9 Reasons to Invest in Property in Liverpool and Where to Buy

A city on many “one to watch” property investment lists, we’d argue that now is a great time to invest in Liverpool property.

Liverpool is an exciting Northern city with a long, proud history. As well as plenty of assets that will enable it to meet its ambitions for the future. With a growing population and investment contributing to its growth, there are plenty of reasons investors should be looking to Liverpool.

Liverpool started catching the eye of property investors, particularly in 2020. Which saw increased interest due to relatively low house prices and high rental demand. With property prices below the UK average, annual property price growth on the rise and a strong rental market, there’s plenty of reasons to invest in Liverpool property.

If you’re wondering “is Liverpool a good place to invest in property?” read on to find out our top reasons to invest in property in Liverpool and where to buy.

1. Invest in Liverpool Property: A Strong Northern Economy

One of the Northern Powerhouse Cities, Liverpool is a big contributor to the UK economy. It sits at the centre of the broader Merseyside Economic Area. By the end of 2024, annual GVA growth is predicted to be higher than all other locations in the North West, reaching £14.4 billion.

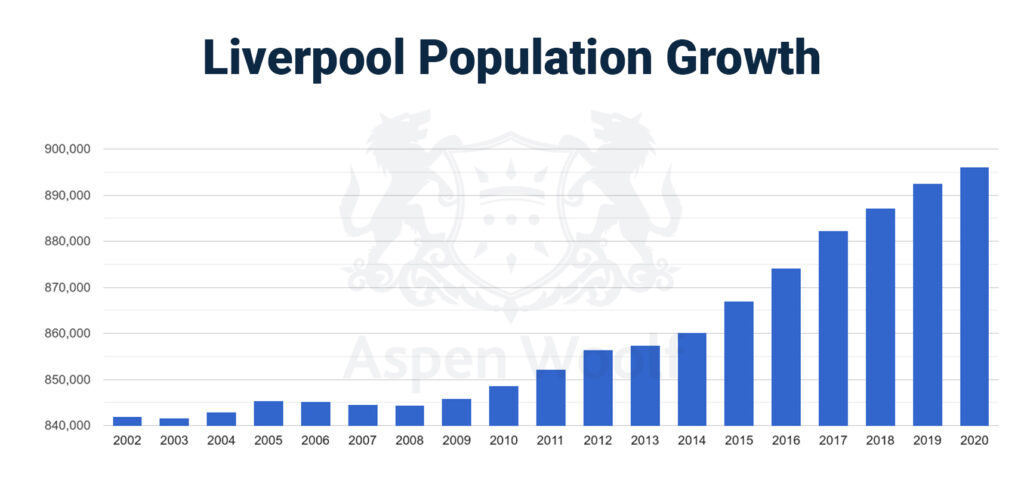

As the fifth-largest metropolitan area in the UK, the current metro area population of Liverpool is currently 917,000. The wider catchment area puts 2.5 million people within reach, of which 1.4 million are working age.

Continual regeneration projects are transforming Liverpool’s city centre. This is making it a great place to live and work. Initiatives like Project Jennifer, Anfield Stadium, Liverpool ONE Shopping Centre and the Liverpool Waters are leading to growth of the population and economy.

The growing economy and infrastructure and investment are transforming the city. This is why Liverpool makes an attractive case for property investors. This is especially true for those considering buy-to-let as their preferred type of investment in the North of England.

2. Liverpool is a Diverse Business Hub with High-Value Industries

Liverpool is home to businesses and industries from a wide range of high-value sectors. A historic maritime centre, one of the city’s greatest assets is its ports and logistics infrastructure. As well as a new deep-water containment terminal.

Liverpool’s infrastructure enhances the supply chain transit for businesses and world-leading manufacturers. Companies in the manufacturing, pharmaceuticals, life sciences and medical fields, including Jaguar Land Rover, Unilever, AstraZeneca, Nestlé Health Sciences and Orsted, each have significant operations in the city. Three key business parks, including Liverpool Innovation, MerseyWorld and Stonebridge Park mean there are excellent facilities on offer for a wide range of companies.

The Liverpool City Region is one of the UK’s leading financial centres. Thanks to the likes of Santander, Barclaycard and RSA having a base. It is also the largest wealth management centre outside of London, and home to over 650 major law firms.

