Guide to Tax on Buy to Let in the UK

In this article, we take a look at taxes that may apply to buy-to-let property. As well as changes to tax allowances, stamp duty land tax, capital gains and mortgage relief. Also, we’ll touch on common questions about tax on buy to let income.

As the UK property market continues to be a popular avenue for investment, it’s essential to understand the tax that applies to buy-to-let properties.

As a landlord of a buy-to-let property, compliance with tax laws, declaring rental income and understanding allowable expenses is important to ensure your property is as profitable as possible.

Rental Income Tax: Reporting and Calculating Taxable Income

One of the key aspects of buy-to-let tax is the declaration of rental income. In other words, the total amount of rent you receive from your tenants in a year. As a landlord, you are required to declare the rental income you receive from your property on your annual self-assessment tax return.

Rental income from property includes income from short-term or long-term leases and holiday lettings. The rate of tax on rental income depends on a landlord’s personal circumstances. Landlords need to keep detailed records of rental income and expenses to support their tax returns and claims on buy-to-let income tax.

Allowable Expenses: Deductions and Tax Savings

When it comes to tax on buy to let property, while you need to declare rental income, there are many tax-deductive expenses that landlords can claim. These allowances can help a landlord reduce the overall amount of tax they pay.

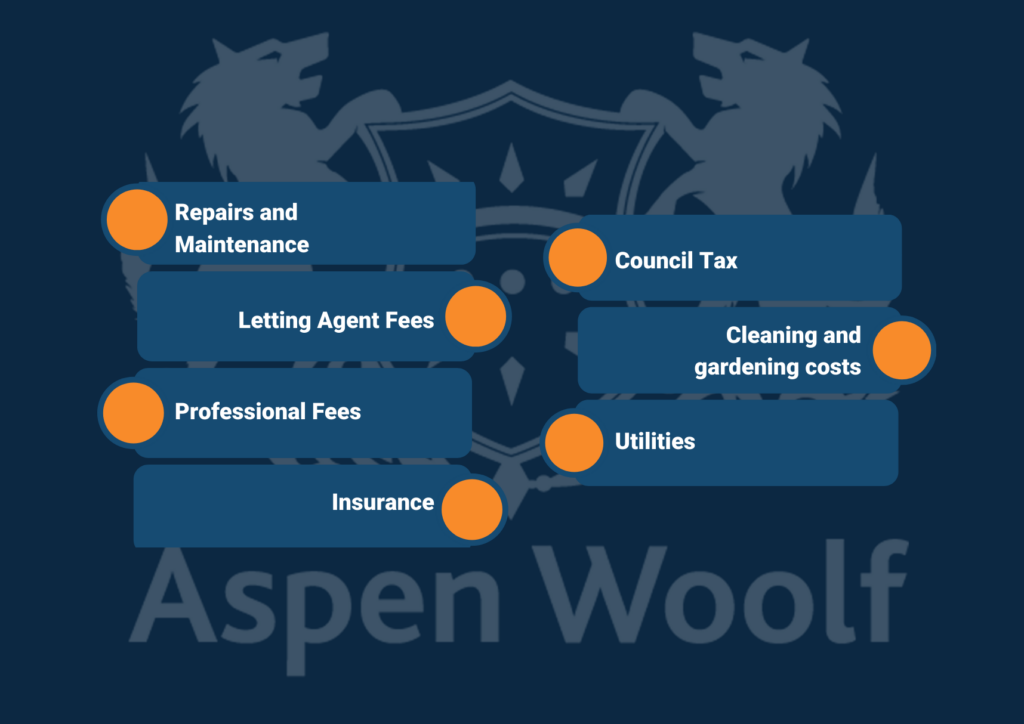

Here are some common buy-to-let tax deductions that landlords can deduct from their rental income to reduce buy-to-let property tax:

- Repairs and maintenance

- Letting agent fees

- Professional fees (e.g., accountants and solicitors)

- Insurance

- Council tax

- Cleaning and gardening costs

- Utilities

What Taxes do Buy-to-Let Landlords Need to Pay?

Here’s an overview of the common taxes associated with buy-to-let property:

Stamp Duty Land Tax

When you purchase a buy-to-let property, you may have to pay stamp duty land tax. Stamp Duty applies to residential and commercial properties, including freehold and leasehold properties. On 23 September 2022, the UK government implemented changes to the Stamp Duty Land Tax thresholds.

The nil rate Stamp Duty tax threshold was raised from £125,000 to £250,000. The maximum purchase price eligible for First Time Buyers’ Relief was raised from £500,000 to £625,000. These adjustments were introduced as a temporary measure to support the housing market, and the reduced rates will be in effect until 31 March 2025.

