UK Rental Yields 2025: Where to Find the Best Buy-to-Let Returns

Let’s be real…

If you’re investing in UK property in 2025 and not paying attention to rental yields, you’re driving blind.

Because in a world of rising mortgage rates, tighter regulations, and regional price plateaus — cash flow is king.

The good news?

Not only are UK rental yields holding steady… in some pockets, they’re booming.

From Bradford to Liverpool, a quiet revolution is happening across Britain’s rental markets. Secondary cities — once overlooked — are now delivering 8%+ yields while demand for long-term rentals surges post-COVID.

In this guide, we’ll show you:

-

What rental yield actually means in 2025

-

What’s driving yield growth right now

-

Where the UK’s best returns can still be found

-

And how to future-proof your portfolio against a shifting economic backdrop

And we’re not just talking theory.

This is a data-backed breakdown using real numbers from Savills, HomeLet, Zoopla, and the ONS — plus internal property investment trends we’re seeing firsthand at Aspen Woolf.

If you’ve been asking yourself…

“Where can I still get strong ROI from UK property in 2025?”

Then this is your cheat sheet.

Let’s dive into the UK rental yield landscape — and where the smart money is heading next.

What Is Rental Yield and Why It Matters in 2025

Let’s strip away the jargon.

Rental yield is the percentage of return an investor earns on a property through rental income — relative to the property’s purchase price.

Think of it as your property’s income efficiency.

The Simple Formula:

Rental Yield (%) = (Annual Rent / Property Value) × 100

So if you buy a flat for £200,000 and rent it out for £1,200/month (£14,400/year), your gross rental yield is:

(£14,400 / £200,000) × 100 = 7.2%

Why It Matters in 2025 (More Than Ever)

In 2025, rental yield is no longer optional homework. It’s the first line of defence against:

-

Rising interest rates eating into net profits

-

Lower capital appreciation in overheated post-COVID regions

-

Higher landlord costs (e.g. energy efficiency upgrades, tax changes)

As more investors shift from speculation to income-first strategies, yield has become the new performance metric.

And the smartest investors aren’t just chasing high yields — they’re asking:

“Is this yield sustainable in 2026, 2027, and beyond?”

UK Rental Yields at a Glance (2025)

Here’s what national averages look like right now:

| Region | Avg. Gross Yield (2025) | Trend vs. 2024 |

|---|---|---|

| North West | 6.5% – 8.5% | 🔼 Rising |

| Yorkshire & Humber | 6.2% – 8.0% | 🔼 Rising |

| East Midlands | 5.5% – 7.2% | 🔼 Slightly Up |

| Greater London | 3.8% – 5.2% | 🔽 Flatlining |

| South East | 4.1% – 5.5% | 🔼 Stable |

Related Articles:

Key Factors That Influence Rental Yields in 2025

Rental yields don’t appear out of thin air.

They’re the end result of supply, demand, tenant demographics, and economic forces — all colliding at once. And in 2025, several key trends are reshaping what “high yield” really means in the UK.

Let’s break it down.

1. Location Dynamics

No surprise here — location remains king. But in 2025, we’re seeing a shift:

-

Northern Powerhouse cities (Manchester, Liverpool, Leeds) are outperforming the South in both yield and rental demand.

-

Areas near university zones, new infrastructure projects, or city regeneration hubs are drawing higher tenant interest and rent premiums.

-

Commuter towns with strong transport links (like Luton, Bradford, and Nottingham) are becoming high-yield outliers due to affordability gaps.

Explore properties in Leeds, Liverpool, and Bradford

2. Tenant Demand & Demographics

2025 tenants are more mobile, digital, and value-conscious than ever.

-

Young professionals are prioritising rental flexibility in city centres over buying.

-

The rise of “rentvestors” (those who rent where they live, but invest elsewhere) is creating rental hotspots in high-yield postcodes.

-

Remote workers are fuelling rental demand in lifestyle towns once overlooked by investors.

This demographic shift means consistent occupancy rates in the right areas — which directly boosts your yield over time.