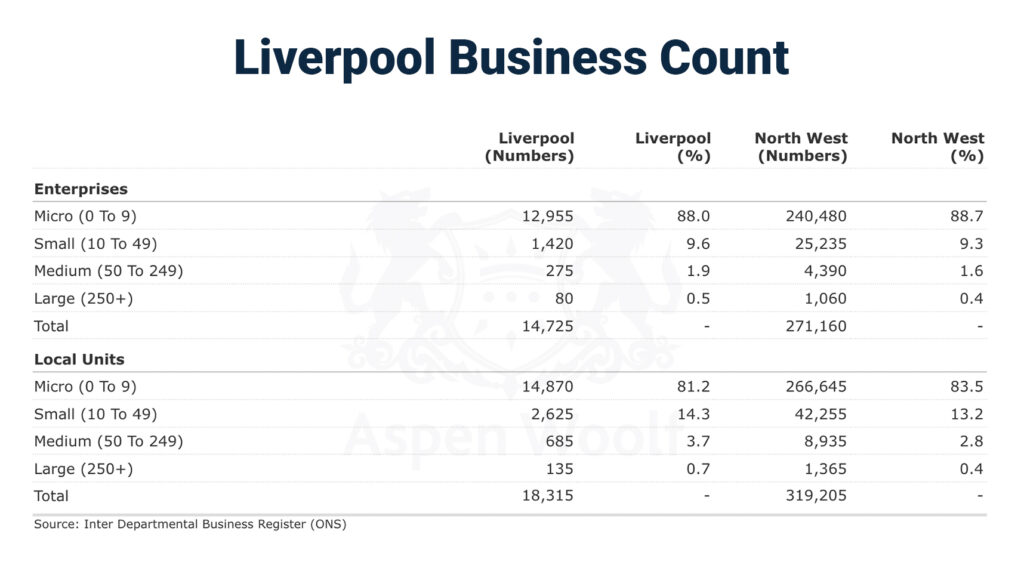

With four universities, Liverpool supplies businesses with a steady pipeline of skilled workers. Young people are a key rental demographic. This constant surge of young professionals and students make Liverpool one of the best buy-to-let areas in the UK.

3. Liverpool Business: The Up-and-Coming Startup Scene

With an active city centre, busy port, growth opportunities and host city for events like Fintech North and the Binary Tech Conference, Liverpool is becoming ever-popular as a startup destination in the North-West.

A number of financial backers continue to support the startup ecosystem. Santander bank has a startup incubator and Liverpool’s MSIF Fund delivered £158 million to support local businesses to date. Tech Nation gave the city a 79% rating for Tech Sector Growth Potential, predicting it as a hub for tech growth.

Already an established base for fintech companies, edtech is another area that is gaining ground in the city. As well as companies specialising in cutting-edge technologies like VR and AR gaming.

Liverpool is also the most filmed UK city outside London. Companies such as Hurricane Films, Lime Pictures and LA Productions call the city home. A new studio due for completion is soon to further boost the city’s creative, TV and film credentials.

Diverse, high net-worth industries mean an influx of workers and young professionals. They are a key rental demographic in search of high-quality accommodation. Which makes it a good time to invest in Liverpool property.

4. Liverpool’s Housing Market is Attracting Buyers

Despite the UK property market having a slight slump in 2023, house prices in Liverpool increased by 1.3% in November 2022. This is more than the average for the North West.

Why invest in Liverpool property? Because over the longer term, Liverpool property prices are on an upward trajectory. Over the last year property prices in the area grew by 13.2%, increasing in price on average by £21,000.