The additional 3% stamp duty on additional dwellings remains the same and applies to buyers already owning one or more residential properties, including buy-to-let properties and holiday homes.

Capital Gains Tax

When you sell a buy-to-let property, you will have to pay capital gains tax on any profit you make. The amount of capital gains tax you pay will depend on your circumstances.

Capital Gains Tax applies to the profit made from the sale of a property. Each individual has an annual exemption threshold. The capital gains tax allowance for the 2023 to 2024 tax year has decreased by more than 50% to £6,000.

If you’re a basic rate taxpayer, the rate you pay depends on the property’s profit amount and your taxable income. If you pay a higher rate of Income Tax, you’ll pay 28% on your gains from residential property.

Capital Gains Tax must be reported to HM Revenue & Customs through a self-assessment tax return by January 31 following the tax year.

Mortgage Interest Relief

Landlords have faced challenges in recent years due to increasing interest rates and buy-to-let mortgage tax reforms, impacting profitability compared to earlier decades.

Prior to April 2017, landlords could claim tax relief on mortgage interest at the highest rate they pay tax. From April 2020, landlords receive a tax credit equal to 20% of their mortgage interest payments instead of deducting mortgage interest from rental income.

Under the new system of landlord taxes UK, higher or additional-rate taxpayers are no longer eligible to claim tax relief on their mortgage repayments, as the tax credit only refunds at the basic rate of 20%, not at the higher tax rate they pay.

The rule change could potentially impact landlords by pushing them into a higher tax bracket. Landlords must now declare the income used to pay the mortgage on their tax return, which might raise their revenue and push them into the higher rate tax brackets, depending on other income sources like salary.

Non-Resident Landlord Scheme

If an individual or company rents out a property in the UK while living abroad, they are classified as a non-resident landlord. This means they are obligated to pay property rental income tax and capital gains tax on any properties.

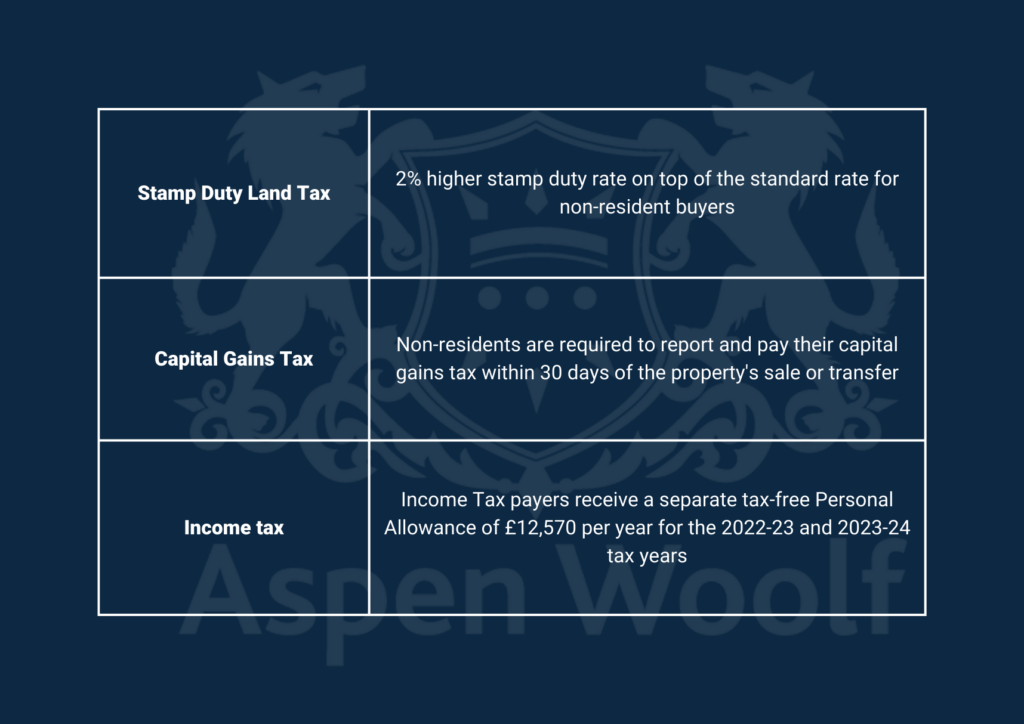

The key tax obligations that apply for overseas investors in UK property include:

- Stamp Duty Land Tax: Overseas investors are subject to a higher stamp duty rate when purchasing UK property. A 2% surcharge applies on top of the standard rate for non-resident buyers.

