe from any liabilities or debts that the company might face. This means that if there are legal claims or financial troubles with the company, creditors cannot go after your personal belongings (things like your savings, real estate and investments, etc.)

The separation between personal assets and the limited company’s assets adds an extra layer of protection for investors, which can be an advantage in some circumstances.

Access to Different Financing Options

Typically, unless an investor is a cash buyer, they will need to take out a mortgage to fund their property purchase. Those that invest in property through a limited company have access to a broader range of financing options that can help to support their investment projects.

While limited company investors have access to bank loans (just as individuals can get loans), limited companies can also apply for business-specific loans, which typically have different terms and conditions when compared to personal loans.

Investors that look to buy a property through a limited company have a few different financing options:

- Commercial mortgages: A commercial mortgage allows limited companies to borrow a sum of money to buy properties, and the property itself serves as collateral for the loan.

- Buy-to-let mortgages: BTL mortgages are available for limited company investors looking to purchase residential properties for the purpose of renting them out.

- Development finance: These specialised loans provide financial support for residential or commercial development projects. They differ from traditional property mortgages because the financing is typically short-term (6 to 24 months).

- Development finance loans: These loans are used to cover expenses related to purchasing land and financing construction costs. They’re suitable for new builds, conversions, or refurbishment projects.

- Portfolio Mortgage: If you own four or more properties, you may qualify for a portfolio mortgage. This type of mortgage is for companies with multiple investment properties.

What are the Disadvantages of Buying Property Through a Limited Company?

When it comes to buying a buy-to-let property through a limited company, there are a few disadvantages that investors should consider:

Higher Administrative Responsibilities

Can a limited company buy a house? Yes. But If you invest in property through a limited company, you’ll need to maintain proper company records, file annual accounts and tax returns, and comply with various legal obligations.

Business Set-up Costs

Setting up a limited company for property usually requires an additional budget. You’ll need to register the company, pay fees for filing documents, and hire professionals like accountants and tax advisors to ensure compliance with laws.

Getting Your Income

There are two main ways to get money out of a limited company:

- Dividends: The first £2,000 you take is tax-free and anything above that amount is subject to 7.5% for basic rate taxpayers and 38.1% for higher rate taxpayers (these taxes are in addition to the corporation tax).

- Salary: Another way to get your money out of a limited company is by taking a salary. However, you will need to contribute to national insurance, which can sometimes be more expensive than the higher tax rates associated with dividends.

Limited Availability of Mortgage Products

Mortgages for limited companies are generally only available for Special Purpose Vehicles (SPVs). An SPV is a limited company specifically formed for property investment purposes, such as buying, selling and renting properties.

If you’re wondering how to buy a house through your business UK, to be eligible for a limited company mortgage, the following criteria must be met:

- The company must be registered as a limited company

- Most lenders require the company to be registered as an SPV. This means that the company’s main purpose should be property investment

- In some cases, lenders may require personal guarantees from the directors of the company, meaning directors are personally responsible for the mortgage in case of default

- Shareholders of the company are often limited to a maximum of two individuals, who must also be directors of the company

What Tax Considerations Do I Need to Keep in Mind?

In certain circumstances, investing in property via a limited company can give tax advantages to investors. However, in most circumstances, limited companies are subject to the following taxes:

Corporation Tax

When purchasing a property through a limited company, rental income generated from the property is subject to corporation tax.

Since April 2023, businesses will pay the higher 25% corporation tax rate (up from 19%), provided they report profits above £250,000. Smaller entities with profits of up to £50,000 remain at the previous 19% rate.

Stamp Duty Land Tax (SDLT)

Do limited companies pay stamp duty? Yes, SDLT is payable on all property purchases over a certain threshold. SDLT rates may differ from those applicable to individuals, and an additional 3% surcharge may apply.

Companies must pay a 3% additional SDLT if the property purchase is £40,000 or more. If the property costs more than £500,000, the 15% higher threshold SDLT rate for corporate bodies may apply.