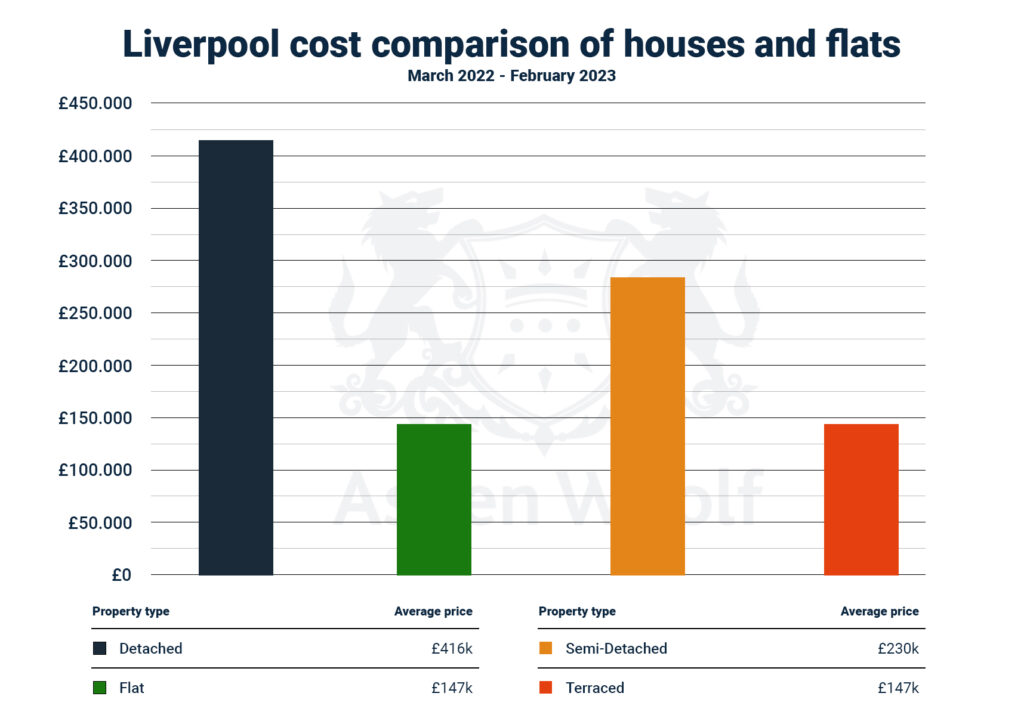

Land registry figures show that in 2022 the average price of a property in Liverpool was £184,447. While property prices are on the upward trend, they are still relatively affordable for investors. The average price of a property in the UK was £290,000 in January 2023.

Out of all areas of the city, the highest annual growth in the region was in Allerdale. Allerdale had the highest annual growth in property prices, increasing 15.6% to £194,000. As the property market begins to stabilise after record high property prices, the market is once again becoming more favourable to buyers in certain areas.

Terraced houses saw the biggest rise in property prices in Liverpool in November 2022. They increased by 11.5%, to £162,168 on average. Flats were up 10.8% annually, reaching an average price of £137,211.

For investors, Liverpool is a good location to invest. Buyers in Liverpool paid 16.6% less than the average price in the North West. Which was £221,000 (in November 2022) and the Liverpool rental market is on the rise too.

As of the end of 2022:

- The average price for properties in Liverpool: £184,447

- Average price for a property in the North West: £221,224

- Average price for UK property: £294,910

Factoring in predictions from Savills, which anticipate 11.7% price growth in the North West region and 6.2% in the UK overall by 2027, investors in Liverpool property could be set for a fantastic cash pay-out thanks to growth in capital gains in the coming years.

5. Liverpool Offers Competitive Yields

With plenty of investment transforming the city and planned for the next 5 years, now is a great time for investors to grab a piece of the action in Liverpool.

Average rental yields in Liverpool are currently at a six-year high. Yields in Liverpool range on average between 4-9%, depending on the property and postcode. Six of the postcodes in the Liverpool area are currently in the top 25 buy-to-let areas of the UK.

The highest ranking of the postcodes, L7, saw average yields of 9.79% in 2022. Other postcodes such as L5 near the newly built Everton Stadium averaged 6.36%. And L3 in Vauxhall at 6.69% respectively. According to City Residential, more than 3,400 rental units are under construction in the city centre. As well as a further 7,200 are awaiting approval.

Postcodes in the North-West are becoming increasingly popular. Especially as investors look to diversify their portfolios and get ahead of investment trends. A city with a high young population, there’s a robust rental market that investors can capitalise on. This makes it a great time to invest in Liverpool property.

6. Life in Liverpool: Vibrant and Lively

With plenty of galleries, museums, an iconic waterfront, legendary nightlife, Premier League football at Liverpool and Everton and a UNESCO World Heritage Site, Liverpool offers plenty to see and do. Liverpool’s attractions and infrastructure have grown in recent years. From the city’s Exhibition Centre to the increasing capacity of Liverpool FC’s iconic Anfield stadium.

A 24-hour city, vibrant and creative Liverpool is one of Europe’s best places to visit. The city’s residents are known for being friendly and down-to-earth. The city boasts plenty of greenery with Sefton Park and Palm House in the centre, and Calderstones Park which even boasts a Japanese Garden and mini railway.