3. Property Type & Condition

The type of property you buy has a huge impact on rental yield:

| Property Type | Yield Profile | Notes |

|---|---|---|

| Purpose-Built Student Flats | High (7%–10%) | Consistent demand, especially near major universities |

| New-Build City Apartments | Moderate (5%–7%) | High tenant appeal, low maintenance |

| HMOs (Houses in Multiple Occupation) | Very High (8%–12%) | More management, but strong cash flow |

| Luxury Buy-to-Let Units | Low to Moderate | More vacancy risk, but potential for capital growth |

✅ Bonus Tip: Renovated properties with modern energy standards (EPC B or higher) are in high demand due to tenant cost savings and future compliance.

More information: Build to Rent Investment Trends

4. Legislation & Compliance Costs

Yield isn’t just what goes in — it’s what you keep.

And with new regulations around Energy Performance Certificates (EPCs), licensing, and Section 21 reform, the cost of being a landlord is rising.

Key 2025 compliance factors:

-

Minimum EPC rating for rentals is moving toward “C”

-

Local councils are increasing selective licensing schemes

-

Mortgage interest relief rules remain unchanged, favouring cash buyers or corporate structures

All of this affects your net rental yield, especially if you don’t plan for it.

Learn more: Risks to Consider When Investing

5. Rental Market Inflation

This one’s big.

In 2025, rents are still rising across most UK regions. According to HomeLet and Zoopla:

-

Average UK rents increased 8.2% year-on-year

-

Northern cities outpaced London in rental growth for the first time in a decade

-

Rent caps and freezes in Scotland are shifting investor interest south

The silver lining? Even as purchase prices stabilise, rents are climbing faster, which is driving yield expansion in well-positioned postcodes.

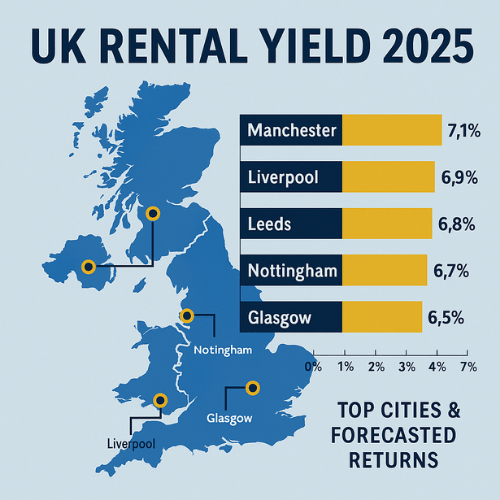

The UK’s Top Yielding Cities in 2025 (Data-Backed List)

If you’re investing in property UK-wide this year, your #1 priority is likely clear:

Where do I get the best returns without gambling on volatility?

That’s where rental yield becomes your compass.

Based on 2025 data from HomeLet, Rightmove, and internal Aspen Woolf analytics, here are the top 7 high-yield cities delivering strong ROI — not just in raw yield, but also in sustainable demand and future growth potential.

1. Bradford — Up to 8.2% Yield

Bradford is fast becoming a buy-to-let hotspot for serious investors. With average property prices hovering around £170,000, it’s one of the most affordable cities in the UK.

The city’s ongoing regeneration projects and growing student population make it ideal for yield-focused investors.

Explore our Bradford property listings

2. Liverpool — 8.5% Yield in Prime Zones

Liverpool consistently ranks among the highest rental yield cities in the UK, particularly in areas like L7 and L6. Its blend of affordable property prices and high tenant demand — driven by universities, tech jobs, and short-term lets — is unmatched.

Bonus: Read our full guide to investing in Liverpool property

3. Leeds — 7.8% Yield + Capital Growth Upside

Leeds offers a rare hybrid model: healthy rental income and substantial capital appreciation. It’s a favourite for those balancing short-term cash flow with long-term asset growth.

With developments in South Bank, Holbeck, and city centre, yields are staying strong even as values climb.

Check out our property investment insights in Leeds

4. Manchester — 7.1% Gross Yield

Manchester has long been a magnet for professionals, students, and global investors. And in 2025, it’s holding steady — both in demand and returns.

Average prices may be higher (~£245,000), but occupancy is consistent, and yields remain strong in areas like Salford and Ancoats.

If you’re new to this market, see our investment guide to Manchester property

5. Nottingham — 7.0% Average Yield

Nottingham balances yield and growth effortlessly. Its two major universities create constant rental demand, while the tram network and inward investment keep appreciation potential high.

Investors are finding exceptional returns in NG7, NG1, and NG3 postcodes.