- Capital Gains Tax: Overseas investors are subject to capital gains tax on any profit made from the sale of UK property. Non-residents are required to report and pay their capital gains tax within 30 days of the property’s sale or transfer.

- Income tax: In the UK, individuals with income from property have a tax-free allowance on the first £1,000 of rental income– known as a property allowance. Income Tax payers receive a separate tax-free Personal Allowance of £12,570 per year for the 2022-23 and 2023-24 tax years.

Tax Planning Strategies: Maximising Efficiency within the Buy-to-Let Sector

For UK buy-to-let landlords, effective tax planning is essential to optimise returns on rental property. Here are some of the key things landlords should pay attention to:

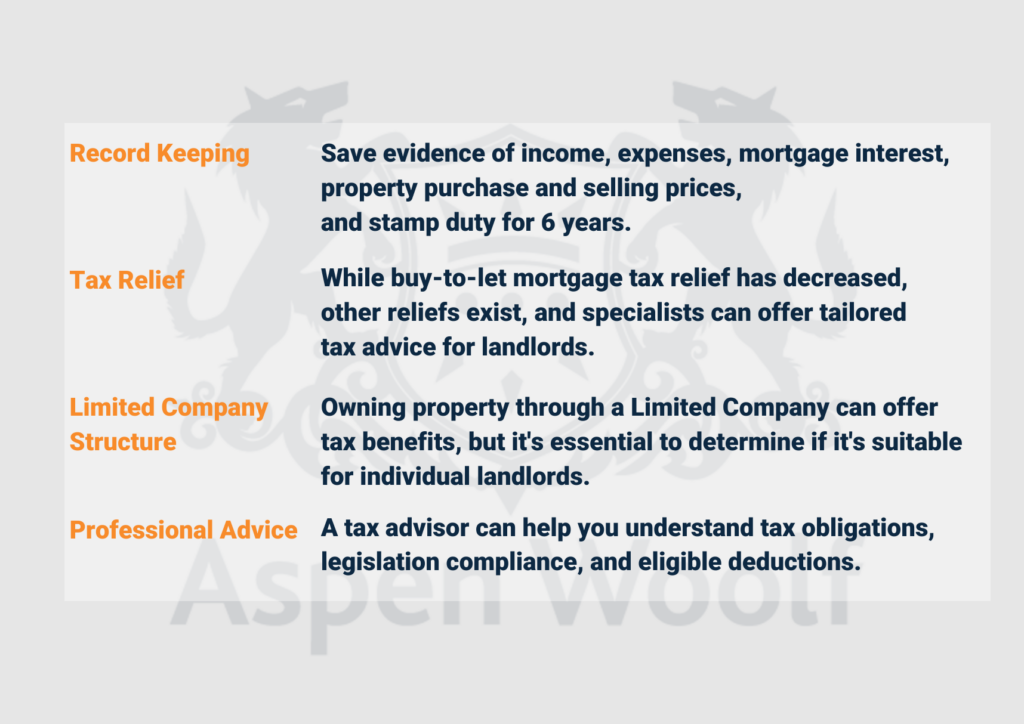

- Record Keeping

One essential strategy is to ensure thorough record-keeping of all rental income and expenses, which will allow landlords to claim eligible deductions.

Records should be kept for 6 years and can include evidence of:

- Rental income

- Allowable expenses

- Mortgage interest payments

- Purchase price of the property

- Selling price of the property

- Stamp duty land tax paid

- Tax Relief

While tax relief on buy-to-let mortgages has been reduced, other tax reliefs can help reduce taxable income for landlords. Advisors specialising in the buy-to-let sector can provide buy-to-let tax advice to suit landlords’ circumstances.

- Limited Company Structure

Using a Limited Company Structure for property ownership can offer potential tax advantages, as corporate tax rates are often lower than personal tax rates. However, it is essential to weigh the pros and cons of this structure, as it may only be suitable for some landlords.

Benefits of investing in property via a limited company:

- Tax Efficiency and Savings: Investing through a limited company can lead to potential tax savings as profits are subject to Corporation Tax (25% as of April 2023) instead of income tax rates, benefiting investors in higher tax brackets or with multiple properties.

- Asset Protection and Liability Limitation: Holding property within a limited company safeguards personal assets from the company’s liabilities or debts. This offers investors an extra layer of protection.

- Access to Different Financing Options: Limited company investors can access a broader range of financing options, including commercial mortgages, buy-to-let mortgages, development finance and portfolio mortgages.

Drawbacks of Investing in Buy-to-Let via a Limited Company

- Administrative Responsibilities: Investing through a limited company involves maintaining proper company records, filing annual accounts and buy-to-let tax returns, leading to increased administrative burdens for investors.