In 2023, Liverpool is set to be further put on the map as the host of the Eurovision song contest. The musical spectacle attracts hype like no other event and Liverpool will host the event from 9-13 May 2023.

Hosting such a big event such as Eurovision is expected to give the city’s hospital and tourism economy an additional boost. Liverpool will benefit from a so-called “Olympic effect”. That is when major international events lead to a lasting impact on investment, the economy and tourism of the area. This was certainly something seen with Birmingham as the host of the Commonwealth Games 2022.

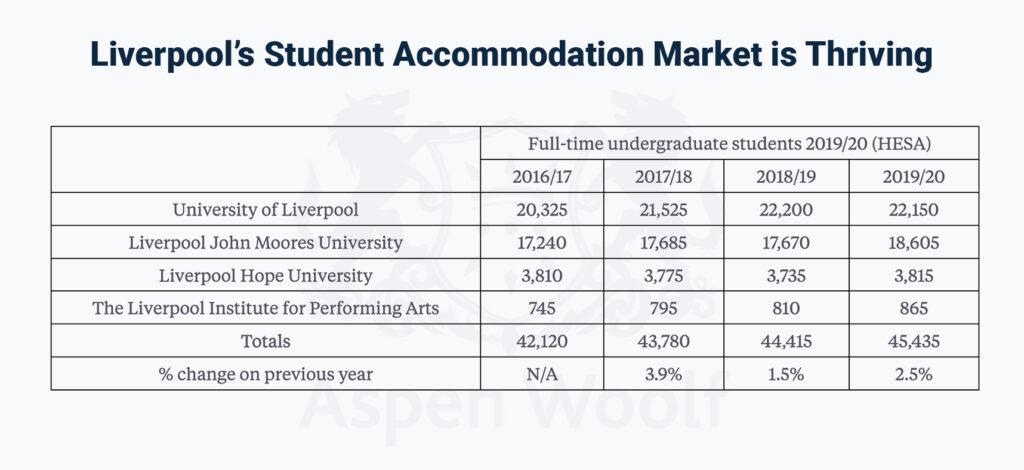

7. Liverpool’s Student Accommodation Market is Thriving

While the buy-to-let market is strong, student property is the fastest growing sector of the Liverpool property market.

Liverpool’s world-renowned universities, The University of Liverpool, Liverpool John Moores University, Liverpool Hope University and Edge Hill University produce a pipeline of more than 30,000 graduates every year.

Investors can expect good returns thanks to a growing number of student tenants looking for quality accommodation in the city. With around 15,000 student beds, there is strong demand for rental property. This presents investors with an ideal rental market for their properties.

Demand for accommodation is only set to increase. Especially thanks to the rising number of students who choose to study in the city. This increases the shortfall in accommodation. Shared student accommodation presents excellent yields for investors. And there is demand in areas such as Kensington and Toxteth in particular.

8. Liverpool Regeneration Projects Transforming the City

In the last couple of decades, Liverpool has undergone rapid transformation and regeneration.

Princes Dock is being transformed by a £5 billion investment as part of the Liverpool Water scheme. A £400 million Deep Water Terminal will allow the port to take 95% of the world’s largest ships. Additionally, there is over £1 billion investment in port and infrastructure overall to help Liverpool capitalise on its proximity to four of the world’s top six shipping lanes.

Regeneration Projects You Should Know About

In the last year a number of other regeneration and investment projects have come to fruition or are underway:

- In Summer 2022, the Novotel Hotel opened next to Paddington Village. The 16-floor hotel offers views of the River Mersey and Wirral Peninsula and the towering structure is one of the tallest buildings in the rapidly expanding Knowledge Quarter.

- Duke Street and Parr Street are set to significantly change the Ropewalks area. The development will see some of the buildings along Parr Street extended and the creation of a new seven storey building will bring significant regeneration benefits to the area.

- Parliament Square in the Baltic Triangle, a key digital and creative district, is one of the tallest structures in the area at 17 storeys. The square is set to have a positive economic and regenerative impact in Liverpool.

- The redevelopment of Anfield stadium’s Anfield Road stand is under way, and the Anfield Strategic Regeneration Framework will see the overhaul of some of the derelict properties and land in the area. The project could deliver new commercial and community facilities with enhanced public space.