Browse our Nottingham investment properties

6. Luton — 6.9% and Rising

Luton is one of the UK’s most overlooked commuter belt gems. Just 30 minutes from London, its affordability and rising rent demand make it a great fit for balanced investors.

The airport economy, diverse workforce, and regeneration plans are nudging yields up and vacancies down.

View our Luton opportunities here

7. Birmingham — 6.3% Yield with Olympic Boost

Birmingham may not always top the yield charts, but with £24bn+ regeneration plans and the legacy of the Commonwealth Games, the city is transforming.

Its tenant base is diversifying, and areas like Digbeth, Edgbaston, and the Jewellery Quarter are gaining ground fast.

Explore our Birmingham development pipeline

Each of these cities offers unique returns depending on your investor profile:

| City | Avg. Yield | Growth Potential | Fit |

|---|---|---|---|

| Liverpool | 8.5% | Medium | Yield-Focused |

| Bradford | 8.2% | Low–Medium | Cash Flow Investors |

| Leeds | 7.8% | High | Balanced Strategy |

| Nottingham | 7.0% | High | Long-Term Growth |

| Manchester | 7.1% | High | Growth-Focused Buyers |

| Luton | 6.9% | Medium | Commuter Yield |

| Birmingham | 6.3% | High | Regeneration Play |

4. How to Analyse a Rental Property’s Yield Like a Pro (Step-by-Step)

Most investors glance at a Rightmove listing, see “Potential Gross Yield: 7%,” and move on.

But that’s not how professionals do it.

To truly assess a buy-to-let deal in 2025, you need to break yield down into layers — accounting for real-world expenses, vacancy rates, growth potential, and even tenant profile.

Here’s a step-by-step method seasoned investors use to uncover whether a deal is a cash-flow king or a spreadsheet illusion.

Step 1: Start with Gross Yield (But Don’t Stop There)

Formula:

Gross Yield = (Annual Rent ÷ Property Price) × 100

Example:

If a flat costs £180,000 and you expect £1,200/month in rent:

£14,400 ÷ £180,000 × 100 = 8% Gross Yield

Gross yield gives you a quick way to compare cities. For example, Bradford consistently hits 8%+, while London averages under 4%.

Step 2: Calculate Net Yield

Formula:

Net Yield = (Annual Rent – Expenses) ÷ Property Price × 100

Include expenses like:

- Lettings & management fees (typically 8–12%)

- Maintenance/repairs (~1% of property value annually)

- Ground rent or service charges (if leasehold)

- Insurance

- Void periods (assume 1 month/year unless guaranteed)

Net yield gives you a true profitability picture — not just a brochure headline.

Step 3: Factor in Capital Growth Forecasts

Yields are only half the story. The other half? Appreciation.

Use tools like:

Then compare with Aspen Woolf’s City Guides to align forecasts with real-time investment opportunities.

Example:

Liverpool may offer 8.5% yield, but Leeds may beat it over 5 years in total ROI due to stronger growth potential.

Step 4: Assess Tenant Demand & Occupancy Risk

Yield means nothing if the property sits empty.

Ask:

- Are you near major employers/universities?

- What’s the current rental supply vs demand in that postcode?

- Does the area have long-term tenant stability?

Cross-check with rental indices from HomeLet and demand trends via Rightmove’s rental tracker.

Need help qualifying hotspots? See our guide:

Where Are the Best UK Cities to Invest in Property in 2025?

Step 5: Run “Best, Worst, and Realistic” Case Scenarios

Professional investors never rely on a single forecast.

Instead, they build models around:

- Best Case: Full occupancy, no maintenance issues, rent rise

- Realistic: 11-month occupancy, standard costs, flat rent

- Worst Case: 2-month void, major repair, tenant turnover

This helps you know your break-even point and avoid overleveraging.

Step 6: Benchmark Against Other Assets

If your property nets 5.6% yield with 3.4% capital growth = ~9% annual return, compare it to:

- FTSE 100 dividend stocks: ~3.9%

- Government gilts: ~4.1%

- High-interest savings: ~5%

- Gold: ~7% CAGR (historical)

Use this to validate if the deal is worth the effort and risk.

Need a breakdown? Read:

UK Property vs Other Asset Classes (2025 Risk–Return Guide)

Here’s Section 5: Future Yield Trends — Where Returns Are Heading by 2027, bringing predictive power, authoritative sources, and strategic insight:

5. Future Yield Trends — Where Returns Are Heading by 2027

If 2025 is the year of stabilisation in the UK rental market, 2026–2027 will be the years of segmentation.