- Business Set-up Costs: Setting up a limited company for property investment requires additional expenses. Including company registration fees, document filing fees and the cost of hiring professionals. Such as accountants and tax advisors.

- Limited Availability of Mortgage Products: Mortgages for limited companies are often restricted to Special Purpose Vehicles (SPVs) formed explicitly for property investment. Eligibility criteria may include registration as an SPV, limited shareholders and potential personal guarantees from directors.

- Income Extraction Complexity: Extracting income from a limited company can be complex. There are two main methods. The first is dividends, which incur additional taxes above a certain threshold. The second, is salaries, which require contributions to national insurance. They may be costlier than dividend taxes for higher rate taxpayers.

Read more in our comprehensive guide, Buying Property Through a Limited Company: Pros and Cons.

Seeking Professional Advice: Importance of Consulting a Tax Specialist

If you are investing in an invented property. It’s a good idea to get professional advice from a qualified accountant or tax advisor. They will help you understand tax obligations much better. As well as compliance with all relevant legislation and help you to understand deductions and allowable expenses.

How can I Minimise the Tax Liability on my UK Buy-to-Let Property?

When it comes to minimising the amount of tax you pay as a buy-to-let landlord, here are some of the common things you can do to reduce the amount of tax you are liable for:

- Claim Allowable Expenses: Landlords should keep track of allowable expenses related to their buy-to-let property, such as property repairs, maintenance costs, letting agent fees and insurance premiums etc. These expenses can be deducted from your rental income, reducing your overall taxable profit.

- Utilise Annual Tax Allowances: Take advantage of tax allowances available to you, such as the Annual Investment Allowance (AIA) for property improvements. Landlords may be able to claim items for furnished holiday lettings businesses. As well as for items used in the common parts of a residential building.

- Consider Limited Company Structure: Holding your property through a limited company may be more tax-efficient. Corporate tax rates are often lower than personal tax rates. Meaning, using a limited company structure can offer certain tax advantages, especially for higher-income landlords.

- Utilise Capital Gains Tax Reliefs: If you plan to sell your buy-to-let property, consider the sale timing to utilise any available capital gains tax reliefs. For example, Entrepreneur’s Relief (now called Business Asset Disposal Relief) or Private Residence Relief may apply in certain circumstances.

- Pension Contributions: Consider making contributions to a pension scheme. Considering this can reduce your taxable income. As well as potentially push you into a lower tax bracket and lower your overall tax liability.

- Spouse or Partner Tax Planning: If you co-own the property with a spouse or partner, transferring ownership to the partner with the lower income may help you take advantage of their lower tax bracket.

What are the Recent Changes in Mortgage Interest Tax Relief for Buy-to-Let Landlords?

In the 2023-2024 tax year, here are some tax changes landlords need to stay ahead of:

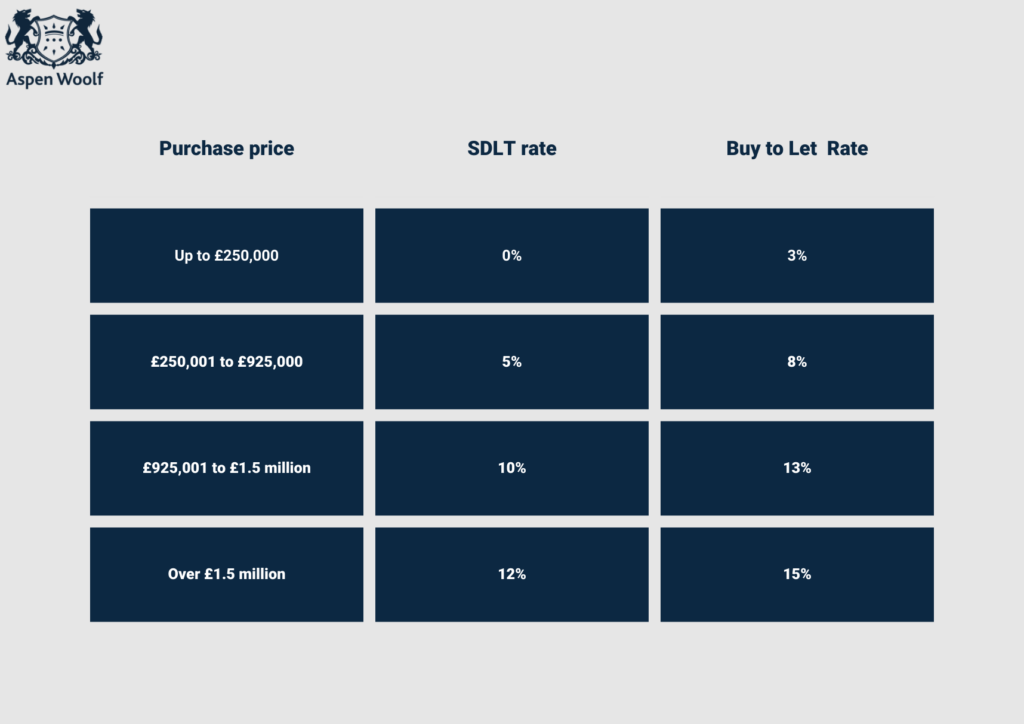

- Stamp Duty: Stamp duty tax rates vary based on property price, with an additional 3% surcharge for second properties in England and 4% in Wales and Scotland.

Stamp Duty rates for buy-to-let landlords in England are as follows for the 2023/2024 tax year:

- Capital Gains Tax: The tax-free allowance has decreased from £12,300 to £6,000 and is expected to drop further to £3,000 in 2024. Residential property carries a 28% capital gains charge for higher or additional rate taxpayers.

- Income tax rates: Rental property income in the 2023/24 tax year falls into different bands. Now with tax rates ranging from 0% to 45% based on an individual’s income level.

- Mortgage interest tax relief: Landlords can claim a tax credit based on 20% of their mortgage interest payments. This change no longer allows higher or additional-rate taxpayers to claim buy-to-let tax relief, which may push some landlords into higher tax brackets.

- Dividend Allowance: Dividend allowance has been reduced to £1,000 from the start of the new tax year and will be further halved to £500 per year in April 2024. This reduction could impact those receiving dividends from property investing companies.

Are There Any Tax Benefits or Relief Available for Buy-to-Let Investors?

Landlords can still benefit from a number of tax reliefs. Although, changing legislation has led to reduced profits for many landlords compared to recent decades:

- Mortgage Interest Tax Relief: New buy to let tax rules came into effect in April 2020. Buy-to-let landlords can still claim a tax credit based on 20% of their mortgage interest payments. This allows them to offset a portion of their mortgage interest expenses against their rental income.

- Allowable Expenses: Buy-to-let investors can deduct certain allowable expenses from their rental income to reduce their taxable profit.

- Capital Gains Tax Allowance: When selling a buy-to-let property, investors can benefit from the capital gains allowance. Which allows them to make a certain amount of profit tax-free.

Who Pays Council Tax on Buy to Let?

All residential properties are liable for council tax which is Council tax is calculated based on location and type of housing. The council tax band is set by the Valuation Office Agency (VOA) falling within A-H. The banding is based on the amount the property could be sold for, and the cost for each band varies by council.

The responsibility for paying council tax on a buy-to-let property usually falls on the tenants who live in the property. It’s important for landlords to ensure that the tenancy agreement clearly states that the tenants are responsible for paying the council tax. Landlords should also keep a copy of the council tax payment schedule as part of their records for the tenancy.

In certain circumstances, the landlord may be liable for paying council tax. Such as when the property is vacant or during periods when there are no tenants. Additionally, if the property is a House in Multiple Occupation (HMO) and the tenants have separate tenancy agreements for their rooms, the landlord may be responsible for paying the council tax.

Are Solicitors Fees Tax Deductible for Buy to Let?

Solicitors’ fees can be tax-deductible for buy-to-let landlords in the UK. Solicitor’s fees in relation to your buy-to-let property are allowable expenses. Which can be deducted from your rental income before calculating your taxable profit.

The following solicitors’ fees may be tax-deductible for buy-to-let landlords:

- Conveyancing Fees: The solicitor’s conveyancing fees are considered allowable expenses when you purchase or sell a buy-to-let property. Conveyancing fees are the costs associated with the legal and administrative work. Meaning the work related to transferring the ownership of a property from one party to another.

- Tenancy Agreements: If you engage a solicitor to draft or review tenancy agreements for your rental property, the fees can also be claimed as allowable expenses.

- Legal Advice: Solicitor’s fees for seeking legal advice related to your buy-to-let property or any landlord-related matters can also fall under allowable expenses.

Conclusion

Navigating the complex world of btl tax in the UK is crucial for landlords to remain compliant with tax laws and optimise their rental property’s profitability. From reporting and calculating rental income to understanding the different taxes landlords must pay, proper record-keeping, utilising allowable tax reliefs, considering the limited company structure and staying informed about tax legislation are some of the critical strategies landlords can implement. To find out more about investing in a buy-to-let property, get in touch with our experts today.