Over the next decade, Liverpool will deliver some of the UK’s more ambitious infrastructure schemes, including

- Liverpool2 deep water port terminal (phase 2),

- Liverpool Waters and Wirral Waters mixed-use development – an investment of £9 billion

- New Royal Liverpool University Hospital and Health Campus and the transformation of North Liverpool, Ten Streets.

Each of these investments brings jobs and boosts the city’s livability. In other words, this presents massive opportunities for property investment in Liverpool.

On top of a £900 million devolution deal, the Liverpool City Region Combined Authority has secured more than half a billion pounds in additional funding from the government. This includes £173 million in Transforming Cities Funding to improve transportation within the city region.

9. Liverpool is a Well-Connected city in the Heart of the North

Liverpool is well connected with 10 motorways, 10 rail-linked terminals, as well as two major airports serving the area. One of which, Manchester Airport, is just 30 minutes from the city centre. The city is a two-hour train journey from London Euston and is in close proximity to Liverpool John Lennon Airport, which flies internationally.

Which Areas of Liverpool are Best for Property Investment?

Liverpool can be divided into four key zones: the traditional core, the commercial district, the waterfront and the creative quarter. Property investments in Liverpool can be found all over the city depending on your goals and level of investment.

L1

The City Centre has benefitted from a range of investment and regeneration in recent years, making it a vibrant and attractive place to live. Property investors have increasing confidence in the area, particularly with the new £5.5 billion Liverpool Waters development.

The L1 postcode delivers attractive average yields of around 7% and the average price for a property in Liverpool City Centre over the last year was £168,059, according to Rightmove.

Kensington

With recent investment in the hospital, further development has helped to bolster the appeal of Kensington, which is located on the fringe of the city centre and a great place to invest in Liverpool property.

In the last year, the average price for a property in Kensington was £138,663.

Toxteth

Toxteth is an inner-city area of Liverpool located to the south of Liverpool City Centre. While there is much-terraced housing, many large Victorian properties are being broken up into separate dwellings creating a growing number of flats.

One the cheaper areas of Liverpool for property, there is much regeneration taking place, and the area is popular with students and is coined an “up-and-coming” part of the city.

Average property prices in Toxteth over the past year were £157,614.

Bootle

Located north of the City Centre, the L20 area of Bootle offers mid-priced property and plenty of HMO properties (House in Multiple Occupation). Adjoining the City of Liverpool and home to many docks, it is well serviced by bus and rail routes.

The current average property price in Bootle is around £154,174 – up 11% on the previous year and 23% up on the 2020 peak of £125,790.

Is Property in Liverpool a Good Investment?

In 2022, the North West and Liverpool was one of the best areas to invest – with properties increasing by over £18,000 in a 12-month period to around £180,000 – a price that still remains affordable compared to many other major UK cities.

The North West will remain a strong market and Savills predicts that the region will see a 5-year growth of 11.7%, the highest level of growth of any region in the UK. It is highly likely that Liverpool will remain a hot property market in 2023 and beyond. The city has plenty of potential to deliver strong yields and capital growth for investors.

Will House Prices Drop in Liverpool?

While overall the UK is seeing a slump in housing prices, according to the latest data, property prices on average increased by 13.2% in Liverpool over the last year. The latest HM Land Registry figures show that house prices in Liverpool continue to rise despite a slight drop in property value across the North West.

What is the Best Area to Buy a House in Liverpool?

While prices are rising across the city, there are still plenty of areas where it can make sense to invest in Liverpool. In terms of finding affordable property, here are some of the best invest and let Liverpool locations:

- The L5 area of Everton and Vauxhall is one of the best buy to let areas in Liverpool with rental yields of 7% and average property prices of £130,000.

- Those looking for growth may want to take a closer look at L15. In the past 5 years, properties in the area have experienced 24% growth. A little more expensive than other areas, the average property price in 2022 was £202,000, putting it closer to the UK average than other postcodes in Liverpool.

- The L6 area of Elm park is a great area for buy-to-let purchases, combining good yields, affordable properties and good annual growth. Properties are still affordable with an average price of £151,000 and yields of around 6%. Over the last 5 years the area has experienced 29% growth making it a good target area for Liverpool property investments.

__________________________________________________________

Liverpool is a city on its ascendancy and with new infrastructure investments and a strong business ecosystem, there are plenty of reasons to invest in Liverpool property. Comparatively low property prices, high rental demand and yields in many city areas make Liverpool a great choice for buy to let property investors. Find out more about the options in Liverpool by getting in touch with us today.