Capital Gains Tax (CGT) and Reliefs:

When you sell a property, capital gains apply to any profit you make. However, if the property is held in a limited company, Business Asset Disposal Relief (formally “entrepreneurs’ relief” or “incorporation relief”) may apply.

Business Asset Disposal Relief reduces the amount of CGT a business needs to pay, from 20% of qualifying profits to 10%. Most businesses are charged the lower tax rate of 10% on gains made up to the £1 million allowance.

Once you surpass this allowance, you are charged the usual CGT rate charged on gains at 18% or 28% depending on your tax bracket. For the tax year 2023–2024 the annual exempt amount is £6,000.

Inheritance Tax and Estate Planning

Inheritance tax is based on the value of an estate after a person has died. The standard inheritance tax rate is 40%, which is charged on the part of the estate that is above £325,000.

However, If a property is part of a limited company, it will not be considered part of an individual estate. Which means you can mitigate the amount of inheritance tax paid.

Holding property in a limited company gives you more options if you plan to pass the business on to your family. It’s much more straightforward to transfer limited company shares than privately held property. And it may also be protected from stamp duty and capital gains liabilities.

Personal Vs Limited Company Ownership: Factors to Consider

When considering whether it’s more advantageous to invest in property as an individual or through a limited company, there are many factors to think about first:

Your Tax Situation and Personal Goals

For those in a lower tax bracket or wanting to use a property as their primary residence, it usually doesn’t deliver many advantages to have a limited company structure.

On the other hand, if you are a higher tax bracket earner and plan to build a property portfolio or reinvest the profits, a limited company structure might make more sense.

Your Long-Term Investment Strategy

A limited company buying property might have a more advantageous tax structure for those focusing on generating rental income and those looking to take advantage of tax deductions available to limited companies.

If you intend to keep a property for longer, as a private owner, you might be eligible for tax-free gains through Private Residence relief.

The Size of Your Property Portfolio

If you plan on building a property portfolio or adding additional properties in the coming years, a limited company structure may make sense from a tax and administrative perspective. Smaller portfolios (typically those under 4 properties) are unlikely to experience the same benefits.

Exit Strategy

If you plan to sell the property in the short term or flip it, personal ownership may give you more benefits through private residence relief. Suppose you plan to keep properties for the long term. In that case, limited company structures give you more options regarding estate planning or passing on property assets to future generations.

Should I seek Professional Advice when Considering Buying Property Through a Limited company?

Whether or not it’s advantageous to buy a property through a limited company depends on your circumstances. Some people invest via a limited company because mortgage payments are no longer tax-deductible expenses .

Owning a property through a limited company involves complex legal and tax considerations. While there are many pros to holding assets within a limited company, as highlighted above, there are drawbacks too.

Individuals should get specialist tax advice before investing in property to fully understand the implications and legal requirements associated with a limited company ownership structure.

What are the Tax Benefits of Purchasing Property via a Limited Company?

One of the main advantages of buying property through a limited company is the potential for lower tax rates. While individuals pay income tax on rental income, limited companies are subject to corporation tax, which is set at 23% or 19% if profits are below £250,000.

Limited companies can typically deduct several expenses related to the property. Expenses include maintenance costs, mortgage interest rates, and property management fees, which can help lower the overall tax liability.

If you plan to hold a property for the long term, investing through a limited company gives you more options regarding inheritance tax. It’s far easier to pass shares in a limited company to beneficiaries. This reduces the impact of inheritance tax compared to transferring individual properties.

