There is no search results.

Is an Investment Property in Liverpool Really a Good Idea?

Is an Investment Property in Liverpool Really a Good Idea?

Liverpool is an exciting Northern city which is considered to have one of the fastest-growing property markets in the UK. One of the facts which will certainly catch the attention of many a property investor is that Liverpool property growth is outperforming London by five times.

Now let’s take a look at why Liverpool is a good place to invest in property.

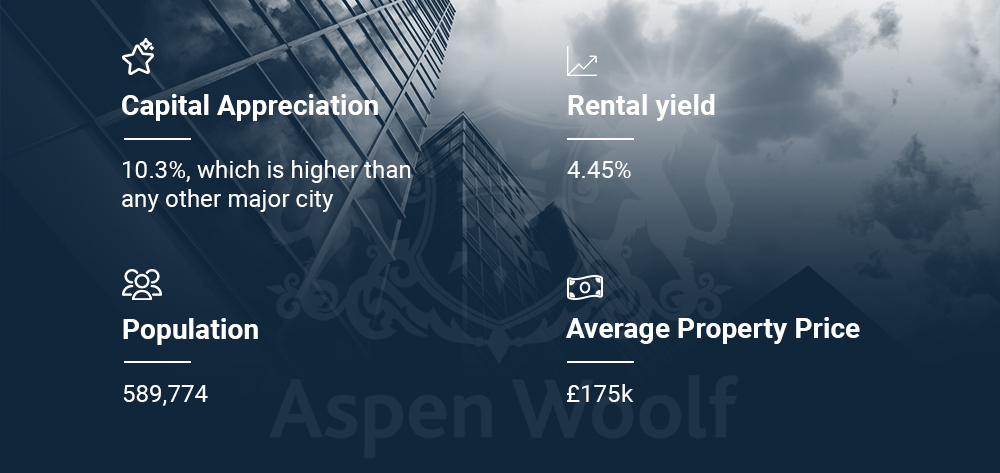

- Rental Yields– As one of the most important elements every investor should pay attention to, Liverpool rental yields sure don’t disappoint. While average rental yield in Liverpool sits at over 5%, certain Liverpool postcodes can reach an impressive 10%. Read more about Liverpool postcodes, right here.

- Rental Demand– With ongoing investments and Liverpool’s economic growth over the recent years, this vibrant city has experienced an influx of both young professionals and students looking to rent out quality accommodation. Liverpool can boast a student population of over 70.000 and a thriving business scene. Having said that, a reliable stream of tenants should never be an issue with an investment property in Liverpool.

- Property Affordability– The Liverpool property market is considered as one of the most cost-effective markets in the country. According to the latest figures from Rightmove, Liverpool properties have an average price of £208,370. With Liverpool property prices sitting below the UK’s average, and predictions from Savills suggesting Liverpool is set to become the property market leader in the country, it’s easy to see why this Northern city is such a catch.

- Property Price Growth– house price growth is one of the most, if not the most important measurement to follow when considering where to invest in property. Liverpool house prices, along with property demand will continue to grow thanks to the ongoing regeneration projects.

- Tourist Hot Spot– With plenty of galleries, museums, an iconic waterfront, legendary nightlife, and so much more Liverpool offers plenty to see and do. Having said that, Liverpool attracts both tourists and locals which in turn boosts the local economy.

What to expect from your Investment Property in Liverpool?

If you’re wondering if an investment property for sale in Liverpool is a good idea now, here are a few pieces of info to put you at ease.

- Looking back over the past five years, Liverpool property prices have gone up by 25%

- Liverpool can boast with record-breaking levels of investment which will, in turn, create thousands of new jobs in the city

- Around 750,000 students call Liverpool home, meaning there’s plenty of demand for high-quality accommodation

- Liverpool is considered as one of the best-connected cities in the UK. Not to mention the HS2 project will further reduce travel times and boost the local economy

Liverpool property market is accelerating faster than ever before, thus those who decide to invest in a Liverpool property are looking at amazing potential returns.

According to Savills house prices in the North West are expected to grow by 18.8% between 2022 and 2026. Which is 5.7% higher than the expected growth country-wide.

This means, that if you’re looking for a Liverpool investment property for sale now, you’d be looking at very favourable returns. Regardless of whether you’re in the market for Liverpool buy-to-let properties or you’re more long-term oriented.

With Liverpool property prices sitting at £208,370, you’d still be paying less than the UK average of £294,559. Not just less, these numbers show just how much room for growth Liverpool offers.

Who Should Buy an Investment Property in Liverpool?

As a city which is considered as one of the most cost-effective cities in which to buy residential property, Liverpool property market is quite friendly towards a wide range of investment types.

Nevertheless, Liverpool buy-to-let properties and student properties are bound to provide the best ROI. As far as Liverpool property prices go, here’s a little more info on that.

Most properties that have sold over the last 12 months are semi-detached houses, which have reached an average of £230,155. Terraced properties went for an average price of £153,249 and detached properties at an average price of £395,940. Prices were similar to the year before and 12% higher than the peak in 2020, when the average property price reached £186,118.

Where to Find the Best Investment Property for Sale in Liverpool?

Liverpool has topped the charts in TotallyMoney.com’s list of property investment hotspots, boasting a total of six postcodes featuring in the Top 25 of best areas to invest in Liverpool property.

But as far as areas go, these are the ones that show the most potential:

Kensington-In last year, the average price for a property in Kensington was £140,014. Located on the fringe of the city centre.

Toxteth– an inner-city area of Liverpool located to the south of Liverpool City Centre. One of the cheaper areas of Liverpool for property and the area is popular with students and is known as an “up-and-coming” part of the city. Average property prices in Toxteth over the past year were £151,183.

Bootle-Located North of the City Centre, Bootle offers mid-priced property and plenty of HMO properties. It is well-serviced by bus and rail routes. The current average property price in Bootle is around £147,624.