Why Get an Investment Property for Sale in Manchester?

Why Get an Investment Property for Sale in Manchester?

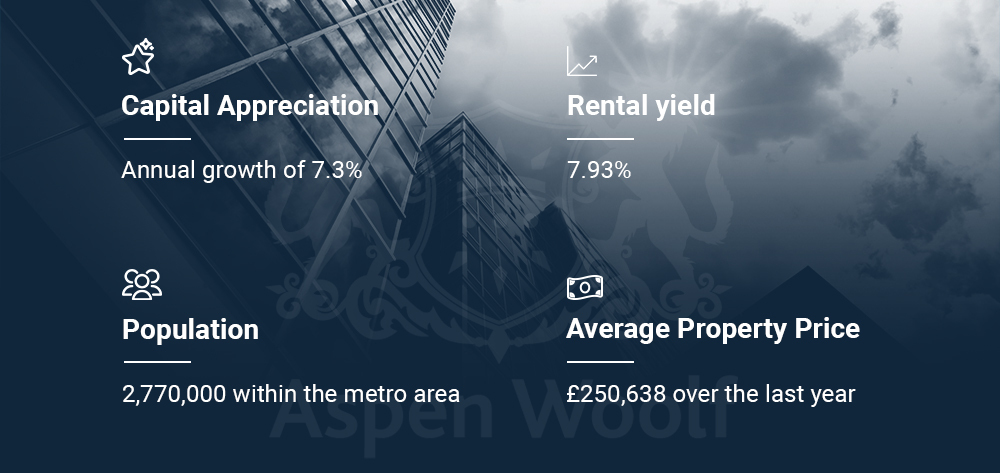

Manchester’s property market has witnessed exceptional growth, surpassing other cities to become one of the UK’s hottest property investment destinations. Not only that, but Manchester regeneration has proved to be one of the greatest success stories in the UK.

As a city with a developing business scene, growing population and a buoyant job market, the city’s attraction knows no bounds and property prices continue to rise across the board.

Now let’s take a look at what can the Manchester property market offer to you as an investor:

- Regeneration Creating Opportunities– as a city that has been undergoing a very successful regeneration process for a number of years now, there have been many positive developments thanks to it. Manchester has become one of the UK’s most thriving and exciting cities. With a strong economy and world-class universities, it is ever-more inviting for both young professionals and students. With this increase in popularity comes a serious rise in demand and property prices as well.

- High Rental Returns– those in search of an investment property for sale in Manchester definitely won’t be disappointed by the sheer potential of returns. Manchester is considered as one of the best cities to invest in, not just in the UK, but in the world. Not only that but Manchester’s population is expected to grow by 185,000 by 2037, which will further increase the demand and in turn the rents. Looking into the future, the forecasts seem quite optimistic as well. The value of properties in Manchester is expected to rise by 17.1% over the next 5 years, which is certainly a piece of data you should remember.

- Great Demand– with everything coming back to life after multiple national lockdowns, things, or should we say rents, are looking up in 2022. Students are coming back to the city, businesses are re-opening and there’s a steady stream of tourists in the city, all of which is influencing the rise in demand for rental properties in Manchester. Just like the rest of UK, the gap between supply and demand is certainly noticeable in Manchester as well. This means the perceived value of all buy-to-let properties Manchester has to offer is growing accordingly.

- House Price Growth- In the last 10 years Manchester property prices increased by an incredible 378.96%. Also, JLL’s 2020 Northern England Forecasts suggests that Manchester property investments will experience sales price growth of 17.1% and rental growth of 16.5% over the nest 5 years. Which is great news for those looking at long-term earnings from their investments.

- Property Affordability– Despite the lucrative rental yields, house prices remain affordable, particularly compared to other cities in the UK. Most notably London with an asking price of £896,315 for a single property you could buy several properties in Manchester. The average property prices in Manchester stood at £202,905 in December 2020, a rise of 6.14% compared to the previous 12 months. In 2021, average property prices grew by 12.12%, while rent prices grew by 6.8%. In terms of property types, flats in Manchester sold for an average of £193,087 and terraced houses for £214,066.

What to Expect From Your Investment Apartments in Manchester?

Properties in Manchester will experience the highest price growth over the next few years. According to Savills the North West region will see prices rise by 18.8% by 2026. JLL predicted a 4% growth of rental values in 2022. Oxford Economics says Manchester will have the highest economic growth of all UK cities over the next five years.

As this data goes to show the Manchester property market is one of the most lucrative ones in the UK. The future doesn’t disappoint either, as this growth is set to continue for many more years. In addition regeneration projects set for Manchester along with these predictions can tell you capital growth will be far from disappointing.

Manchester’s ever-increasing population is continuing to put pressure on the city’s housing supply. This means that the time to look for an investment property for sale in Manchester is now! Especially if you want to secure a Manchester property while the prices are still relatively low and enjoy the capital appreciation down the line.

Who Should Invest in Manchester Property?

Manchester is the home to five of the UK’s leading universities which are very attractive to both domestic and international students. The demand for accommodation exceeds supply and landlords can expect high demand from students and young professionals.

Meaning, that both student properties in Manchester and buy-to-let properties are a great choice for property investors. With a student retention rate of 51% and a very consistent demand for quality accommodation, the opportunity to make excellent returns on your investment is indeed very attractive.

So, regardless of whether you’re interested in short or long-term returns, Manchester will not disappoint. It can only open more doors for you to explore the type of investments you’re interested in.

Where to Buy Investment Properties in Manchester?

While looking for the perfect Manchester investment property for sale it’s important to take note of the location. Mainly as this will heavily influence your potential returns. Here are a few of the top manchester property investment hot spots:

- Manchester City Centre– As the city’s population continues to grow there is currently a lack of housing stock to meet demand, particularly high-end flats. This is an ideal place to invest. With plenty of regeneration and investment projects making city center living an attractive option, along with house prices, and yields rising more rapidly than other up and coming areas of the city. Properties in Manchester City Centre sold for an average price of £255,485 over the last year.

- Salford– The area is popular with students, making buy-to-let student accommodation an attractive option. With the regeneration of Salford Quays and MediaCityUK in close proximity, young professionals, too are moving to the area. Last year flats in Salford sold for an average of £249,507.

- Stockport -This area is popular with families and commuters travelling into the city for work thanks to efficient transport connections. A highly sought-after residential area, there is strong demand for property and rental accommodation in Stockport. Average property prices sat at around £279,236 over the last year.

- Moss Side– Popular area with students thanks to its proximity to Manchester and Manchester Metropolitan universities. While mainly Victorian terraces, new builds have been introduced in recent years along with the regeneration and investment in the area. Properties in Moss Side had an overall average price of £192,378 over the last year.