New life for Britain’s old industrial cities

Large regeneration projects are attracting businesses and homebuyers to these once overlooked areas

Regeneration projects are rapidly bringing Britain’s cities back to life. With the government promising to accelerate the pace of change, we take a fresh look at some once neglected neighbourhoods.

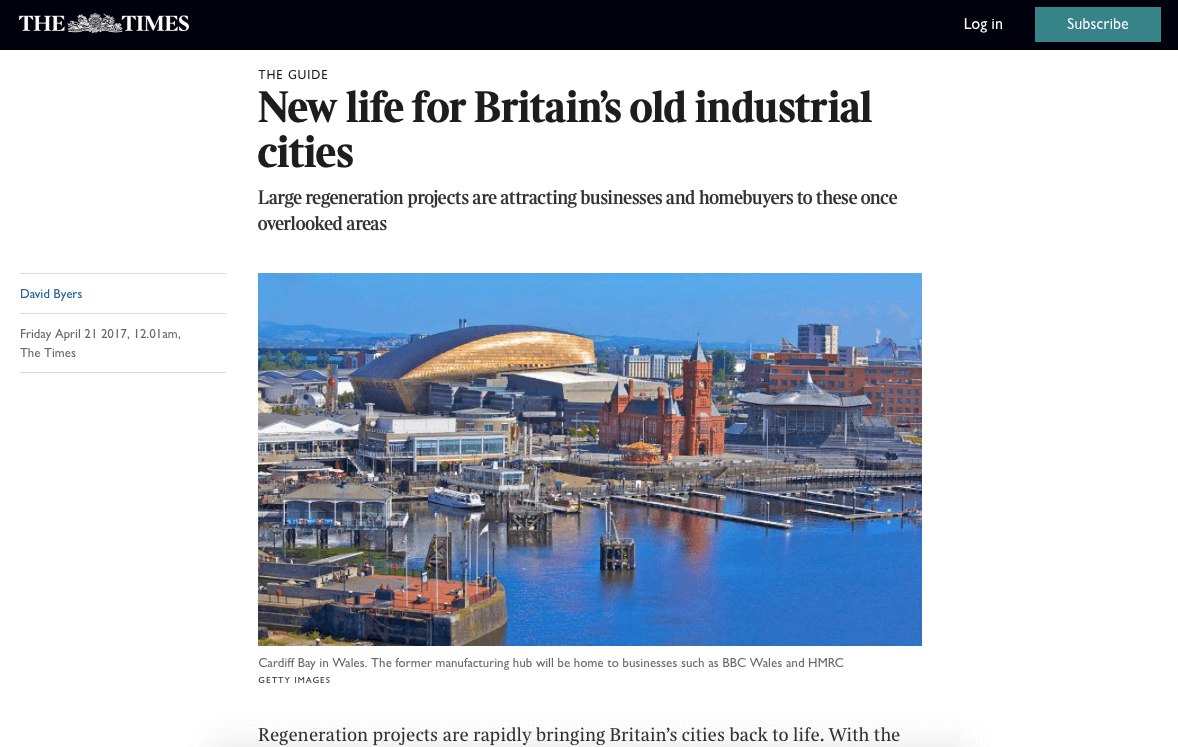

Central Square, Cardiff

One million square feet of residential, retail and office space is to be built round Cardiff Central station. Commercial tenants include BBC Wales, which will move into 150,000 sq ft premises, and the Welsh headquarters of HM Revenue & Customs.

Gareth Carter, the development director at Savills in Cardiff, says that the businesses moving to Central Square have freed up land for much-needed housing. “Cardiff is a hotspot. There’s inward migration from surrounding areas. It has business, financial services and insurance, although there’s less manufacturing,” he says.

The average price of property in the city is £215,158, according to Rightmove — up 4 per cent on last year, and 9 per cent since 2014. Cardiff’s population is growing at one of the fastest rates in the UK. By 2035 it is predicted to increase by 72,000 people, to 360,000.

Eldon Grove is a development in Liverpool with one and two-bedroom apartments starting at £94,950 through Aspen Woolf.

