There is no search results.

Why Buy Property in Luton?

Why Buy Property in Luton?

With so much talk around Liverpool, Manchester and similar property hotspots, but rarely does anyone mention this Bedfordshire town. Especially considering that as a town on London’s commuter belt, it definitely deserves more attention.

With investments regenerating the town over the past decade, people are beginning to think differently about property investment in Luton.

Now let’s take a look at the top reasons the Luton property market should be on your radar:

- Great Economic Potential– after launching Luton Investment Framework (LIF) in 2016, the town is showing massive improvements. This was achieved by creating sustainable growth and making Luton a vibrant place to work and live.

- Outstanding Transport Links & Conveniences– along with being a commuter-friendly town, over the years a number of business and technology hubs have sprung up in Luton. This fact in particular goes hand in hand with growing and ever-more robust property prices and rents.

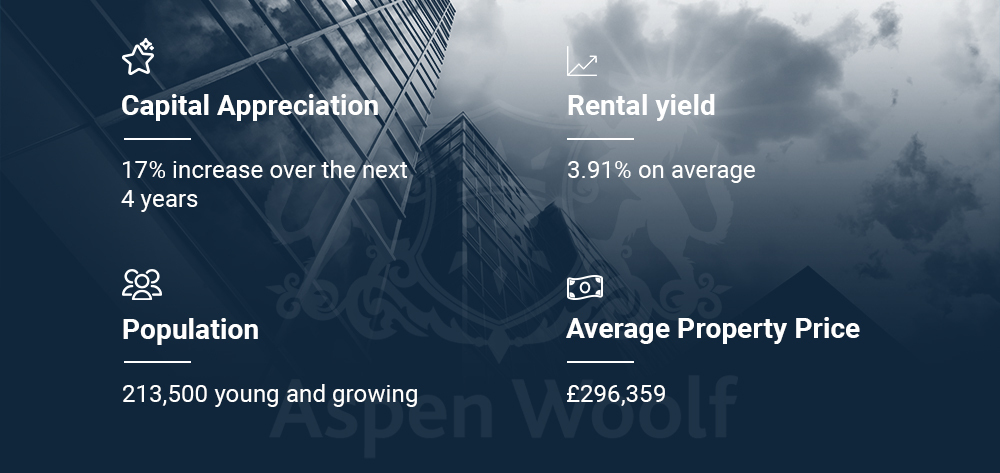

- Favourable House Price Growth– if you’re looking for a property for sale in Luton now, you could experience a capital growth rate of 17% by 2025. Regardless of two national lockdowns and Brexit influencing the market, Luton’s property market doesn’t seem to be slowing down.

- Still Affordable Luton House Prices– With London’s sky-high property prices, both property investors and commuters are looking to Luton as their destination of choice. Even though there are more options available, including Basingstoke, Gravesend, Windsor and Northampton, all are more expensive than this Bedfordshire town

- Great Rental Demand– the town is suffering from a housing shortage. This is great news for those on the lookout for buy to let property in Luton as it indicates sustained tenant demand which is likely to result in increasing housing prices and rents and yields. Not to mention the average rent in London is 27% higher than that in Luton. Which also increases the appeal for anyone looking to escape the steep London prices.

What to Expect From Property Investment in Luton?

As a town that’s already attracting an increasing number of young professionals another market that property investors shouldn’t ignore is the robust student rental market.

Luton’s student rental market presents property investors with the potential for strong returns. The already existing housing shortage transcends into student accommodation as well. Students, especially international students, are increasingly seeking quality private accommodation that can meet their needs.

Luton property prices have gone up by 11.6% in 2021, and it’s a general prediction that house prices will continue to rise. Namely, the forecasts indicate that house prices in the UK will rise anywhere between 3% and 5%, there’s no reason why Luton would be the exception.

Over the last year, property prices for Luton properties for sale stood at £306,227. The largest percentage of sold properties were semi-detached properties with an average price of £326,328. The second place belongs to terraced properties with an average price of £276,090. Lastly, detached properties that sold for an average price of £442,723.

What’s important to note, especially for investors that have yet to buy property in Luton, are the upcoming energy efficiency laws. Meaning, that it’s advisable for all those looking for a Luton property for sale, that the said piece of property can abide by these regulations. That, in essence, means you should be looking for new built properties in Luton rather than the cheaper older properties.

In order to make the most of your investment, you should definitely stay up to date with the changes both in the market and legally.

Who Should Buy Property in Luton?

As London’s number one commuter town, Luton presents a brilliant opportunity for both buy-to-let investors and those looking into investing in student housing.

Luton is a town that keeps attracting more and more businesses which will in turn create an inviting proposition for anyone who wants to part with the expensive life in London. Namely around 23 million people who are within two hours of the town.

Going back to what we’ve previously mentioned, Luton is seriously undersupplied in terms of housing stock. For that reason, this increase in population will put even more pressure on the rental market. This fact alone should make any investor quite happy, as it indicates an imminent increase in rents and a strong rental demand.

The current average rent sits at £842 a month, according to Varbes. Which is still a very compelling price, compared to London’s average of £1,832.

Now circling back to the student rental market, the University of Bedfordshire has a large campus in the centre of town. It offers nearly 450 undergraduate and postgraduate courses to approximately 3,200 undergraduate, 1,700 postgraduate and 120 postgraduate research students coming from over 120 countries.

Having said that, Luton’s student demographic makes shows a very strong need for new built, quality accommodation. It’s a very appealing prospect for anyone in the market for property for sale in luton now. Especially if you’re looking to get strong returns and enjoy a consistent demand way beyond 2022.

Areas which should definitely be on your radar are:

- Central Luton

With an average price of £292,051, the Luton LU1 postcode experienced an 8% drop in average property price on the previous year. Being the home to the University of Bedfordshire, this area is perfect for those interested in targeting the student rental market.

- LU2 Postcode

This area held an overall average price of £320,233 for Luton properties. Considering it is the site of Luton Airport, it’s perfect for commuters. Thus making it the top location for buy-to-let investors.

- LU3 Postcode

This Luton postcode houses semi-detached properties from the 1920s and 1930s, making it perfect for families looking to escape London. Properties in LU3 had an overall average price of £305,631.

- LU4 Postcode

Another commuter-friendly area that is home to a number of listed buildings and in proximity to the M1. Properties in LU4 had an overall average price of £301,869 over the last year.

All of these factors mean Luton is now becoming a fast favourite of savvy property investors, offering a stable income, great capital growth, and a fantastic return on investment.

You can see on our website property for sale in Luton, and if you have any questions do not hesitate to contact us for more information.