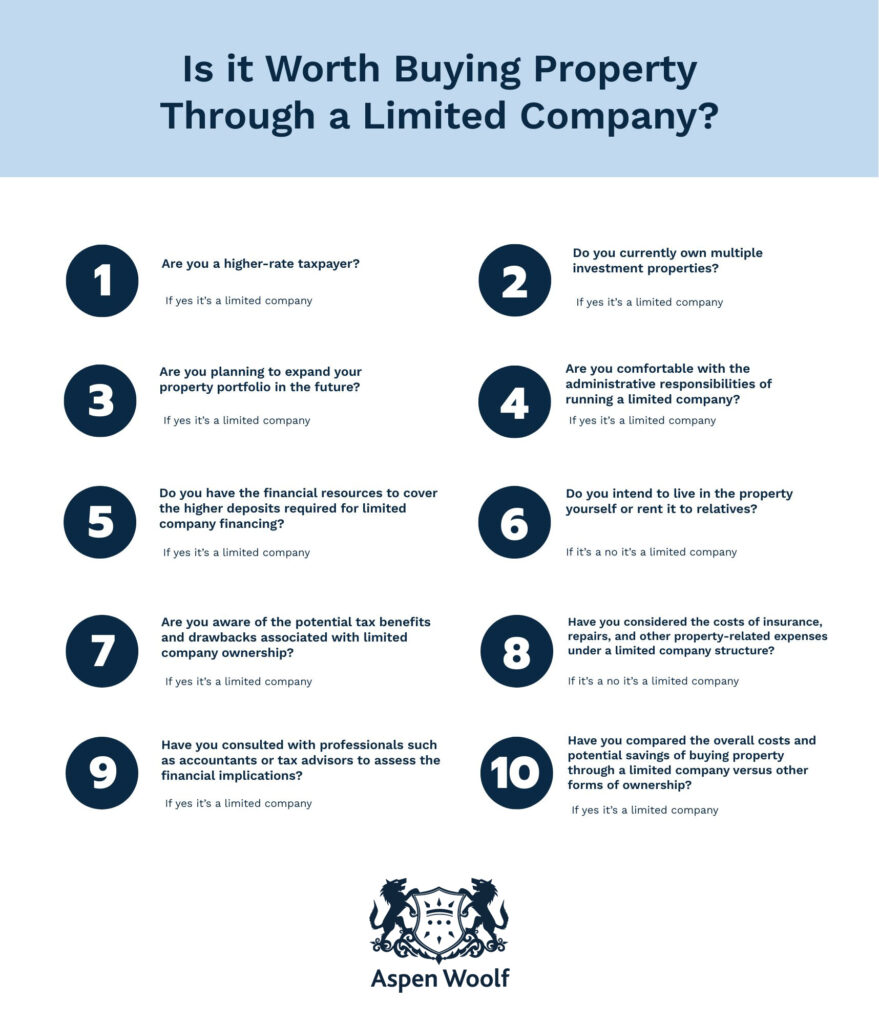

Is it Worth Buying Property Through a Limited Company?

The only way to know if buying property through a limited company benefits you is to run the numbers. Higher-rate taxpayers may find more advantages in buying a property through a limited company, but that depends on an individual’s circumstances.

Better for Higher Tax Payers

Generally speaking, most investors may find it costly and tax-inefficient to hold a buy-to-let via a limited company if limited to one or two properties. To have benefits, generally, it takes at least 4 properties to make a limited company structure worth it. The profit margin can shrink rapidly with high deposits, insurance, tax, and repairs.

Higher Deposits Required

Due to the current economic situation in the UK, many business mortgage lenders may ask for higher deposits of between 30-50%, which can also impact investors looking to finance their investments through a limited company.

Want to Live in Your Investment?

You might wonder, “Can my limited company buy my house?”. Investors should remember that most lenders will not allow you to rent the property to yourself or your relatives. Generally, a buy-to-let mortgage will require evidence of an active tenancy agreement to proceed.

Conclusion

With the potential for tax efficiency, substantial savings, asset protection and estate planning options, a limited company structure can appeal to many investors. However, there are also considerations to keep in mind. The size of your property portfolio, tax bracket and exit strategy can impact the advantages your stand to gain from investing as a limited company. Whether you plan on investing individually or through a limited company, contact our experts, who can help you find the perfect property.