That’s not just a prediction. It’s a warning.

Because the days of blanket “buy-to-let boom” are over. Moving forward, rental yields will vary dramatically based on three drivers: affordability, migration trends, and supply constraints.

Let’s break down the macro signals, then zoom into cities where returns could grow — or shrink.

The National Outlook: Yields Hold, but Not Everywhere

According to Savills’ latest rental market forecast, UK-wide average rents are expected to grow:

- 2025: +5.5%

- 2026: +4.0%

- 2027: +3.5%

That’s a ~13.5% cumulative rise over three years, suggesting net yields will rise for cash buyers, but be eroded for investors facing higher mortgage costs.

Key takeaway? Your financing model matters more than ever.

Rising Stars: Cities Set for Rental Yield Growth

Bradford

- Low average prices (~£170,000)

- Strong student population

- High net migration inflow (ONS)

- Major regeneration via the City Village Project

Expected yield trajectory: 8.2% → 8.8% by 2027

Explore available deals: Bradford Investment Opportunities

Liverpool

- High concentration of young renters

- Shortage of quality rental housing

- City-wide infrastructure upgrades: Lime Street, Knowledge Quarter

- Yields already at 8.5% in 2025

Expected yield trajectory: 8.5% → 9.2% by 2027

Supporting data: Build-to-Rent Trends in the UK

Luton

- 30-minute commuter link to London

- Property values 40% lower than Greater London

- Strong rental competition among airport staff, students & commuters

Expected yield trajectory: 6.9% → 7.4% by 2027

Read more: Luton Property Investment Insights

Yield Compression Risk Zones

London

- High entry price

- Weak gross yields (3–4%)

- Strong long-term capital growth potential

- Rent growth capped by affordability thresholds

Expected trajectory: Yields may remain flat despite rental increases.

Bristol

- Yields currently at ~4.5%

- Growth ceiling due to rapid gentrification

- Tenant demand remains high

- Operating costs likely to rise faster than rents

Data-Backed Insight: Yield Will Follow Migration

One of the most overlooked predictors of future rental yield is internal UK migration.

Cities with net inbound migration — students, remote workers, or post-Brexit returnees — will outperform yield-wise by 2027.

According to ONS projections:

- Leeds, Sheffield, Nottingham, and Manchester will see population growth of 4–8% by 2027

- Expect rental demand — and therefore yields — to follow

Deep dive: Leeds Property Investment Trends 2025

Bonus: Interactive Yield Growth Tracker (Optional Embed)

Want to visualise where yields are moving?

Explore our Rental Yield Glossary to understand every metric.

Here’s your final section — written to inspire action, build trust, and naturally prompt internal linking and next steps. This conclusion wraps the article with impact and authority:

6. Final Thoughts: How to Build a Yield-Optimised Portfolio in 2025

If there’s one truth the data has made crystal clear, it’s this:

Rental yield in 2025 is no longer just a number — it’s your moat.

Whether you’re investing to generate income, hedge against inflation, or replace your salary long-term, yield is the real-time performance metric that can’t be ignored.

But knowing where to invest is only half the game.

Building a yield-optimised portfolio requires:

- Data-led city selection – Think Liverpool, Bradford, Luton — not just London

- Tenant demand alignment – Proximity to universities, business hubs, and infrastructure

- Structure planning – Using SPVs, smart financing, and legal safeguards to enhance net yield

- Sustainable strategy – Factoring in maintenance, voids, and future regulation (like EPC)

Want a Blueprint? We’ve Got You Covered

If you’re serious about yield-first investing, these resources will take you from insight to execution:

- How to Build a Property Portfolio in the UK (Step-by-Step Guide)

- Investing in UK Property from Abroad: A Guide for Expats & International Buyers

- Glossary: Key Investment Terms

- Sustainable Property Investment in the UK

Ready to Start?

At Aspen Woolf, our award-winning team specialises in high-yield property investments in high-growth UK cities — from off-plan developments to fully tenanted units.

→ Browse Our Investment Properties

→ Speak With a Yield Specialist

Don’t chase yield blindly. Understand it. Structure it. Build it.

Because in 2025, your yield is your compass — and the right strategy will take you further than ever before.