Vauxhall, Liverpool

There has been vast regeneration in Liverpool, with projects such as the Georgian Quarter, the Baltic Triangle and the Albert Dock, near the city centre, receiving international recognition. Now attention is shifting to the north of the city centre. Property experts believe that the multitude of projects taking place in old industrial buildings and brownfield sites — a short walk from the city centre — will push up house prices within five to ten years. The average price of a house in Liverpool is £151,443, according to Rightmove, 8 per cent up on 2014.

Port Dundas, Glasgow

Glasgow’s regeneration has been undented since it hosted the Commonwealth Games in 2014, and house prices in the city are expected to grow by 17 per cent by 2021 — more than six percentage points more than the Scottish average, according to the JLL property services company.

This is partly attributed to interest in unloved places such as Port Dundas, in the north of the city. Tech companies are flocking there, enticed by cheap rents and the ultra-fast fibre network being introduced. Port Dundas is a former 19th-century industrial hub characterised by the disused textile mills, chemical works and granaries that line the canal. Many have been converted into workspaces, high-end retail spaces, offices and flats. A typical property in Port Dundas costs about £163,000.

However, more housing is needed and it is hoped that Glasgow’s £1.13 billion regeneration plan will attract residential investors to the area, plus big-name arts venues to follow in the footsteps of the National Theatre of Scotland, which opened its £6.5 million Rockvilla headquarters in November last year.

South Bank, Leeds

The regeneration is touted as the biggest change to Leeds in more than 100 years. The aim is to “double the size of the city centre by transforming South Bank into a distinctive European destination for investment, living, learning, creativity and leisure”. More than 6,000 people live in South Bank, with a further 4,000 homes on the way.

The plan is to regenerate 457 acres of land south of the River Aire. The developer, Vastint, the property arm of the Ikea Group, has bought the 20-acre former Tetley brewery site and has applied for planning permission to turn it into homes, plus a retail and hotel complex. A neighbouring six-acre site has been bought by the developer CEG to build a 40-storey residential tower plus offices, retail and leisure facilities.

Leeds station is being transformed into the “Yorkshire Hub”, a regional railway centre integrating HS2, Northern Rail and the upgraded Trans-Pennine route. According to Rightmove, the average property price in Leeds is £189,704, a rise of 5 per cent in a year and 11 per cent since 2014.

Work has begun on the Southampton Harbour Hotel and Spa at the city’s Ocean Village marina

Portsmouth and Southampton

These south coast urban centres are working together on a series of projects to promote regional growth and jobs.

In Southampton there will be the £85 million Watermark leisure complex, with 20 restaurants and 260 flats next to the WestQuay shopping centre. A £450 million redevelopment of neighbouring Royal Pier will include 500,000 sq ft of offices, 730 flats and 40 shops. Another 457 homes are to be built on the riverside near the Southampton Football Club ground. At Ocean Village Marina in Southampton a 76-bedroom hotel and apartments are being built.

In Portsmouth 2,370 homes and 580,000 sq ft of work space for the marine and manufacturing sectors are to be built on Tipner and Horsea islands.

According to research by Savills, the growing economic performance could be undermined by a chronic lack of housing. The estate agency claims that the M27 corridor needs 4,000 more homes a year and it is falling short by 940 a year. Demand for housing pushed up prices by 10.7 per cent in the year to September. Portsmouth’s average house price is £213,139, according to Rightmove — a rise of 8 per cent in a year. Southampton’s average price is £223,040, also a rise of 8 per cent.

Birmingham and the Midlands Engine

The prospect of Brexit might terrify the City of London, but the government hopes the booming Midlands will help to prop up the domestic economy. The West and East Midlands are about to get a facelift, with £7 billion of projects announced by the government last month. As part of its “Midlands Engine” plan, the government is seeking developers and investors for 19 projects, including the £1 billion regeneration of Nottingham city centre, the £75 million National Space Park in Leicester, and £175 million Tudor Cross development, near Bolsover in Derbyshire.

The schemes seeking investment include the regeneration of Birmingham Curzon station (£500 million), the HS2 interchange at Solihull and the £2 billion UK Central Hub development. Ministers have pledged to spend £392 million on transport and infrastructure projects in the region.

There have been a significant number of regeneration projects in the Midlands already, in particular in Birmingham, with HS2 set to cut journey times from London to under an hour for many. HSBC, Deutsche Bank and HMRC have moved staff here. The housebuilder Berkeley Homes has announced that it would open a division in Birmingham — its first foray out of the southeast in more than a decade.